Global Food Glazing Agents Market Overview

- The Global Food Glazing Agents Market is valued at USD 4.8 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for processed and ready-to-eat food products, which require glazing agents for enhanced appearance, texture, and shelf life. The rising consumer preference for visually appealing food products and the expansion of bakery and confectionery sectors have led to a surge in the use of glazing agents across various food applications.

- Key players in this market are concentrated in regions such as North America and Europe, where there is a high demand for processed and convenience foods. Countries like the United States and Germany dominate the market due to their advanced food processing industries, strong bakery and confectionery sectors, and stringent quality standards, which necessitate the use of food glazing agents to meet consumer expectations.

- Recent regulatory developments in the European Union have strengthened requirements regarding the use of food glazing agents, with a growing emphasis on natural and approved sources. These regulations aim to enhance food safety and consumer trust, ensuring that only safe and high-quality glazing agents are used in food products. The European Food Safety Authority (EFSA) has reported increased adoption of natural glazing agents, reflecting the market’s shift toward clean-label and sustainable ingredients.

Global Food Glazing Agents Market Segmentation

By Type:The food glazing agents market is segmented into various types, including Stearic Acid, Candelilla Wax, Carnauba Wax, Beeswax, Shellac, and Other Types. Among these, Carnauba Wax is the most dominant due to its natural origin, excellent gloss properties, and suitability for clean-label formulations, making it a preferred choice for food manufacturers. The increasing consumer demand for natural and organic products has further propelled the use of Carnauba Wax in food applications.

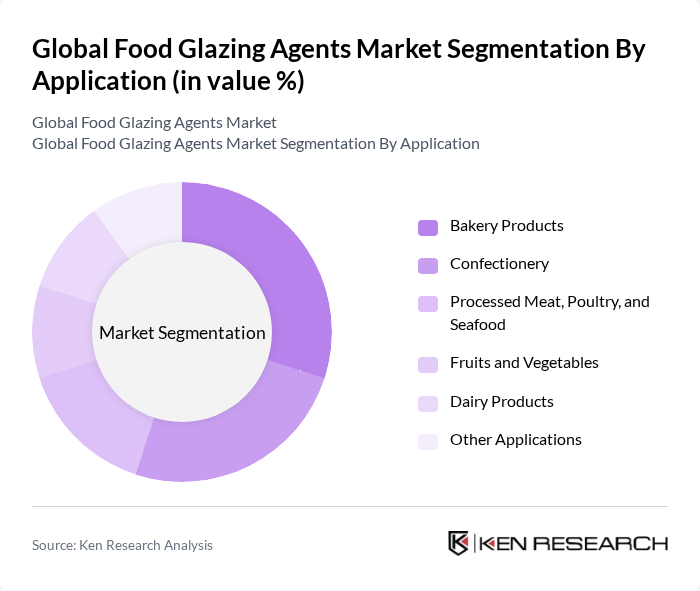

By Application:The applications of food glazing agents include Bakery Products, Confectionery, Processed Meat, Poultry, and Seafood, Fruits and Vegetables, Dairy Products, and Other Applications. The Bakery Products segment holds a significant share due to the increasing consumption of baked goods, the need for improved shelf life and visual appeal, and the trend towards artisanal and premium bakery products. Confectionery also represents a major application, driven by the demand for glossy finishes in chocolates, candies, and coated sweets.

Global Food Glazing Agents Market Competitive Landscape

The Global Food Glazing Agents Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Tate & Lyle PLC, DuPont de Nemours, Inc., Kerry Group PLC, BASF SE, DSM Nutritional Products, Univar Solutions Inc., Sensient Technologies Corporation, Emsland Group, Naturex S.A., Batory Foods, Fuchs North America, AAK AB, Mantrose-Haeuser Co., Inc., Capol GmbH, Masterol Foods, Ziegler & Co. GmbH contribute to innovation, geographic expansion, and service delivery in this space.

Global Food Glazing Agents Market Industry Analysis

Growth Drivers

- Increasing Demand for Processed Foods:The global processed food market is projected to reach $4.8 trillion in future, driven by urbanization and busy lifestyles. This surge in demand for convenience foods directly influences the food glazing agents market, as these agents enhance the visual appeal and shelf life of processed products. The rise in disposable incomes, particularly in developing regions, further supports this trend, with an estimated increase of 6% in consumer spending on processed foods annually.

- Rising Consumer Preference for Aesthetic Food Presentation:Aesthetic appeal in food products is increasingly important, with 75% of consumers stating that presentation influences their purchasing decisions. This trend is particularly evident in the bakery and confectionery sectors, where glazing agents are essential for enhancing visual appeal. The global bakery market is expected to grow to $550 billion in future, indicating a robust demand for glazing solutions that cater to consumer preferences for visually appealing products.

- Growth in the Bakery and Confectionery Sector:The bakery and confectionery market is anticipated to grow significantly, reaching $1.1 trillion in future. This growth is fueled by the increasing consumption of baked goods and sweets, particularly in emerging markets. As consumers seek high-quality, indulgent products, the demand for food glazing agents that improve texture and appearance is expected to rise, providing a substantial opportunity for manufacturers in this sector.

Market Challenges

- Stringent Food Safety Regulations:Compliance with food safety regulations poses a significant challenge for food glazing agents. In the U.S., the FDA enforces strict guidelines on food additives, requiring extensive testing and documentation. Non-compliance can lead to product recalls and financial losses. The cost of ensuring compliance can be substantial, with companies spending an average of $1.2 million annually on regulatory compliance, impacting their operational budgets and market entry strategies.

- Fluctuating Raw Material Prices:The volatility in raw material prices, particularly for natural glazing agents, presents a challenge for manufacturers. For instance, the price of key ingredients like shellac and beeswax has seen fluctuations of up to 35% over the past year due to supply chain disruptions and changing agricultural conditions. This unpredictability can affect profit margins and pricing strategies, making it difficult for companies to maintain competitive pricing in the market.

Global Food Glazing Agents Market Future Outlook

The future of the food glazing agents market appears promising, driven by innovations in food technology and a growing emphasis on sustainability. As consumers increasingly demand clean label products, manufacturers are likely to invest in developing natural and organic glazing solutions. Additionally, the expansion of e-commerce platforms for food products will facilitate greater market access, allowing companies to reach a broader audience and adapt to changing consumer preferences more effectively.

Market Opportunities

- Innovations in Food Glazing Technologies:Advancements in food glazing technologies present significant opportunities for market players. Companies investing in R&D can develop innovative glazing solutions that enhance product quality and shelf life, catering to the evolving demands of consumers. This focus on innovation can lead to increased market share and customer loyalty, particularly among health-conscious consumers seeking high-quality food products.

- Growing Demand for Organic and Natural Glazing Agents:The rising consumer preference for organic products is creating a substantial market opportunity for natural glazing agents. With the organic food market projected to reach $350 billion in future, manufacturers can capitalize on this trend by offering organic glazing solutions. This shift not only aligns with consumer preferences but also enhances brand reputation and market competitiveness in a rapidly evolving industry landscape.