Region:Global

Author(s):Shubham

Product Code:KRAB0700

Pages:93

Published On:August 2025

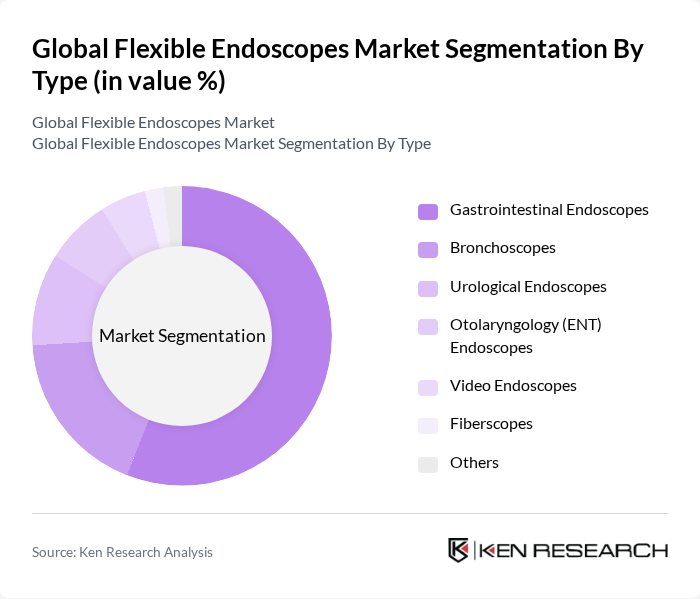

By Type:The flexible endoscopes market is segmented into gastrointestinal endoscopes, bronchoscopes, urological endoscopes, otolaryngology (ENT) endoscopes, video endoscopes, fiberscopes, and others. Gastrointestinal endoscopes hold the largest share due to the high prevalence of gastrointestinal disorders, such as colorectal cancer and inflammatory bowel disease, and the increasing number of diagnostic and therapeutic procedures. Bronchoscopes are witnessing strong demand, driven by the rising incidence of respiratory diseases and the need for minimally invasive diagnostic techniques. Technological advancements, such as high-definition imaging and the integration of artificial intelligence, are further enhancing the adoption of these devices .

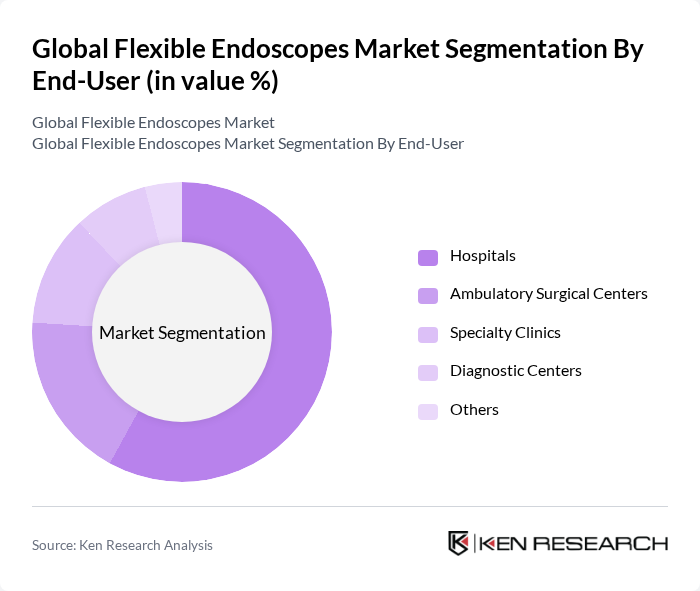

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers, specialty clinics, diagnostic centers, and others. Hospitals are the leading end-users of flexible endoscopes, attributed to their comprehensive facilities, high volume of procedures, and greater investment in advanced endoscopic equipment. Ambulatory surgical centers are experiencing rapid growth due to their cost-effectiveness, efficiency, and increasing adoption of outpatient minimally invasive procedures. Specialty clinics and diagnostic centers are also expanding their use of flexible endoscopes, driven by the demand for early disease detection and specialized care .

The Global Flexible Endoscopes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olympus Corporation, Fujifilm Holdings Corporation, Karl Storz SE & Co. KG, Medtronic plc, Boston Scientific Corporation, Stryker Corporation, PENTAX Medical (HOYA Corporation), CONMED Corporation, Hoya Corporation, Richard Wolf GmbH, EndoMed Systems GmbH, Ambu A/S, ELMED Medical Systems, B. Braun Melsungen AG, Cook Medical, Smith & Nephew plc, Machida Endoscope Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flexible endoscopes market in the None region appears promising, driven by ongoing technological advancements and an increasing focus on patient-centric care. The integration of artificial intelligence in endoscopic procedures is expected to enhance diagnostic accuracy and efficiency. Additionally, the growing trend towards outpatient procedures will likely increase the demand for flexible endoscopes, as healthcare providers seek to optimize patient throughput while minimizing hospital stays.

| Segment | Sub-Segments |

|---|---|

| By Type | Gastrointestinal Endoscopes Bronchoscopes Urological Endoscopes Otolaryngology (ENT) Endoscopes Video Endoscopes Fiberscopes Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Diagnostic Centers Others |

| By Application | Diagnostic Procedures Therapeutic Procedures Screening Procedures Interventional Procedures Others |

| By Component | Endoscope Systems Accessories Imaging Systems Light Sources Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Retail Distribution Wholesale Distribution Direct-to-Consumer Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastrointestinal Endoscopy | 120 | Gastroenterologists, Endoscopy Unit Managers |

| Respiratory Endoscopy | 90 | Pulmonologists, Thoracic Surgeons |

| Urological Endoscopy | 60 | Urologists, Surgical Nurses |

| Endoscope Manufacturing | 50 | Product Development Managers, Quality Assurance Officers |

| Healthcare Procurement | 70 | Hospital Procurement Officers, Supply Chain Managers |

The Global Flexible Endoscopes Market is valued at approximately USD 12.5 billion, driven by the increasing prevalence of gastrointestinal, respiratory, and urological diseases, along with advancements in endoscopic technologies and a growing demand for minimally invasive procedures.