Region:Global

Author(s):Shubham

Product Code:KRAA1883

Pages:91

Published On:August 2025

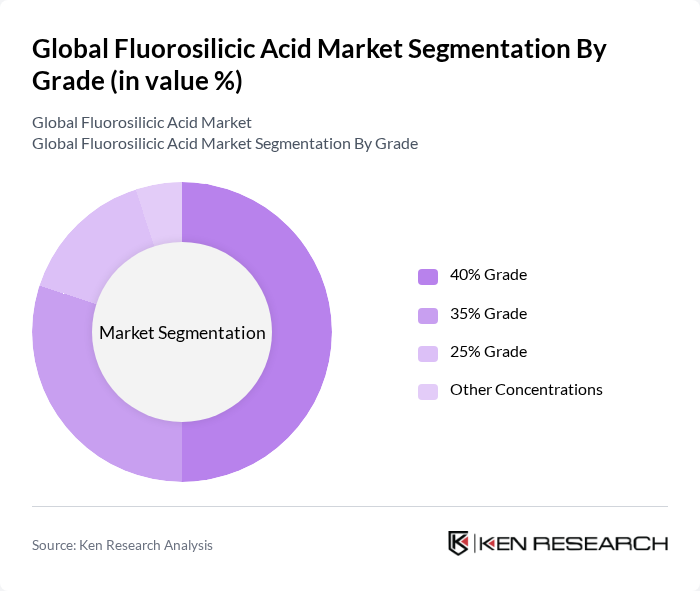

By Grade:The market is segmented by grade into 40% Grade, 35% Grade, 25% Grade, and Other Concentrations. The 40% Grade is widely used in industrial processes and water treatment supply chains, with 25% and 35% common in municipal handling specifications; grades are selected based on handling, storage, and dosing requirements across end-uses. Other concentrations serve niche and specialty applications in chemicals and materials processing.

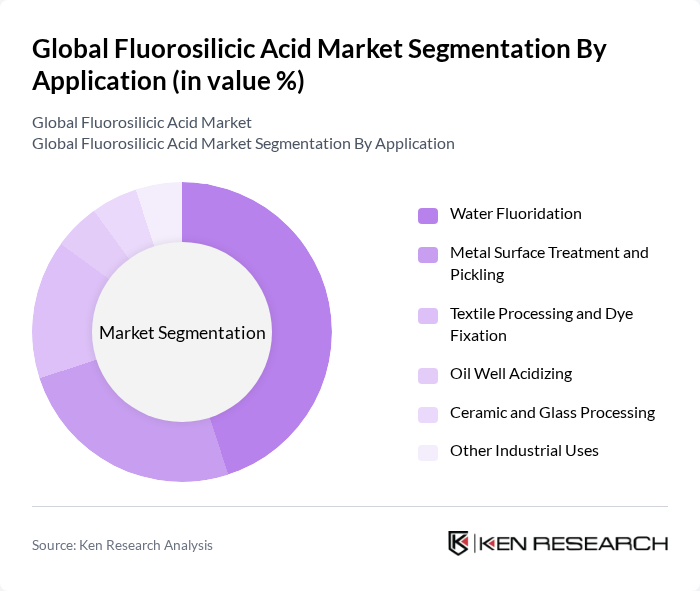

By Application:The applications of fluorosilicic acid include water fluoridation, metal surface treatment and pickling/electroplating, chemical manufacturing, hide processing, glass/textile processing, and other industrial uses. Water fluoridation remains a leading application globally, supported by public health programs; metal surface treatment/electroplating and chemical manufacturing are notable industrial consumers; hide/leather processing and etched/treated glass represent additional demand pockets.

The Global Fluorosilicic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hubei Xingfa Chemicals Group Co., Ltd., Solvay S.A., The Mosaic Company, Yara International ASA, Prayon S.A., J.R. Simplot Company, Innophos Holdings, Inc., Boliden AB, IXOM Operations Pty Ltd, Hawkins, Inc., Univar Solutions Inc. (now Univar Solutions LLC), Chemtrade Logistics Income Fund, Gujarat State Fertilizers & Chemicals Ltd. (GSFC), Grupa Azoty S.A., PhosAgro PJSC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fluorosilicic acid market appears promising, driven by technological advancements and a growing emphasis on sustainable practices. As industries increasingly adopt eco-friendly production methods, the demand for fluorosilicic acid is expected to rise. Additionally, emerging markets in Asia and Africa are likely to see increased investments in water treatment facilities, further boosting the market. Strategic partnerships among key players will also enhance innovation and expand market reach, ensuring a robust growth trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Grade | % Grade % Grade % Grade Other Concentrations |

| By Application | Water Fluoridation Metal Surface Treatment and Pickling Textile Processing and Dye Fixation Oil Well Acidizing Ceramic and Glass Processing Other Industrial Uses |

| By End-Use Industry | Municipal Water Treatment Utilities Chemicals and Fertilizer Processing Metals and Mining Textiles Oil & Gas Others |

| By Sales Channel | Direct Sales (Key Accounts, Tenders) Distributors and Traders Online / E-Procurement Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | ISO Tanks / Tankers HDPE or Lined Drums IBC Totes Others |

| By Price Tier | Economy Standard Premium (High-Purity/Low-Metal) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Water Treatment Facilities | 120 | Water Quality Managers, Environmental Engineers |

| Agricultural Sector Users | 80 | Agronomists, Crop Production Managers |

| Industrial Chemical Manufacturers | 70 | Production Managers, Chemical Engineers |

| Regulatory Bodies | 50 | Policy Makers, Environmental Compliance Officers |

| Research Institutions | 60 | Research Scientists, Academic Professors |

The Global Fluorosilicic Acid Market is valued at approximately USD 500 million, based on a five-year historical analysis. This valuation reflects the market's growth driven by water fluoridation programs and various industrial applications.