Region:Global

Author(s):Shubham

Product Code:KRAC0634

Pages:99

Published On:August 2025

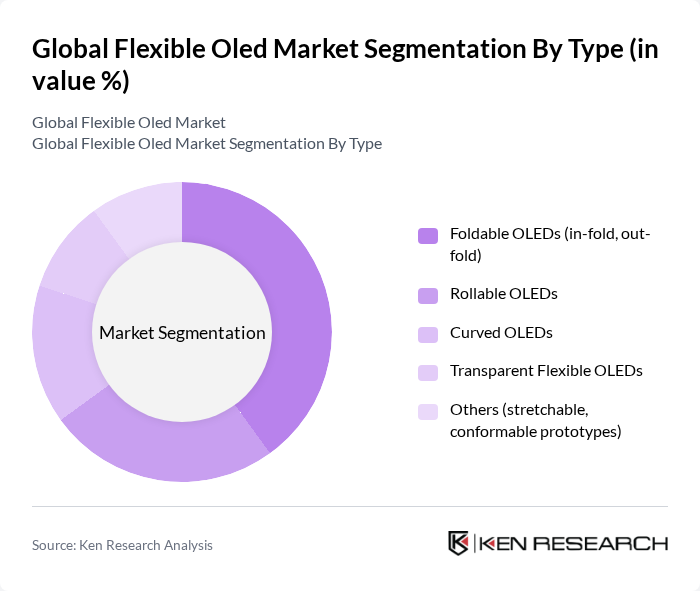

By Type:The flexible OLED market is segmented into various types, including Foldable OLEDs (in-fold, out-fold), Rollable OLEDs, Curved OLEDs, Transparent Flexible OLEDs, and Others (stretchable, conformable prototypes). Each of these subsegments caters to different consumer needs and technological advancements.

The Foldable OLEDs segment is currently dominating the market due to the rising popularity of foldable smartphones and devices. This trend is driven by consumer demand for larger screens in compact forms, allowing for enhanced portability without sacrificing display quality. The innovative designs and functionalities offered by foldable OLEDs have made them a preferred choice among manufacturers, leading to significant investments in this subsegment.

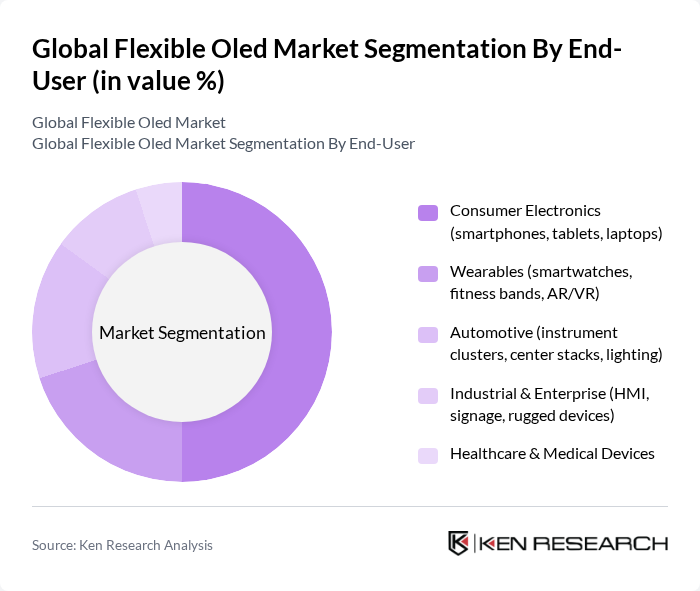

By End-User:The market is also segmented by end-user applications, including Consumer Electronics (smartphones, tablets, laptops), Wearables (smartwatches, fitness bands, AR/VR), Automotive (instrument clusters, center stacks, lighting), Industrial & Enterprise (HMI, signage, rugged devices), and Healthcare & Medical Devices.

The Consumer Electronics segment is the largest contributor to the flexible OLED market, driven by the increasing adoption of OLED displays in smartphones and laptops. The demand for high-quality displays with vibrant colors and better energy efficiency has led manufacturers to prefer OLED technology over traditional LCDs. This trend is expected to continue as consumers seek devices that offer superior visual experiences.

The Global Flexible Oled Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Display Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., Visionox Technology Inc., Tianma Microelectronics Co., Ltd., China Star Optoelectronics Technology (CSOT, TCL CSOT), AU Optronics Corp. (AUO), Sharp Corporation, Japan Display Inc. (JDI), Universal Display Corporation (UDC), Royole Corporation, OLEDWorks LLC, Kateeva, Inc., Merck KGaA, DuPont de Nemours, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flexible OLED market appears promising, driven by continuous technological advancements and increasing consumer demand for innovative display solutions. As manufacturers focus on enhancing durability and reducing production costs, the market is likely to witness a surge in adoption across various sectors, including automotive and smart home devices. Additionally, the integration of AI in display technologies is expected to create new opportunities for customization, further propelling market growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Foldable OLEDs (in-fold, out-fold) Rollable OLEDs Curved OLEDs Transparent Flexible OLEDs Others (stretchable, conformable prototypes) |

| By End-User | Consumer Electronics (smartphones, tablets, laptops) Wearables (smartwatches, fitness bands, AR/VR) Automotive (instrument clusters, center stacks, lighting) Industrial & Enterprise (HMI, signage, rugged devices) Healthcare & Medical Devices |

| By Application | Smartphones & Mobile Devices Televisions & Large Displays IT Displays (laptops, monitors, tablets) Automotive Displays & Lighting Wearable Displays Digital Signage & Commercial Displays |

| By Distribution Channel | OEM/ODM Supply Agreements Direct Sales to Brands Distributors/Value-Added Resellers Online B2B Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level (mass smartphones, wearables) Mid-Range Premium/Flagship Professional/Commercial |

| By Technology | Active-Matrix OLED (AMOLED) Passive-Matrix OLED (PMOLED) Transparent OLED Top-emitting/Bottom-emitting OLED Substrate Type (plastic, ultrathin glass, metal foil) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smartphone Manufacturers | 120 | Product Managers, Supply Chain Analysts |

| Television Producers | 80 | Technical Directors, Procurement Managers |

| Wearable Device Companies | 70 | Design Engineers, Marketing Managers |

| Display Technology Innovators | 60 | R&D Heads, Technology Strategists |

| Consumer Electronics Retailers | 90 | Sales Managers, Category Buyers |

The Global Flexible OLED Market is valued at approximately USD 10 billion, driven by the increasing demand for lightweight and flexible display technologies in consumer electronics, automotive, and industrial applications, particularly in smartphones and wearables.