Region:Global

Author(s):Rebecca

Product Code:KRAA1471

Pages:100

Published On:August 2025

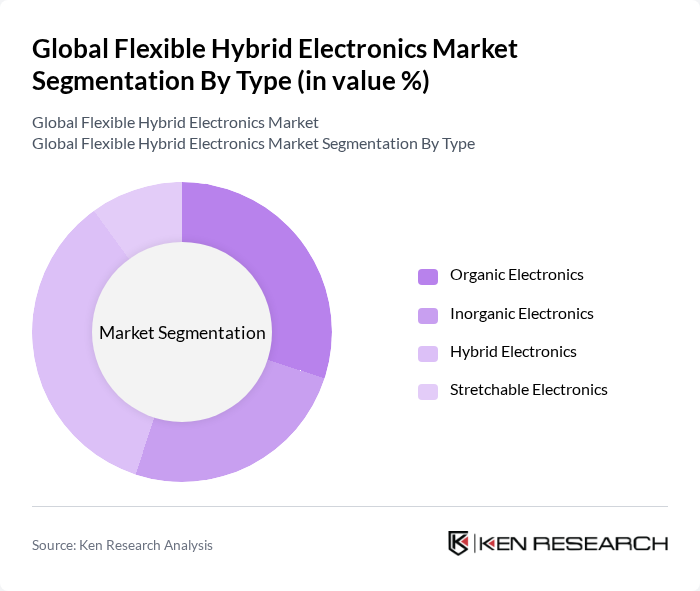

By Type:The flexible hybrid electronics market is segmented into four main types: Organic Electronics, Inorganic Electronics, Hybrid Electronics, and Stretchable Electronics. Each of these subsegments plays a crucial role in the overall market dynamics, with varying applications and technological advancements driving their growth. Organic electronics are widely used for lightweight, flexible displays and sensors. Inorganic electronics offer higher performance and reliability, especially in harsh environments. Hybrid electronics combine the strengths of both organic and inorganic materials, enabling multifunctional and robust devices. Stretchable electronics are gaining traction in wearable health monitoring and biomedical applications due to their ability to conform to complex surfaces .

The Hybrid Electronics subsegment is currently dominating the market due to its versatility and ability to combine the benefits of both organic and inorganic materials. This hybrid approach allows for enhanced performance in various applications, including wearables, smart devices, and industrial sensors. The increasing consumer demand for multifunctional devices that are lightweight and flexible has further propelled the growth of this subsegment, making it a key player in the flexible hybrid electronics landscape .

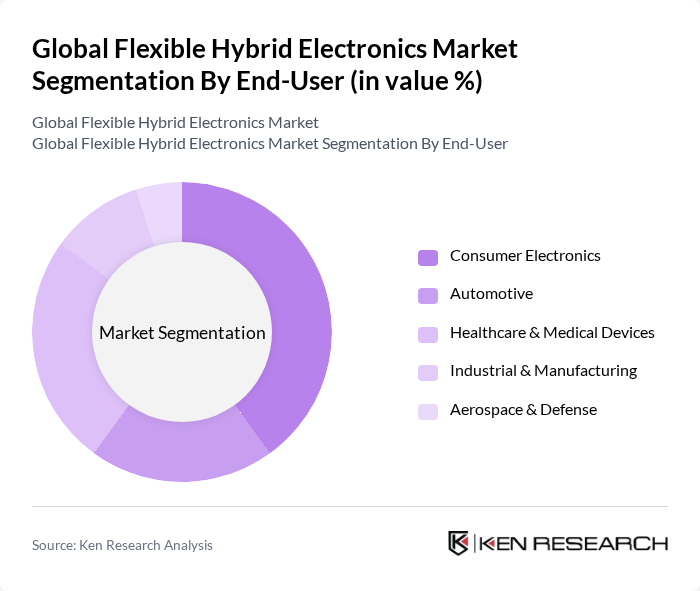

By End-User:The market is segmented by end-user into Consumer Electronics, Automotive, Healthcare & Medical Devices, Industrial & Manufacturing, and Aerospace & Defense. Each of these sectors utilizes flexible hybrid electronics for different applications, contributing to the overall market growth. Consumer electronics leverage FHE for wearables, foldable displays, and smart packaging. Automotive applications include flexible sensors for safety and monitoring. Healthcare & medical devices use FHE for patient monitoring and diagnostics. Industrial & manufacturing sectors benefit from flexible sensors and RFID, while aerospace & defense applications focus on lightweight, ruggedized electronics .

The Consumer Electronics segment leads the market, driven by the rapid adoption of smart devices, wearables, and foldable displays. The demand for innovative and compact electronic solutions in smartphones, tablets, and other personal devices has significantly increased the need for flexible hybrid electronics. This trend is further supported by advancements in technology and consumer preferences for lightweight, portable, and multifunctional devices .

The Global Flexible Hybrid Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as FlexEnable, PragmatIC Semiconductor, Thin Film Electronics ASA, Samsung Electronics Co., Ltd., LG Display Co., Ltd., NXP Semiconductors N.V., E Ink Holdings Inc., 3M Company, Panasonic Corporation, Sony Corporation, DuPont de Nemours, Inc., Acreo Swedish ICT, VTT Technical Research Centre of Finland, Imec, TNO, DuPont Teijin Films, American Semiconductor Inc., Lockheed Martin Corporation, General Electric Company, Domicro BV contribute to innovation, geographic expansion, and service delivery in this space .

The future of the flexible hybrid electronics market appears promising, driven by technological advancements and increasing consumer demand for innovative solutions. As manufacturers invest in research and development, the integration of artificial intelligence and machine learning into flexible electronics is expected to enhance functionality and user experience. Furthermore, the growing emphasis on sustainability will likely lead to the development of eco-friendly materials, aligning with global environmental goals and consumer preferences for green technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Electronics Inorganic Electronics Hybrid Electronics Stretchable Electronics |

| By End-User | Consumer Electronics Automotive Healthcare & Medical Devices Industrial & Manufacturing Aerospace & Defense |

| By Application | Wearable Devices Smart Packaging Flexible Displays Sensors (Temperature, Pressure, Biosensors) RFID & Security Tags Health Performance Tools Applications in Cars and Airplanes |

| By Component | Substrates (Plastic, Polyimide, PET) Conductors (Silver Ink, Copper, Carbon) Active Components (ICs, Transistors, Diodes) Surface Mount Devices Printed Chips |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Retail Wholesale E-commerce Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wearable Technology Development | 100 | Product Development Managers, R&D Engineers |

| Automotive Electronics Integration | 80 | Automotive Engineers, Supply Chain Managers |

| Healthcare Device Manufacturing | 70 | Medical Device Engineers, Regulatory Affairs Specialists |

| Consumer Electronics Market | 90 | Marketing Managers, Product Line Directors |

| Flexible Electronics Research & Development | 60 | Research Scientists, Innovation Managers |

The Global Flexible Hybrid Electronics Market is valued at approximately USD 155 million, driven by the increasing demand for lightweight and flexible electronic devices across various sectors, including consumer electronics, healthcare, automotive, and industrial applications.