Region:Global

Author(s):Rebecca

Product Code:KRAA2853

Pages:91

Published On:August 2025

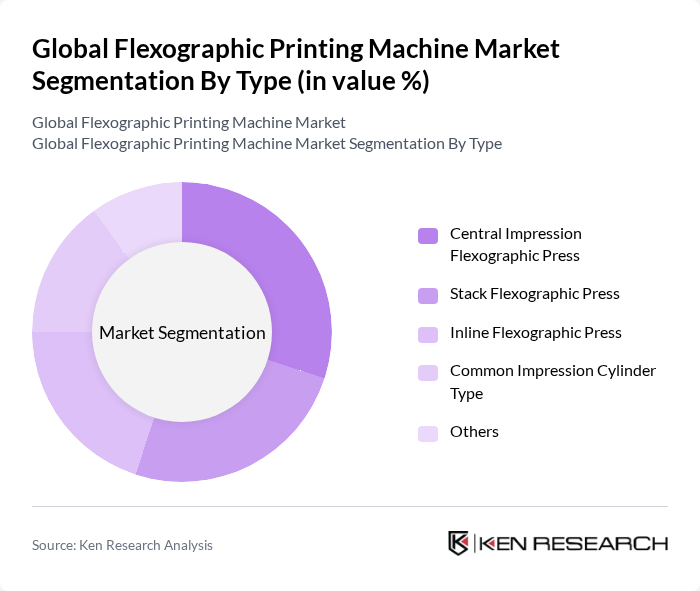

By Type:The flexographic printing machine market is segmented into various types, including Central Impression Flexographic Press, Stack Flexographic Press, Inline Flexographic Press, Common Impression Cylinder Type, and Others. Each type serves different printing needs and applications, catering to diverse customer requirements.

The Central Impression Flexographic Press is currently the leading sub-segment in the market due to its ability to produce high-quality prints at high speeds, making it ideal for large-scale production. This type of press is particularly favored in the packaging industry, where efficiency and print quality are paramount. The growing trend towards shorter print runs and customization has also contributed to its dominance, as it allows for quick changeovers and reduced waste.

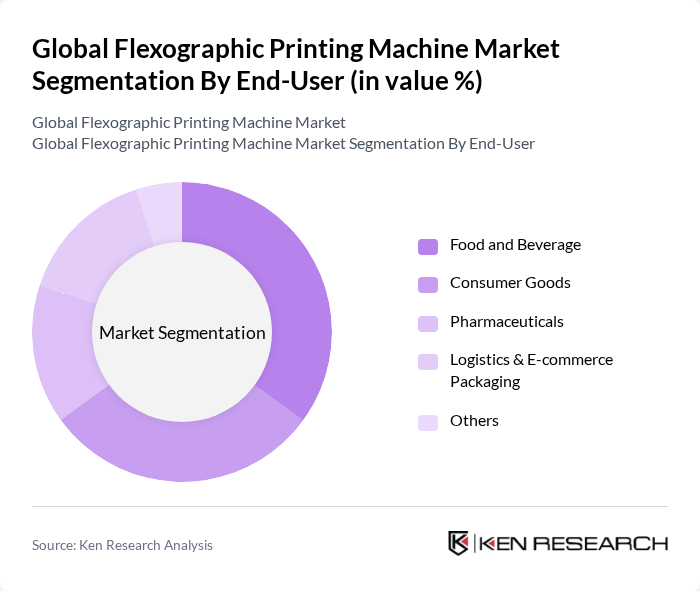

By End-User:The market is segmented by end-user industries, including Food and Beverage, Consumer Goods, Pharmaceuticals, Logistics & E-commerce Packaging, and Others. Each segment has unique requirements and preferences that influence the choice of flexographic printing machines.

The Food and Beverage sector is the largest end-user of flexographic printing machines, driven by the increasing demand for packaged food products and beverages. The need for attractive packaging that enhances brand visibility and complies with regulatory standards has led to a surge in the adoption of flexographic printing technologies. Additionally, the trend towards sustainable packaging solutions is further boosting the demand in this sector.

The Global Flexographic Printing Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bobst Group S.A., Mark Andy Inc., Heidelberger Druckmaschinen AG, Comexi Group Industries S.A., Koenig & Bauer AG, Uteco Converting S.p.A., Gallus Ferd. Rüesch AG, Omet S.r.l., Nilpeter A/S, Windmöller & Hölscher KG, Flexo Wash ApS, MPS Systems B.V., Esko-Graphics BV, DuPont de Nemours, Inc., Siegwerk Druckfarben AG & Co. KGaA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flexographic printing machine market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As companies increasingly adopt eco-friendly practices, the demand for innovative printing solutions will rise. Furthermore, the integration of automation and IoT technologies is expected to enhance operational efficiency, allowing manufacturers to meet evolving consumer preferences. This dynamic landscape will likely foster new opportunities for growth and innovation in the flexographic printing sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Central Impression Flexographic Press Stack Flexographic Press Inline Flexographic Press Common Impression Cylinder Type Others |

| By End-User | Food and Beverage Consumer Goods Pharmaceuticals Logistics & E-commerce Packaging Others |

| By Application | Labels & Tags Flexible Packaging Corrugated Packaging Cartons Wallpaper & Displays Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Water-based Inks Solvent-based Inks UV-cured/Energy-curable Inks Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Price Range | Low Range Mid Range High Range Others |

| By Automation Level | Manual Semi-automated Fully Automated |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 150 | Production Managers, Quality Control Supervisors |

| Label Printing Sector | 100 | Operations Directors, Product Managers |

| Corrugated Box Manufacturing | 80 | Plant Managers, Supply Chain Coordinators |

| Commercial Printing Services | 60 | Business Development Managers, Technical Directors |

| Emerging Markets Analysis | 50 | Market Analysts, Regional Sales Managers |

The Global Flexographic Printing Machine Market is valued at approximately USD 1.9 billion, reflecting a significant growth trend driven by the increasing demand for flexible packaging solutions across various industries, including food and beverage, pharmaceuticals, and consumer goods.