Region:Global

Author(s):Shubham

Product Code:KRAC0870

Pages:86

Published On:August 2025

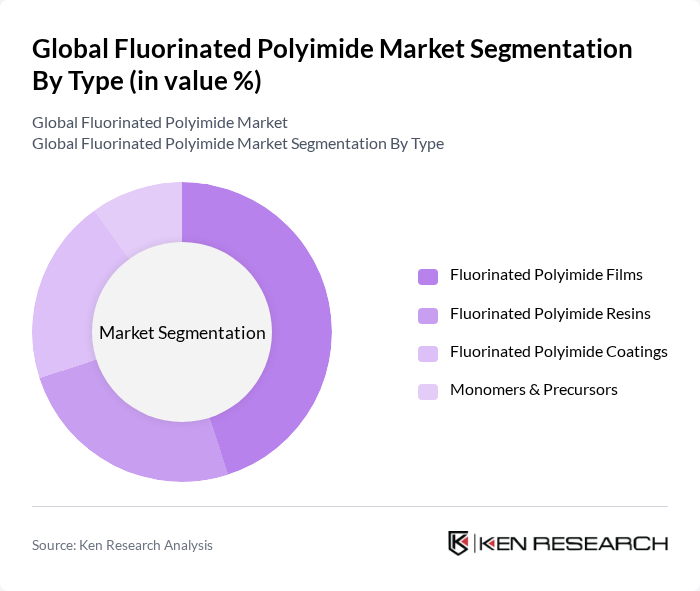

By Type:The market is segmented into four main types: Fluorinated Polyimide Films, Fluorinated Polyimide Resins, Fluorinated Polyimide Coatings, and Monomers & Precursors. Among these, Fluorinated Polyimide Films hold the largest share, primarily due to their extensive use in flexible electronics, display devices, and advanced circuit applications. The demand for lightweight, high-performance materials in consumer electronics and optoelectronic displays continues to drive this segment .

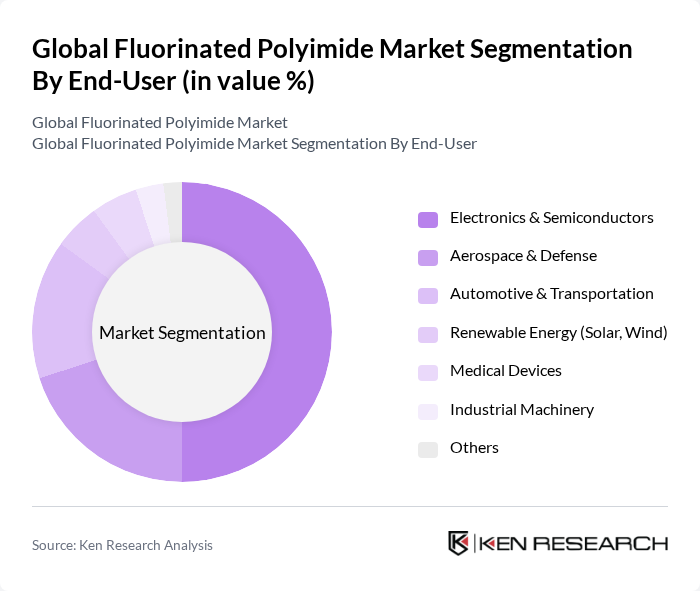

By End-User:The end-user segments include Electronics & Semiconductors, Aerospace & Defense, Automotive & Transportation, Renewable Energy (Solar, Wind), Medical Devices, Industrial Machinery, and Others. Electronics & Semiconductors represent the largest segment, fueled by the rapid expansion of consumer electronics, 5G infrastructure, and semiconductor manufacturing. The need for advanced materials that offer high thermal stability and electrical insulation is a key factor in this dominance. Aerospace & Defense, Automotive, and Renewable Energy also represent significant growth areas due to the increasing adoption of high-performance polymers in critical applications .

The Global Fluorinated Polyimide Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont de Nemours, Inc., Kaneka Corporation, Mitsubishi Gas Chemical Company, Inc., Ube Industries, Ltd., Toray Industries, Inc., Daikin Industries, Ltd., SKC Co., Ltd., Saint-Gobain S.A., W. L. Gore & Associates, Inc., Solvay S.A., 3M Company, Hubei Sanxia New Material Technology Co., Ltd., Hexion Inc., Polyimide Technologies, Inc., Hubei Huitian New Material Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fluorinated polyimide market appears promising, driven by technological advancements and increasing applications across various industries. The integration of smart technologies and the shift towards sustainable materials are expected to shape market dynamics significantly. As industries prioritize lightweight and high-performance materials, the demand for fluorinated polyimides will likely rise, fostering innovation and collaboration among key players. This evolving landscape presents opportunities for growth and expansion in emerging markets, particularly in renewable energy and automotive sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Fluorinated Polyimide Films Fluorinated Polyimide Resins Fluorinated Polyimide Coatings Monomers & Precursors |

| By End-User | Electronics & Semiconductors Aerospace & Defense Automotive & Transportation Renewable Energy (Solar, Wind) Medical Devices Industrial Machinery Others |

| By Application | Flexible Display Materials Electrical Insulation Structural Resins Solar Cells & Photovoltaics Lighting Devices Adhesives & Sealants Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Product Form | Sheets Rolls Custom Shapes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Applications | 100 | Materials Engineers, Aerospace Product Managers |

| Electronics Industry | 80 | Product Development Engineers, Supply Chain Managers |

| Automotive Sector | 70 | Quality Assurance Managers, Procurement Specialists |

| Medical Devices | 40 | Regulatory Affairs Specialists, R&D Managers |

| Industrial Applications | 90 | Operations Managers, Technical Sales Representatives |

The Global Fluorinated Polyimide Market is valued at approximately USD 1.1 billion, driven by increasing demand for high-performance materials in industries such as electronics, aerospace, and automotive. This market is expected to grow significantly due to the unique properties of fluorinated polyimides.