Region:Global

Author(s):Dev

Product Code:KRAC0469

Pages:98

Published On:August 2025

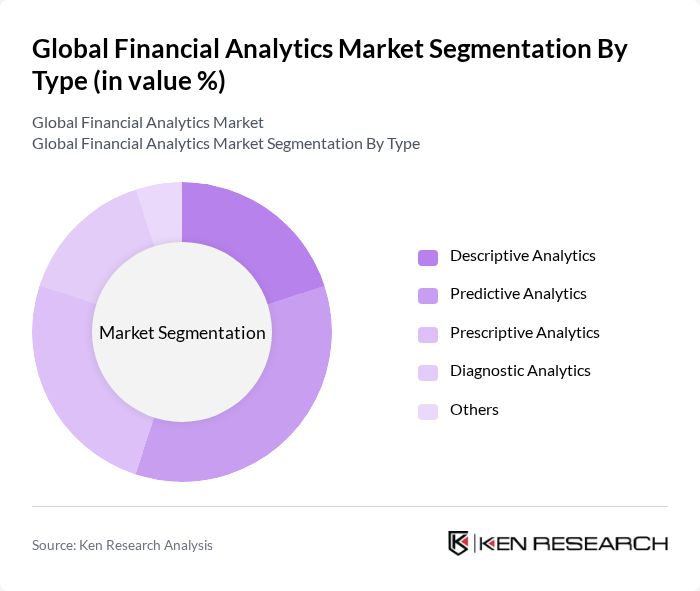

By Type:The financial analytics market is segmented into various types, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Diagnostic Analytics, and Others. Among these, Predictive Analytics is currently the leading sub-segment, driven by its ability to forecast future trends and behaviors based on historical data. Organizations are increasingly adopting predictive models to enhance decision-making processes, optimize resource allocation, and mitigate risks. The demand for real-time insights and actionable intelligence is propelling the growth of this segment.

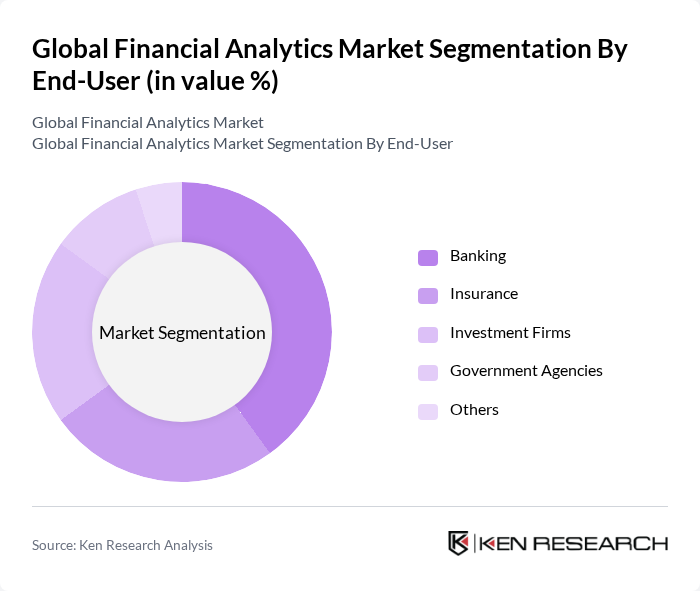

By End-User:The end-user segmentation includes Banking, Insurance, Investment Firms, Government Agencies, and Others. The Banking sector is the dominant end-user, as financial institutions increasingly rely on analytics to enhance customer experience, manage risks, and comply with regulatory requirements. The growing emphasis on data security and fraud detection is driving banks to invest in advanced financial analytics solutions, making this segment a key player in the market.

The Global Financial Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAS Institute Inc., Oracle Corporation, SAP SE, Microsoft Corporation, Tableau Software (Salesforce), QlikTech International AB, FICO (Fair Isaac Corporation), MicroStrategy Incorporated, TIBCO Software Inc., Domo, Inc., Sisense Inc., Alteryx, Inc., ThoughtSpot, Inc., Looker (Google Cloud), Moody’s Analytics, Inc., S&P Global Market Intelligence, Wolters Kluwer (OneSumX), Workiva Inc., BlackRock (Aladdin), Bloomberg L.P., Refinitiv (LSEG), Coupa Software, Unit4 (Prevero), Anaplan, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the financial analytics market appears promising, driven by technological advancements and evolving consumer expectations. As organizations increasingly prioritize real-time analytics and customer-centric solutions, the integration of AI and machine learning will play a pivotal role in enhancing decision-making processes. Furthermore, the growing emphasis on data-driven strategies will likely lead to increased investments in analytics tools, fostering innovation and competitive advantage across the financial sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics Others |

| By End-User | Banking Insurance Investment Firms Government Agencies Others |

| By Application | Governance, Risk & Compliance (GRC) Fraud Detection & Prevention Financial Forecasting & Budgeting Profitability & Performance Management Customer & Revenue Analytics (CLV, churn, pricing) Treasury & Cash Flow Analytics Asset & Portfolio Analytics (incl. ALM) Others |

| By Deployment Mode | On-Premises Cloud Hybrid |

| By Component | Solutions Services (Professional & Managed) |

| By Sales Channel | Direct (Enterprise & Strategic Accounts) Indirect (Channel/Resellers, SI/Consulting) |

| By Industry Vertical | BFSI Retail & E-commerce Healthcare & Life Sciences IT & Telecom Energy & Utilities Manufacturing Government & Public Sector Others |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Analytics | 120 | Risk Managers, Data Analysts |

| Insurance Industry Insights | 100 | Actuaries, Compliance Officers |

| Investment Firms Performance Metrics | 80 | Portfolio Managers, Financial Advisors |

| Corporate Finance Analytics | 70 | CFOs, Financial Controllers |

| Fintech Solutions Adoption | 90 | Product Managers, Technology Officers |

The Global Financial Analytics Market is valued at approximately USD 12 billion, reflecting a significant growth trend driven by the increasing demand for data-driven decision-making and the adoption of cloud-based solutions across various financial sectors.