Region:Global

Author(s):Shubham

Product Code:KRAD0686

Pages:85

Published On:August 2025

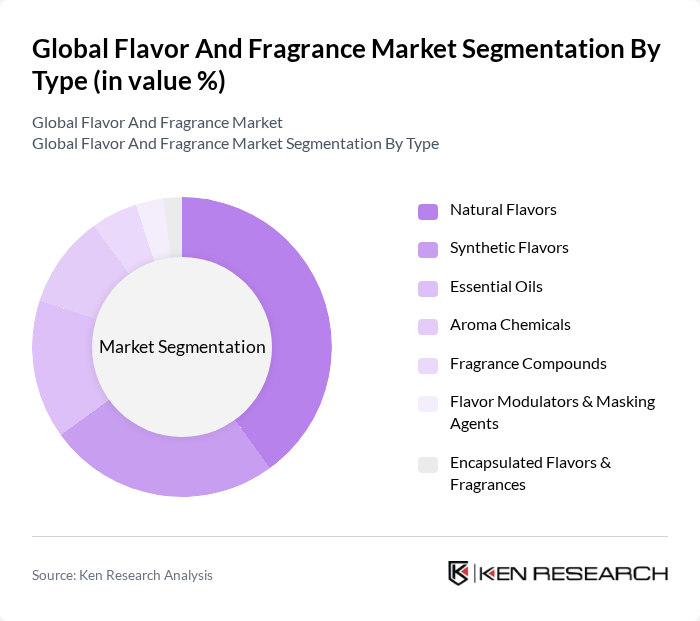

By Type:The market is segmented into various types, including Natural Flavors, Synthetic Flavors, Essential Oils, Aroma Chemicals, Fragrance Compounds, Flavor Modulators & Masking Agents, and Encapsulated Flavors & Fragrances. Among these, Natural Flavors are gaining significant traction due to increasing consumer demand for clean-label, plant-based, and sustainable ingredients across F&B and personal care. Synthetic Flavors remain important for cost-efficiency and consistency but face regulatory and perception pressures that encourage reformulation toward natural and nature-identical options. Essential Oils continue to grow, supported by wellness, aromatherapy, and natural positioning, while advances in aroma chemicals, modulators, and encapsulation improve stability, release profiles, and off-note masking for complex applications.

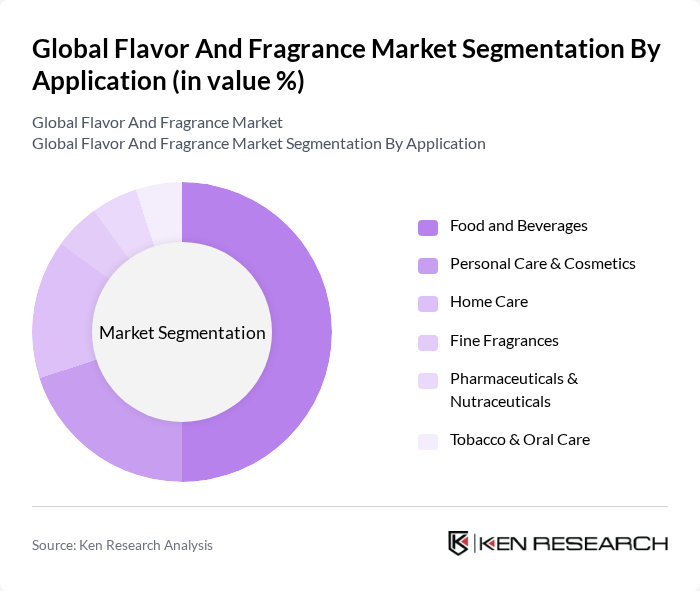

By Application:The applications of flavors and fragrances span across Food and Beverages, Personal Care & Cosmetics, Home Care, Fine Fragrances, Pharmaceuticals & Nutraceuticals, and Tobacco & Oral Care. Food and Beverages is the largest application area, driven by new product development in beverages, bakery, dairy, and confectionery, and the shift to clean-label formulations. Personal Care & Cosmetics represent a significant share as consumers seek unique, long-lasting scents and sensorial experiences, with steady growth in deodorants, hair care, and skincare. Nutraceutical flavoring is rising as brands mask off-notes in functional ingredients, while home care and fine fragrances continue benefiting from premiumization and wellness trends.

The Global Flavor And Fragrance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Givaudan SA, dsm-firmenich AG, International Flavors & Fragrances Inc. (IFF), Symrise AG, Takasago International Corporation, Sensient Technologies Corporation, MANE, Robertet SA, Bell Flavors & Fragrances, Inc., DRT – Dérivés Résiniques et Terpéniques (A Firmenich Company), T. Hasegawa Co., Ltd., Kerry Group plc (Taste & Nutrition), McCormick & Company, Incorporated (Flavor Solutions), Axxence Aromatic GmbH, Wild Flavors GmbH (ADM) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flavor and fragrance market appears promising, driven by technological advancements and evolving consumer preferences. Innovations in flavor and fragrance technology, such as AI-driven formulations, are expected to enhance product development efficiency. Additionally, the growing emphasis on sustainability will likely lead to increased investments in eco-friendly practices, aligning with consumer demand for responsible sourcing and production methods, thereby shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Flavors Synthetic Flavors Essential Oils Aroma Chemicals Fragrance Compounds Flavor Modulators & Masking Agents Encapsulated Flavors & Fragrances |

| By Application | Food and Beverages (Bakery, Confectionery, Dairy, Savory & Snacks, Beverages) Personal Care & Cosmetics Home Care (Soaps, Detergents, Household Cleaners, Air Care) Fine Fragrances Pharmaceuticals & Nutraceuticals Tobacco & Oral Care |

| By End-User | Food & Beverage Manufacturers Fragrance Houses & Perfume Brands Personal Care & Cosmetic Companies Home & Fabric Care Manufacturers Pharma & Nutraceutical Companies Contract Manufacturers (CDMOs) |

| By Distribution Channel | Direct (Key Accounts/OEMs) Distributors/Agents E-commerce/B2B Portals Retail & Specialty Ingredient Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa Others |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Liquid Powder/Dry Emulsions/Pastes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Flavoring | 120 | Product Development Managers, Flavor Technologists |

| Cosmetics and Personal Care Fragrances | 100 | Brand Managers, R&D Scientists |

| Household Products Fragrance Development | 80 | Marketing Directors, Product Line Managers |

| Natural and Organic Flavor Trends | 70 | Sustainability Officers, Regulatory Affairs Specialists |

| Emerging Markets Analysis | 90 | Market Analysts, Regional Sales Managers |

The Global Flavor and Fragrance Market is valued at approximately USD 33 billion, reflecting a five-year historical analysis and recent estimates indicating a combined industry value in the low-thirty billion range.