Region:Global

Author(s):Shubham

Product Code:KRAA1747

Pages:86

Published On:August 2025

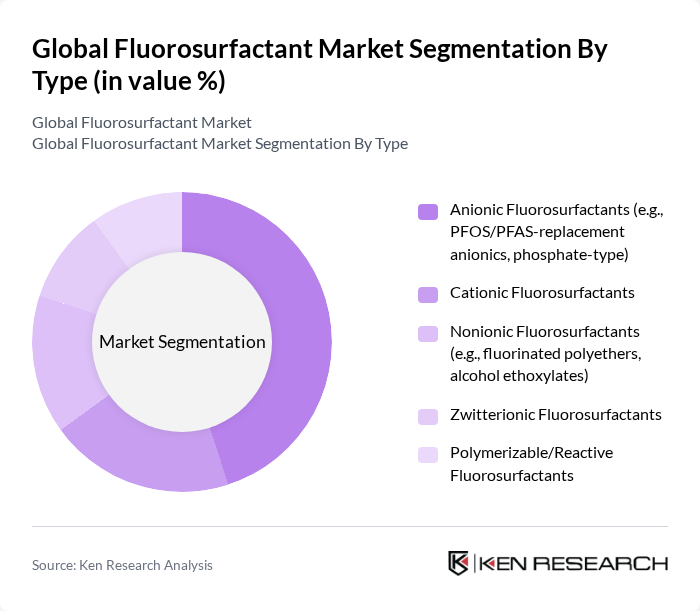

By Type:The fluorosurfactant market is segmented into various types, including Anionic, Cationic, Nonionic, Zwitterionic, and Polymerizable/Reactive Fluorosurfactants. Among these, Anionic Fluorosurfactants are widely used in industrial applications—particularly in paints and coatings—due to strong wetting, spreading, and leveling performance at very low use levels; regulatory and customer requirements are driving innovation toward short-chain and alternative anionic chemistries that replace legacy PFOS/PFOA-based systems .

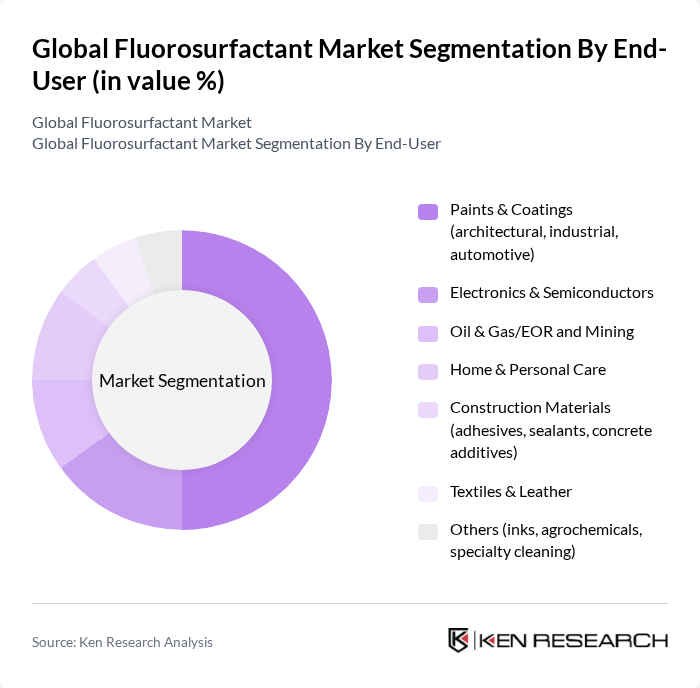

By End-User:The end-user segmentation includes Paints & Coatings, Electronics & Semiconductors, Oil & Gas/EOR and Mining, Home & Personal Care, Construction Materials, Textiles & Leather, and Others. The Paints & Coatings segment is the most significant, supported by automotive, architectural, and industrial coating applications where ultra-low surface tension improves wetting, leveling, anti-cratering, and defect control; electronics and precision cleaning/coating also represent key uses as component miniaturization and cleanroom standards rise .

The Global Fluorosurfactant Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Chemours Company, Daikin Industries, Ltd., AGC Inc. (AGC Chemicals), Solvay S.A., Dynax Corporation, Shanghai 3F New Materials Co., Ltd., Dongyue Group, Merck KGaA, Clariant AG, Wacker Chemie AG, Johnson Matthey plc, Pilot Chemical Company, Nouryon, DIC Corporation, Juhua Group Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fluorosurfactant market appears promising, driven by increasing demand for sustainable and efficient chemical solutions. As industries prioritize eco-friendly practices, the development of biodegradable fluorosurfactants is expected to gain traction. Additionally, the integration of digital technologies in supply chains will enhance operational efficiency, allowing manufacturers to respond swiftly to market changes. These trends indicate a dynamic landscape where innovation and sustainability will shape the market's trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Anionic Fluorosurfactants (e.g., PFOS/PFAS-replacement anionics, phosphate-type) Cationic Fluorosurfactants Nonionic Fluorosurfactants (e.g., fluorinated polyethers, alcohol ethoxylates) Zwitterionic Fluorosurfactants Polymerizable/Reactive Fluorosurfactants |

| By End-User | Paints & Coatings (architectural, industrial, automotive) Electronics & Semiconductors Oil & Gas/EOR and Mining Home & Personal Care Construction Materials (adhesives, sealants, concrete additives) Textiles & Leather Others (inks, agrochemicals, specialty cleaning) |

| By Application | Paints, Inks & Coatings (wetting, levelling, anti-cratering) Industrial & Institutional Cleaners Oilfield Chemicals (drilling fluids, oil recovery) Firefighting Foams (AFFF/fluorine-free transitions) Adhesives & Sealants Others (polishes, waxes, photographic, plating) |

| By Distribution Channel | Direct Sales to OEMs and Formulators Authorized Chemical Distributors Digital/Online B2B Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Commodity Grade Mid-range Performance Grade High-performance/Specialty Grade |

| By Packaging Type | Bulk Packaging (drums, IBCs) Small Packs (pails, cans) Custom/Returnable Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coatings and Paints Industry | 100 | Product Development Managers, Technical Directors |

| Textile Manufacturing Sector | 80 | Procurement Managers, Quality Assurance Heads |

| Oil & Gas Applications | 70 | Field Engineers, Operations Managers |

| Personal Care Products | 90 | Formulation Chemists, Brand Managers |

| Electronics and Semiconductor Industry | 60 | Manufacturing Engineers, R&D Managers |

The Global Fluorosurfactant Market is valued at approximately USD 630 million, with recent valuations ranging from USD 625 million to USD 735 million. This valuation reflects the impact of tightened PFAS regulations and the ongoing demand in various industries such as paints and electronics.