Region:Global

Author(s):Rebecca

Product Code:KRAE0006

Pages:95

Published On:December 2025

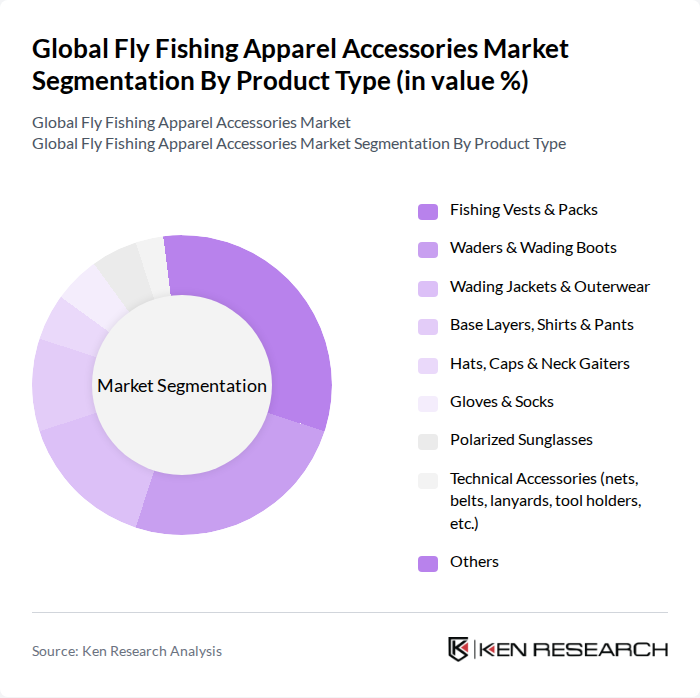

By Product Type:The product type segmentation includes various categories of fly fishing apparel and accessories that cater to different needs and preferences of anglers. The dominant sub-segment in this category is Fishing Vests & Packs, which are essential for carrying tackle, fly boxes, tools, hydration, and personal items while keeping gear organized and easily accessible on the water. Waders & Wading Boots also hold significant market share, as breathable, durable, and ergonomically designed models are critical for anglers who fish in rivers, streams, and coastal areas where stability, insulation, and waterproof performance are required. The increasing trend of outdoor activities, the growth of destination fly fishing tourism, and the demand for technical, lightweight, and sustainable materials are driving the growth of these sub-segments, along with jackets, sun-protective shirts, and polarized eyewear that enhance comfort and safety in varying weather conditions.

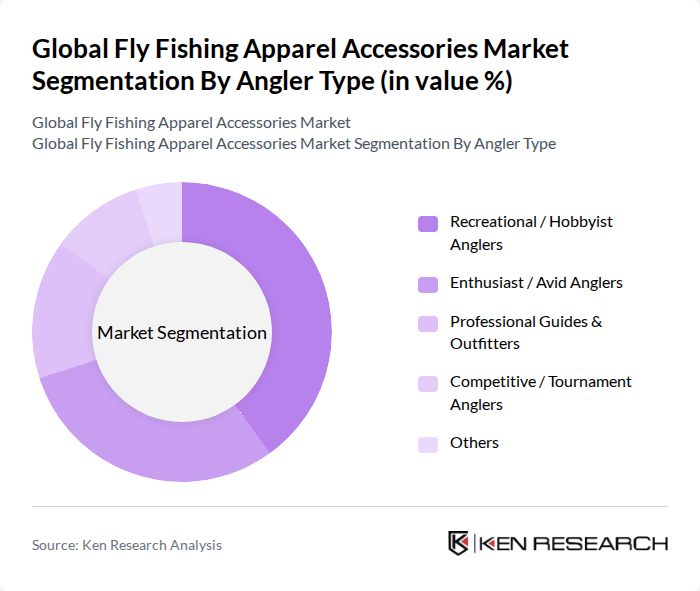

By Angler Type:The angler type segmentation categorizes consumers based on their level of engagement in fly fishing. The Recreational / Hobbyist Anglers sub-segment is the largest, supported by growing interest in outdoor leisure, wellness?oriented nature activities, and the accessibility of beginner?friendly fly fishing experiences and entry?level gear packages. Enthusiast / Avid Anglers also represent a significant portion of the market, as they often invest in premium, technical apparel and accessories with advanced features such as breathable waterproof membranes, ergonomic boot designs, UV?protective fabrics, and modular storage systems to enhance performance and durability over frequent use.

The Global Fly Fishing Apparel Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Patagonia, Inc., Simms Fishing Products LLC, The Orvis Company, Inc., Columbia Sportswear Company, Fishpond, Inc., Redington (Far Bank Enterprises), Umpqua Feather Merchants, Sage Fly Fish (Far Bank Enterprises), Temple Fork Outfitters (TFO), BUFF, S.A. (Original Buff), AFTCO Mfg. Co., Inc. (American Fishing Tackle Company), Eagle Claw Fishing Tackle Co. (Wright & McGill Co.), Cabela’s LLC, Bass Pro Shops, Skwala Fishing contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fly fishing apparel accessories market appears promising, driven by increasing consumer interest in outdoor activities and sustainability. As more individuals seek eco-friendly options, brands that prioritize sustainable practices are likely to gain a competitive edge. Additionally, the integration of technology into apparel will enhance functionality, appealing to a tech-savvy demographic. Companies that adapt to these trends will be well-positioned to capture market share and drive growth in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fishing Vests & Packs Waders & Wading Boots Wading Jackets & Outerwear Base Layers, Shirts & Pants Hats, Caps & Neck Gaiters Gloves & Socks Polarized Sunglasses Technical Accessories (nets, belts, lanyards, tool holders, etc.) Others |

| By Angler Type | Recreational / Hobbyist Anglers Enthusiast / Avid Anglers Professional Guides & Outfitters Competitive / Tournament Anglers Others |

| By Gender & Fit | Men’s Fly Fishing Apparel & Accessories Women’s Fly Fishing Apparel & Accessories Youth / Kids’ Fly Fishing Apparel & Accessories Unisex & Adaptive Fit |

| By Material & Performance | Synthetic Technical Fabrics (nylon, polyester, etc.) Natural & Bio-based Fabrics (cotton, merino wool, hemp, etc.) Blended Performance Fabrics Sustainable / Recycled Materials Others |

| By Distribution Channel | Online Direct-to-Consumer (Brand Webstores) Online Marketplaces & E-commerce Retailers Specialty Fly Shops & Outdoor Retailers Sporting Goods & Department Stores Guide Services, Outfitters & Resorts Others |

| By Price Range | Budget / Entry-Level Mid-Range Premium / Technical Luxury / Custom |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fly Fishing Apparel Retailers | 80 | Store Managers, Buyers |

| Avid Fly Fishers | 120 | Recreational Anglers, Fishing Guides |

| Outdoor Apparel Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Fishing Equipment Distributors | 50 | Sales Representatives, Distribution Managers |

| Environmental Organizations Focused on Fishing | 40 | Policy Analysts, Conservation Officers |

The Global Fly Fishing Apparel Accessories Market is valued at approximately USD 3.2 billion, reflecting a significant growth trend driven by increased participation in outdoor sports and the rising demand for specialized fishing apparel.