Global Food Flavor Market Overview

- The Global Food Flavor Market is valued at approximately USD 19 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for processed and packaged foods, rising consumer preference for natural and clean-label flavors, and robust expansion in the beverage industry. The market is also influenced by innovations such as AI-based flavor profiling, encapsulation technologies for enhanced shelf-life and taste, and the growing trend toward clean label products that emphasize transparency and natural ingredients. Additionally, there is a notable rise in demand for functional and immunity-boosting flavors, reflecting post-pandemic consumer priorities.

- Key players in this market include the United States, Germany, and China, which dominate due to their advanced food processing industries, strong consumer bases, and significant investments in research and development. The United States leads in flavor innovation and production capacity, Germany is recognized for its high-quality standards and technological advancements, and China, with its vast population and growing middle class, presents a rapidly expanding market for food flavors. The Asia-Pacific region, particularly China, is currently the fastest-growing market, driven by urbanization, changing dietary habits, and increasing demand for flavored snacks and ready-to-eat products.

- In 2023, the European Union continued to enforce and update regulations that limit the use of artificial flavors in food products. These regulations aim to promote the use of natural flavors and enhance consumer safety by ensuring food products are free from harmful additives. This initiative reflects a broader trend toward healthier eating and transparency in food labeling, aligning with consumer demand for natural ingredients and authenticity in food experiences.

Global Food Flavor Market Segmentation

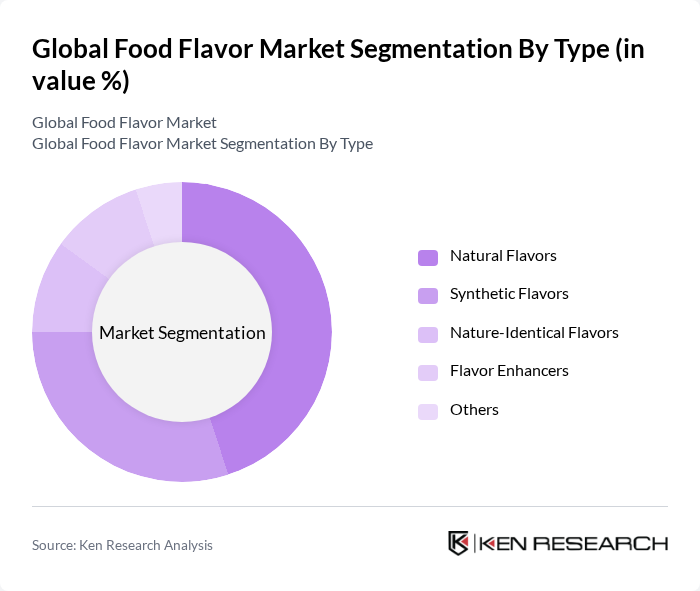

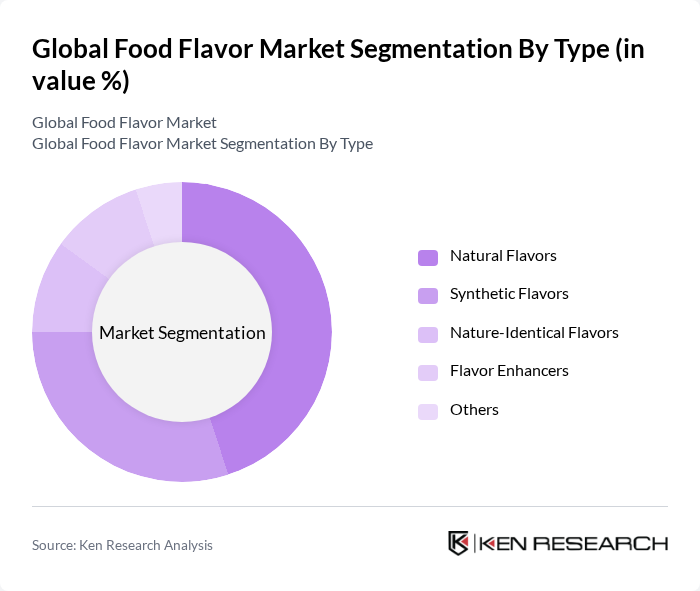

By Type:The food flavor market is segmented into various types, including Natural Flavors, Synthetic Flavors, Nature-Identical Flavors, Flavor Enhancers, and Others. Among these, Natural Flavors are gaining significant traction due to the increasing consumer preference for clean label products and the demand for healthier food options. Synthetic Flavors, while still present, are facing scrutiny due to health and regulatory concerns, leading to a shift toward more natural alternatives. The market for Flavor Enhancers is also expanding as manufacturers seek to improve taste profiles without adding calories or artificial ingredients.

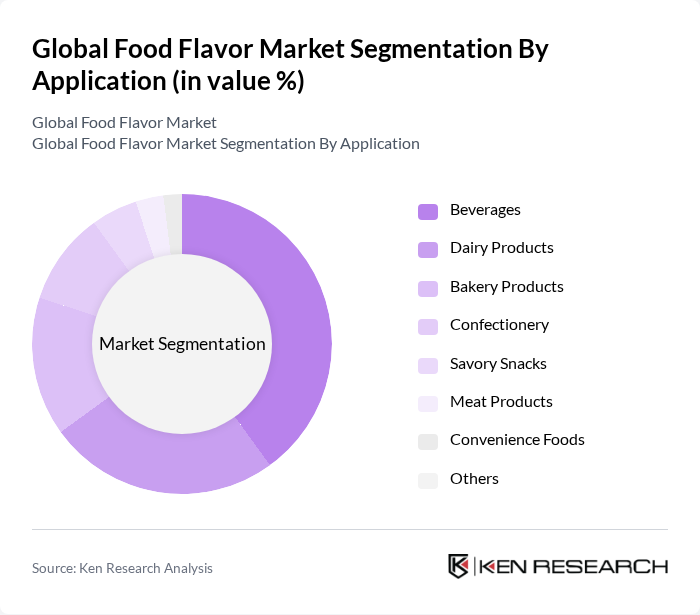

By Application:The applications of food flavors are diverse, including Beverages, Dairy Products, Bakery Products, Confectionery, Savory Snacks, Meat Products, Convenience Foods, and Others. The Beverages segment is the largest, driven by the growing demand for flavored drinks, innovations in beverage formulations, and the introduction of functional beverages. Dairy Products and Bakery Products also represent significant portions of the market, as consumers seek enhanced and authentic flavors in everyday products. The trend toward convenience foods and ready-to-eat meals is further propelling the demand for flavors that cater to busy lifestyles and global taste preferences.

Global Food Flavor Market Competitive Landscape

The Global Food Flavor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Givaudan SA, Firmenich SA, International Flavors & Fragrances Inc., Symrise AG, Sensient Technologies Corporation, Takasago International Corporation, Mane SA, Robertet SA, T. Hasegawa Co., Ltd., Bell Flavors & Fragrances, Inc., D.D. Williamson & Co., Inc., Flavorchem Corporation, Wild Flavors GmbH, Frutarom Industries Ltd., Kerry Group plc, and Huabao Flavours & Fragrances Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Food Flavor Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Natural Flavors:The global shift towards natural ingredients is evident, with the natural flavor market projected to reach $20 billion in future. This demand is driven by consumers seeking healthier, cleaner food options, as 70% of consumers prefer products with natural flavors over synthetic ones. The rise in organic food sales, which reached $62 billion in future, further supports this trend, indicating a robust market for natural flavors in the food industry.

- Rising Health Consciousness Among Consumers:Health awareness is significantly influencing food choices, with 60% of consumers actively seeking healthier food options. The global health and wellness food market is expected to surpass $1 trillion in future. This trend is pushing food manufacturers to incorporate flavors that align with health benefits, such as low-calorie and nutrient-rich options, thereby increasing the demand for innovative flavor solutions that cater to health-conscious consumers.

- Expansion of the Food and Beverage Industry:The food and beverage industry is projected to grow to $8 trillion in future, driven by increasing urbanization and changing lifestyles. This expansion is creating a higher demand for diverse flavors to cater to a broader consumer base. Additionally, the rise of e-commerce in food sales, which saw a 30% increase in future, is facilitating access to a variety of flavor products, further propelling market growth in the flavor sector.

Market Challenges

- Stringent Regulatory Frameworks:The food flavor industry faces significant challenges due to stringent regulations imposed by authorities like the FDA and EFSA. Compliance with food safety standards requires substantial investment, with companies spending an average of $1 million annually on regulatory compliance. These regulations can limit the use of certain flavoring agents, impacting product development and market entry for new flavors, thus posing a challenge for manufacturers.

- Fluctuating Raw Material Prices:The volatility in raw material prices, particularly for natural ingredients, poses a significant challenge to the food flavor market. For instance, the price of vanilla has surged by 300% over the past five years due to supply shortages. Such fluctuations can lead to increased production costs, affecting profit margins and pricing strategies for flavor manufacturers, ultimately impacting their competitiveness in the market.

Global Food Flavor Market Future Outlook

The future of the food flavor market appears promising, driven by the increasing consumer preference for natural and organic products. Innovations in flavor technology, such as the use of biotechnology to create sustainable flavors, are expected to enhance product offerings. Additionally, the growing trend of clean label products will likely push manufacturers to develop flavors that meet consumer demands for transparency and health, fostering a more competitive landscape in the industry.

Market Opportunities

- Growth in the Organic Food Sector:The organic food sector is projected to grow to $100 billion in future, presenting a significant opportunity for flavor manufacturers. As consumers increasingly seek organic options, flavors derived from organic sources will be in high demand, allowing companies to capitalize on this trend by developing organic flavor solutions that meet market needs.

- Development of Customized Flavor Solutions:The demand for personalized food experiences is rising, with 40% of consumers expressing interest in customized flavors. This trend offers flavor manufacturers the opportunity to innovate and create tailored flavor solutions for specific consumer preferences, enhancing customer satisfaction and loyalty while driving sales growth in a competitive market.