Region:Global

Author(s):Rebecca

Product Code:KRAA2913

Pages:82

Published On:August 2025

By Type:The flexible and printed electronics market is segmented into organic electronics, inorganic electronics, hybrid electronics, and others. Organic electronics are gaining traction due to their lightweight, flexible, and low-cost properties, making them increasingly suitable for displays, sensors, and wearable devices. Inorganic electronics, while traditionally rigid, are being adapted for flexible applications, especially in high-performance displays and photovoltaic cells. Hybrid electronics combine organic and inorganic materials, offering a balance of flexibility and enhanced electrical performance. The "Others" category includes emerging technologies such as stretchable and biodegradable electronics, which are still in early development but show significant potential for future applications .

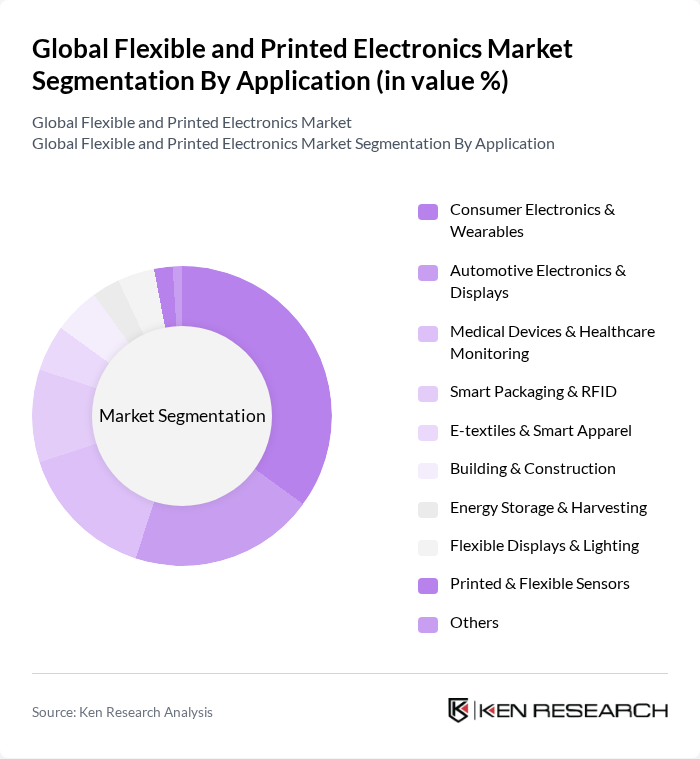

By Application:The applications of flexible and printed electronics span across consumer electronics and wearables, automotive electronics and displays, medical devices and healthcare monitoring, smart packaging and RFID, e-textiles and smart apparel, building and construction, energy storage and harvesting, flexible displays and lighting, printed and flexible sensors, and others. Consumer electronics and wearables remain the leading application area, driven by the demand for lightweight, portable, and innovative device form factors. Automotive electronics are also significant, with flexible displays, touch panels, and sensors being increasingly integrated into vehicles for enhanced user interfaces and safety features. The medical sector is witnessing robust growth due to the adoption of flexible biosensors, diagnostic patches, and wearable health monitors, enabling real-time and non-invasive patient monitoring .

The Global Flexible and Printed Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Display Co., Ltd., E Ink Holdings Inc., PragmatIC Semiconductor Ltd., Thin Film Electronics ASA, NovaCentrix, DuPont de Nemours, Inc., 3M Company, Nissha Co., Ltd., VTT Technical Research Centre of Finland Ltd., Yole Développement, Toppan Inc., Agfa-Gevaert Group, Sun Chemical Corporation, and Merck KGaA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flexible and printed electronics market appears promising, driven by technological advancements and increasing consumer demand. As industries continue to explore innovative applications, particularly in automotive and renewable energy sectors, the integration of flexible electronics is expected to expand significantly. Additionally, the focus on sustainability and eco-friendly materials will likely shape product development, fostering a more environmentally conscious market landscape that aligns with global trends toward greener technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Electronics Inorganic Electronics Hybrid Electronics Others |

| By Application | Consumer Electronics & Wearables Automotive Electronics & Displays Medical Devices & Healthcare Monitoring Smart Packaging & RFID E-textiles & Smart Apparel Building & Construction Energy Storage & Harvesting Flexible Displays & Lighting Printed & Flexible Sensors Others |

| By End-User | Consumer Electronics Manufacturers Automotive OEMs Healthcare Providers & Device Manufacturers Packaging Companies Textile & Apparel Manufacturers Industrial & Building Sector Energy Sector Others |

| By Component | Displays (OLED, LCD, E-paper) Sensors (Temperature, Pressure, Biosensors, etc.) Batteries & Energy Storage Devices Circuits & ICs Conductive Inks & Substrates RFID Tags Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wearable Technology Manufacturers | 60 | Product Managers, R&D Directors |

| Automotive Electronics Suppliers | 50 | Supply Chain Managers, Engineering Leads |

| Smart Packaging Companies | 40 | Marketing Managers, Product Development Heads |

| Consumer Electronics Brands | 55 | Procurement Officers, Innovation Managers |

| Research Institutions Focused on Printed Electronics | 45 | Research Scientists, Academic Professors |

The Global Flexible and Printed Electronics Market is valued at approximately USD 31.8 billion, driven by the demand for lightweight and portable electronic devices, advancements in printing technologies, and the adoption of flexible displays and smart packaging across various sectors.