Region:Global

Author(s):Shubham

Product Code:KRAA1825

Pages:84

Published On:August 2025

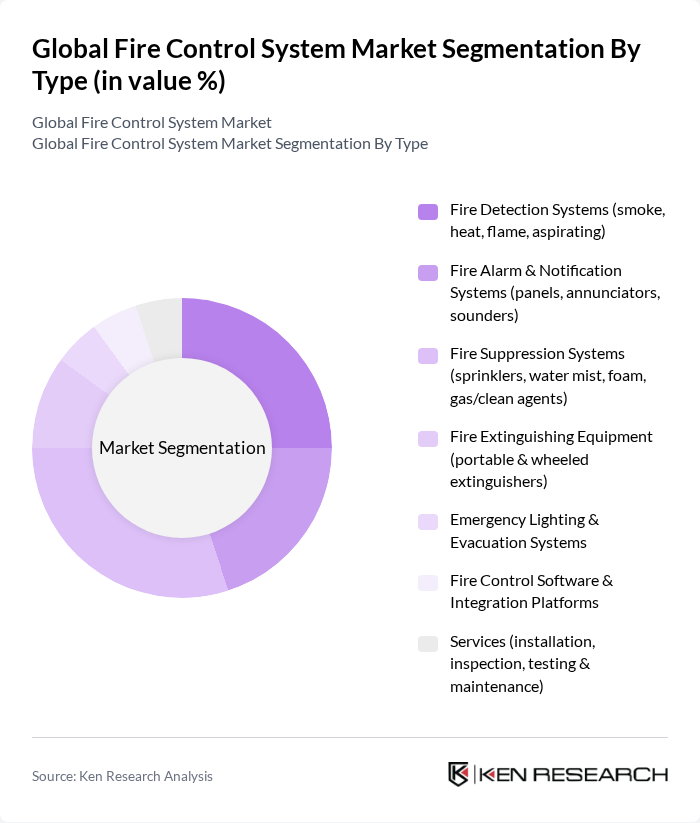

By Type:The fire control system market can be segmented into various types, including fire detection systems, fire alarm and notification systems, fire suppression systems, fire extinguishing equipment, emergency lighting and evacuation systems, fire control software and integration platforms, and services. Each of these subsegments plays a crucial role in ensuring safety and compliance across different environments, with increasing integration into smart building platforms and remote monitoring to meet regulatory compliance and life-safety goals .

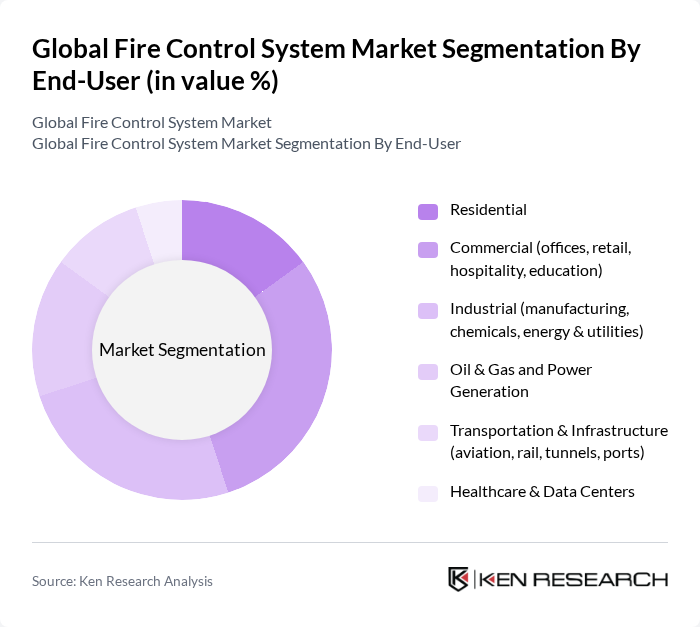

By End-User:The end-user segmentation includes residential, commercial, industrial, oil & gas and power generation, transportation & infrastructure, and healthcare & data centers. Each sector has unique fire safety requirements, increasingly emphasizing code compliance, interoperability with building management systems, and reliability in mission-critical environments such as energy, transportation, and data centers .

The Global Fire Control System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc. (Honeywell Fire, Notifier, Xtralis), Siemens AG (Siemens Smart Infrastructure), Johnson Controls International plc (Tyco, Simplex), Carrier Global Corporation (Kidde, Edwards/EST), Bosch Security Systems GmbH (Bosch Building Technologies), Schneider Electric SE, Eaton Corporation plc (Cooper Safety, Menvier), Minimax Viking GmbH (part of Minimax Fire Solutions), Gentex Corporation, Fike Corporation, Securiton AG (Securitas Group), Halma plc (Apollo Fire Detectors, Advanced, Argus, Honeywell Morley-IAS – note: Apollo/Advanced/Argus are Halma brands), Hochiki Corporation, Firefly AB, Viking Group Inc. (Viking Sprinkler & Suppression) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the fire control system market appears promising, driven by ongoing technological innovations and increasing regulatory pressures. As urbanization continues to rise, particularly in developing regions, the demand for advanced fire safety solutions is expected to grow significantly. Additionally, the integration of IoT and AI technologies will enhance system capabilities, leading to more efficient fire management. Companies that adapt to these trends and invest in smart technologies will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fire Detection Systems (smoke, heat, flame, aspirating) Fire Alarm & Notification Systems (panels, annunciators, sounders) Fire Suppression Systems (sprinklers, water mist, foam, gas/clean agents) Fire Extinguishing Equipment (portable & wheeled extinguishers) Emergency Lighting & Evacuation Systems Fire Control Software & Integration Platforms Services (installation, inspection, testing & maintenance) |

| By End-User | Residential Commercial (offices, retail, hospitality, education) Industrial (manufacturing, chemicals, energy & utilities) Oil & Gas and Power Generation Transportation & Infrastructure (aviation, rail, tunnels, ports) Healthcare & Data Centers |

| By Application | Building Construction (new build) Retrofit & Upgrades Process and Asset Protection (industrial facilities) Critical Infrastructure (data centers, utilities, public facilities) Oil & Gas (upstream, midstream, downstream) Transportation (rolling stock, airports, marine) |

| By Component | Detectors & Sensors Control Panels & Controllers Suppression Hardware (sprinklers, nozzles, cylinders, valves) Alarm & Notification Devices Software, Analytics & Connectivity Services & Spares |

| By Sales Channel | Direct Sales (enterprise/government) System Integrators & Installers Distributors/VARs Online & E-procurement |

| By Distribution Mode | Project-Based Contracts Recurring Service/Maintenance Contracts Retail/Wholesale (devices & extinguishers) OEM/Embedded Supply |

| By Price Range | Entry (mass-market devices) Mid-Range (commercial systems) Premium (mission-critical & clean agent systems) Custom/Engineered-to-Order |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Fire Control Systems | 110 | Defense Procurement Officers, Military Analysts |

| Aerospace Fire Control Technologies | 85 | Aerospace Engineers, Product Development Managers |

| Civilian Fire Control Applications | 60 | Safety Officers, Emergency Response Coordinators |

| Research & Development in Fire Control | 70 | R&D Managers, Technical Directors |

| Market Trends in Fire Control Systems | 90 | Industry Analysts, Market Researchers |

The Global Fire Control System Market is valued at approximately USD 7.5 billion, driven by increasing safety regulations, technological advancements, and heightened awareness of fire safety across residential, commercial, and industrial sectors.