Region:Global

Author(s):Shubham

Product Code:KRAD0600

Pages:83

Published On:August 2025

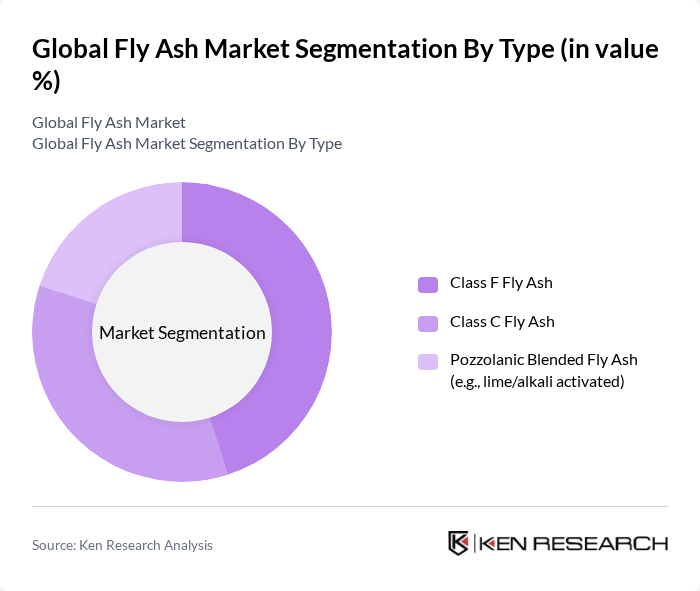

By Type:The market is segmented into three main types of fly ash: Class F Fly Ash, Class C Fly Ash, and Pozzolanic Blended Fly Ash. Class F Fly Ash is derived from burning anthracite or bituminous coal and is known for its pozzolanic properties, making it suitable for high-performance concrete. Class C Fly Ash, produced from lignite or sub-bituminous coal, contains cementitious properties and is often used in structural applications. Pozzolanic Blended Fly Ash includes various blends that enhance the performance of concrete and other construction materials.

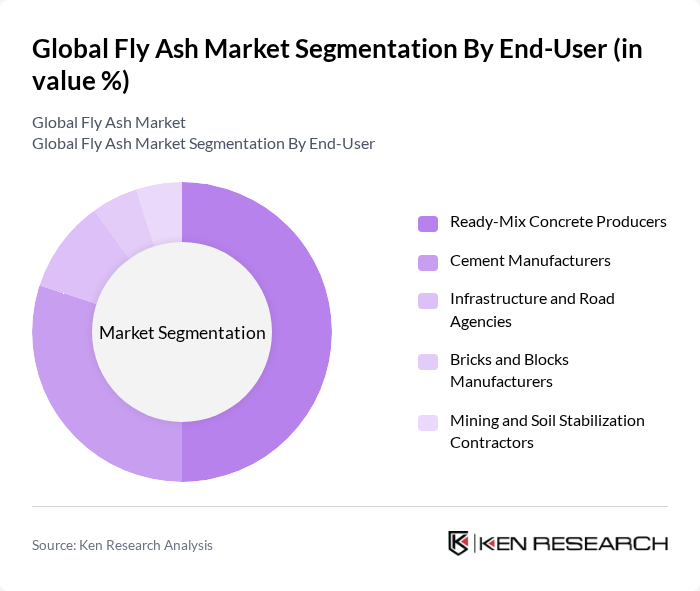

By End-User:The end-user segment includes Ready-Mix Concrete Producers, Cement Manufacturers, Infrastructure and Road Agencies, Bricks and Blocks Manufacturers, and Mining and Soil Stabilization Contractors. Ready-Mix Concrete Producers are the largest consumers of fly ash due to its ability to enhance the strength, workability, and durability of concrete. Cement Manufacturers utilize fly ash as a partial replacement for Portland cement to reduce clinker factor and embodied carbon, while Infrastructure and Road Agencies leverage its properties for pavement, soil stabilization, and base applications.

The Global Fly Ash Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boral Limited, Charah Solutions, Inc., SEFA Group, LafargeHolcim Ltd. (Holcim Ltd.), Heidelberg Materials AG, Eco Material Technologies, Cementir Holding N.V., Titan Cement International S.A., CEMEX, S.A.B. de C.V., CRH plc, Tarmac Trading Limited, Aggregate Industries Limited, Ashtech (India) Pvt. Ltd., UltraTech Cement Limited, Adbri Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fly ash market appears promising, driven by increasing environmental awareness and the push for sustainable construction practices. As infrastructure projects expand globally, particularly in emerging economies, the demand for fly ash is expected to rise. Innovations in recycling technologies and the development of new applications for fly ash will further enhance its market potential. Additionally, collaborations between fly ash suppliers and construction firms will likely foster growth, ensuring that fly ash becomes a staple in eco-friendly building practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Class F Fly Ash Class C Fly Ash Pozzolanic Blended Fly Ash (e.g., lime/alkali activated) |

| By End-User | Ready-Mix Concrete Producers Cement Manufacturers Infrastructure and Road Agencies Bricks and Blocks Manufacturers Mining and Soil Stabilization Contractors |

| By Application | Cement and Concrete Bricks, Blocks, and Pavers Road and Embankment (Soil and Base Stabilization) Waste and Mine Backfill/Grouting Others (e.g., agriculture, flowable fill) |

| By Distribution Channel | Direct Offtake from Utilities/Producers Aggregators and Ash Management Companies Construction Materials Distributors Online and Contractual E-Procurement |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Quality/Specification | ASTM C618 Class F/C Compliant EN 450-1 Conforming Non-conforming/Off-spec for Non-structural Use |

| By Recovery Source | Fresh Fly Ash (from operating coal plants) Harvested/Landfilled Pond Ash Blended/Synthetic Pozzolan Mixes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Utilization | 150 | Project Managers, Site Engineers |

| Cement Manufacturing Sector | 120 | Production Managers, Quality Control Officers |

| Environmental Regulatory Bodies | 60 | Policy Makers, Environmental Scientists |

| Agricultural Applications of Fly Ash | 80 | Agronomists, Soil Scientists |

| Fly Ash Supply Chain Management | 70 | Logistics Coordinators, Procurement Managers |

The Global Fly Ash Market is valued at approximately USD 7.5 billion, driven by the increasing demand for sustainable construction materials, particularly in concrete production, which enhances durability and reduces emissions associated with clinker use.