Region:Global

Author(s):Shubham

Product Code:KRAA3165

Pages:80

Published On:August 2025

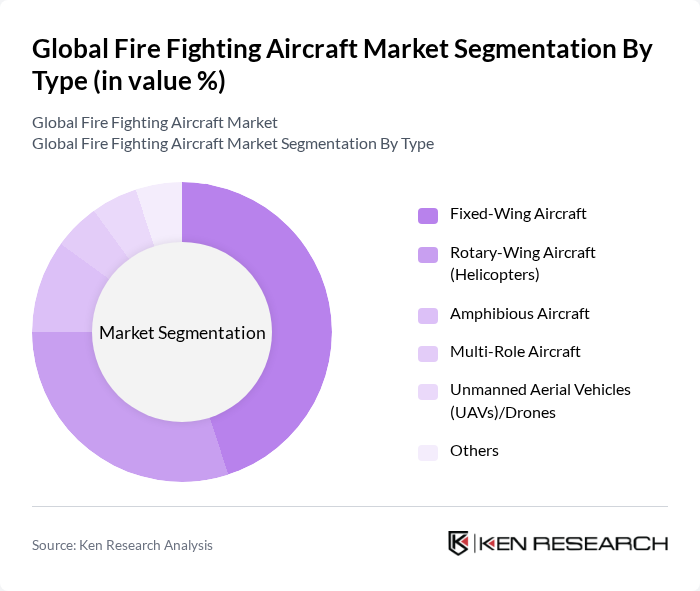

By Type:The market is segmented into Fixed-Wing Aircraft, Rotary-Wing Aircraft (Helicopters), Amphibious Aircraft, Multi-Role Aircraft, Unmanned Aerial Vehicles (UAVs)/Drones, and Others. Fixed-Wing Aircraft remain the most dominant segment, favored for their ability to cover extensive areas rapidly and deliver large payloads, making them essential for wide-scale wildfire suppression. Rotary-Wing Aircraft are critical for precision drops, rapid deployment, and access to challenging terrains, especially in urban-wildland interface zones. Amphibious Aircraft, capable of scooping water from nearby sources, are increasingly utilized in regions with abundant lakes and rivers. UAVs and drones are gaining traction for real-time surveillance, hotspot detection, and situational awareness, complementing manned aircraft in integrated firefighting strategies .

By End-User:The end-user segmentation comprises Government Agencies (Forestry, Civil Protection, Defense), Private Firefighting Operators, Non-Governmental Organizations (NGOs), and the Industrial & Commercial Sector. Government Agencies are the predominant end-users, reflecting their central role in public safety, environmental stewardship, and wildfire management. The trend toward public-private partnerships and increased outsourcing to specialized operators is enhancing operational flexibility and resource availability. NGOs and industrial/commercial stakeholders are also expanding their roles, particularly in high-risk regions and for asset protection .

The Global Fire Fighting Aircraft Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Tractor, Inc., De Havilland Aircraft of Canada Limited, Lockheed Martin Corporation, Textron Aviation Inc., Conair Group Inc., BAE Systems plc, Airbus S.A.S., Northrop Grumman Corporation, Leonardo S.p.A., Erickson Incorporated, SAAB AB, ShinMaywa Industries, Ltd., Coulson Group, Kaman Corporation, and Conair Aerial Firefighting contribute to innovation, geographic expansion, and service delivery in this space .

The future of the firefighting aircraft market appears promising, driven by technological advancements and increasing government support. As climate change continues to exacerbate wildfire conditions, the demand for efficient aerial firefighting solutions will likely rise. Innovations such as drone technology and AI integration are expected to enhance operational capabilities. Furthermore, partnerships between private companies and government agencies will facilitate the development of more effective firefighting strategies, ensuring that resources are allocated efficiently to combat wildfires.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Wing Aircraft Rotary-Wing Aircraft (Helicopters) Amphibious Aircraft Multi-Role Aircraft Unmanned Aerial Vehicles (UAVs)/Drones Others |

| By End-User | Government Agencies (Forestry, Civil Protection, Defense) Private Firefighting Operators Non-Governmental Organizations (NGOs) Industrial & Commercial Sector |

| By Application | Wildfire Control Urban Firefighting Agricultural & Grassland Fire Management Disaster Relief & Emergency Response |

| By Payload Capacity | Less than 1,000 Liters ,000 to 5,000 Liters ,001 to 10,000 Liters More than 10,000 Liters |

| By Sales Channel | Direct Sales Distributors/Dealers Leasing/Charter Services |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Source | Public Sector Funding Private Investments International Aid & Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Firefighting Aircraft | 60 | Fleet Managers, Operations Directors |

| Government Firefighting Agencies | 50 | Fire Chiefs, Emergency Response Coordinators |

| Private Sector Firefighting Services | 40 | Business Owners, Service Managers |

| Aircraft Manufacturers | 40 | Product Development Managers, Sales Executives |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Fire Fighting Aircraft Market is valued at approximately USD 10.8 billion, driven by the increasing frequency and severity of wildfires, advancements in aerial firefighting technologies, and the need for effective disaster management solutions.