Region:Global

Author(s):Geetanshi

Product Code:KRAC0082

Pages:80

Published On:August 2025

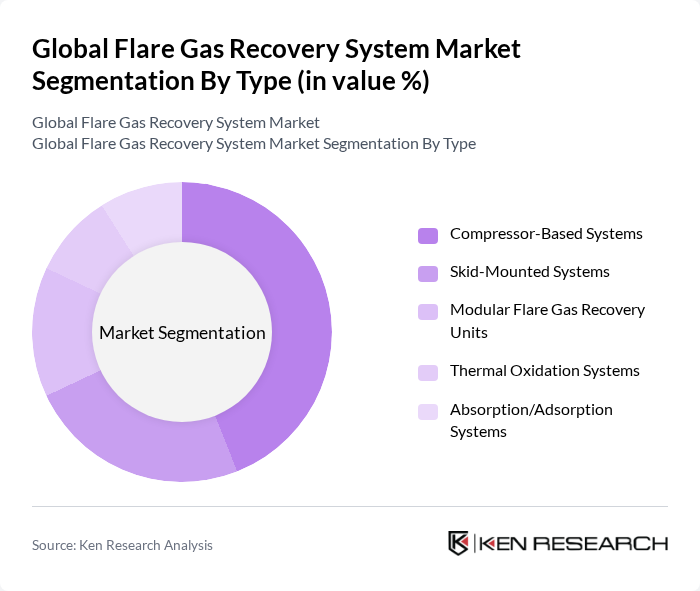

By Type:The market is segmented into various types of flare gas recovery systems, including compressor-based systems, skid-mounted systems, modular flare gas recovery units, thermal oxidation systems, and absorption/adsorption systems. Among these, compressor-based systems are the most widely adopted due to their high throughput, efficiency in recovering gas, and their ability to handle varying flow rates. Skid-mounted systems are also gaining traction for their rapid deployment, modular integration, and ease of installation, making them suitable for temporary and brownfield setups .

By End-User:The end-user segmentation includes upstream oil & gas (exploration & production), midstream (gas processing & transportation), downstream (refining & petrochemicals), chemical manufacturing, and power generation. The upstream oil & gas sector dominates the market due to the high volume of flare gas produced during extraction processes and the need for regulatory compliance. The midstream sector is also witnessing growth as companies seek to optimize gas transportation and processing efficiency, while downstream and industrial users are increasingly adopting FGRS to meet sustainability targets and reduce operational costs .

The Global Flare Gas Recovery System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., John Zink Hamworthy Combustion LLC, Zeeco, Inc., Gardner Denver Holdings Inc., MAN Energy Solutions SE, Exterran Corporation, MPR Services, Inc., SoEnergy International Inc., Schlumberger Limited, Baker Hughes Company, Siemens Energy AG, TechnipFMC plc, Linde plc, Air Products and Chemicals, Inc., SUEZ S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the flare gas recovery system market appears promising, driven by increasing environmental awareness and technological advancements. As global energy prices remain volatile, companies are likely to prioritize efficiency and sustainability, leading to greater adoption of recovery systems. Additionally, the integration of IoT technologies is expected to enhance operational efficiency, while regulatory frameworks will continue to evolve, further supporting the transition towards sustainable energy solutions. Overall, the market is poised for significant growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Compressor-Based Systems Skid-Mounted Systems Modular Flare Gas Recovery Units Thermal Oxidation Systems Absorption/Adsorption Systems |

| By End-User | Upstream Oil & Gas (Exploration & Production) Midstream (Gas Processing & Transportation) Downstream (Refining & Petrochemicals) Chemical Manufacturing Power Generation |

| By Application | Onshore Operations Offshore Operations Refinery Flare Gas Recovery Petrochemical Plant Flare Gas Recovery Others |

| By Component | Compressors Heat Exchangers Control & Monitoring Systems Separation Units Valves & Piping Others |

| By Capacity | Small (Up to 5 bar / <2 MMSCFD) Medium (5–10 bar / 2–10 MMSCFD) Large (10–20 bar / 10–20 MMSCFD) Very Large (>20 bar / >20 MMSCFD) |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Operators | 100 | Field Engineers, Operations Managers |

| Environmental Consultants | 60 | Environmental Analysts, Compliance Officers |

| Technology Providers | 50 | Product Managers, R&D Engineers |

| Regulatory Bodies | 40 | Policy Makers, Environmental Inspectors |

| Academic Researchers | 40 | Research Scientists, Professors in Environmental Science |

The Global Flare Gas Recovery System Market is valued at approximately USD 2.35 billion, reflecting a significant growth trend driven by regulatory pressures and the demand for energy efficiency in the oil and gas sector.