Region:Global

Author(s):Shubham

Product Code:KRAC0623

Pages:83

Published On:August 2025

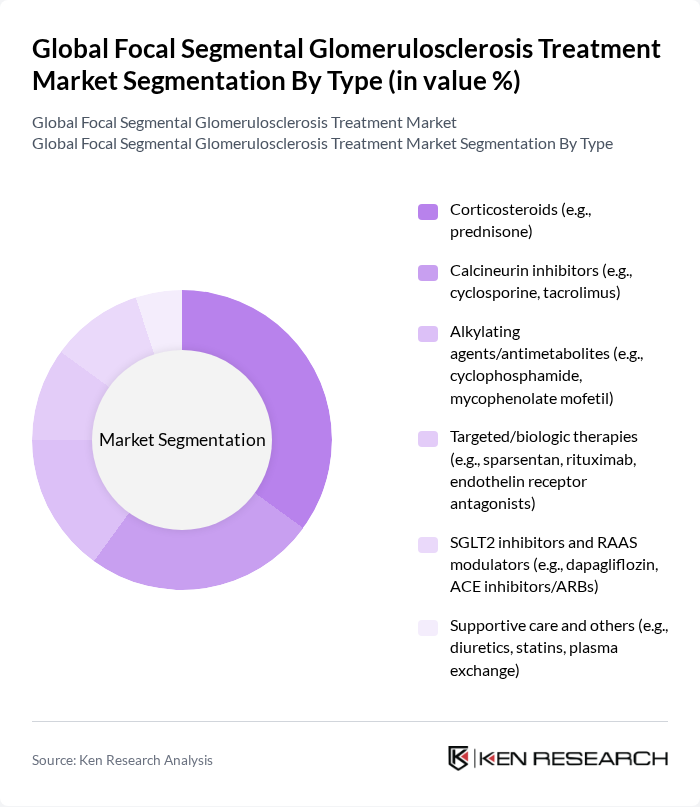

By Type:The treatment options for FSGS are diverse, encompassing various classes of medications that target different pathways involved in the disease. The market is segmented into corticosteroids, calcineurin inhibitors, alkylating agents/antimetabolites, targeted/biologic therapies, SGLT2 inhibitors and RAAS modulators, and supportive care. Among these, corticosteroids are the most widely used due to their effectiveness in managing inflammation and proteinuria associated with FSGS.

By Treatment Stage:The treatment of FSGS is categorized into three stages: initial induction therapy, maintenance therapy, and relapse/refractory management. Initial induction therapy is crucial for achieving remission, while maintenance therapy is essential for sustaining remission and preventing relapses. The market is witnessing a growing trend towards personalized treatment approaches, particularly in managing relapse/refractory cases, which is driving innovation in this segment.

The Global Focal Segmental Glomerulosclerosis Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Travere Therapeutics, Inc., Novartis AG, Calliditas Therapeutics AB, Chemocentryx, Inc. (now part of Amgen Inc.), Pfizer Inc., Johnson & Johnson (Janssen), GSK plc, Regeneron Pharmaceuticals, Inc., Vertex Pharmaceuticals Incorporated, Boehringer Ingelheim International GmbH, AstraZeneca plc, Omeros Corporation, Apellis Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Reata Pharmaceuticals, Inc. (a wholly owned subsidiary of Biogen Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Focal Segmental Glomerulosclerosis treatment market appears promising, driven by ongoing research and technological advancements. The shift towards personalized medicine is expected to enhance treatment efficacy, tailoring therapies to individual patient profiles. Additionally, the integration of digital health solutions will facilitate remote monitoring and management, improving patient engagement and adherence. As these trends evolve, they will likely reshape the landscape of FSGS treatment, fostering innovation and improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Corticosteroids (e.g., prednisone) Calcineurin inhibitors (e.g., cyclosporine, tacrolimus) Alkylating agents/antimetabolites (e.g., cyclophosphamide, mycophenolate mofetil) Targeted/biologic therapies (e.g., sparsentan, rituximab, endothelin receptor antagonists) SGLT2 inhibitors and RAAS modulators (e.g., dapagliflozin, ACE inhibitors/ARBs) Supportive care and others (e.g., diuretics, statins, plasma exchange) |

| By Treatment Stage | Initial induction therapy Maintenance therapy Relapse/refractory management |

| By Route of Administration | Oral Intravenous Subcutaneous |

| By Patient Demographics | Pediatric Adult Geriatric |

| By Distribution Channel | Hospital pharmacies Retail pharmacies Online pharmacies/specialty pharmacies |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Disease Type | Primary (idiopathic) FSGS Secondary FSGS (e.g., APOL1-associated, viral/drug-induced, adaptive) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nephrologist Insights | 100 | Nephrologists, Kidney Disease Specialists |

| Patient Perspectives | 120 | FSGS Patients, Caregivers |

| Pharmaceutical Stakeholders | 80 | Pharma Executives, Product Managers |

| Healthcare Policy Experts | 60 | Health Economists, Policy Analysts |

| Clinical Trial Investigators | 70 | Clinical Researchers, Trial Coordinators |

The Global Focal Segmental Glomerulosclerosis (FSGS) Treatment Market is valued at approximately USD 2.6 billion, based on a five-year historical analysis. This figure aligns with various industry assessments that estimate the market in the low single-billion range.