Region:Global

Author(s):Dev

Product Code:KRAC0531

Pages:96

Published On:August 2025

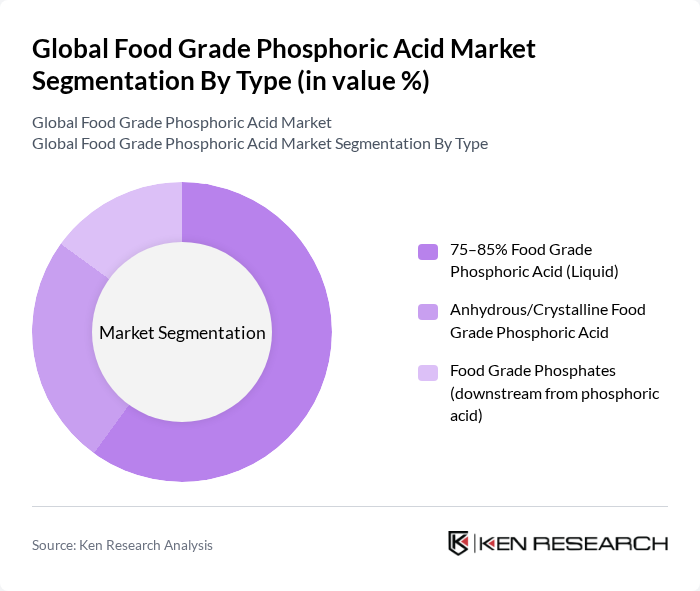

By Type:The market is segmented into three main types: 75–85% Food Grade Phosphoric Acid (Liquid), Anhydrous/Crystalline Food Grade Phosphoric Acid, and Food Grade Phosphates (downstream from phosphoric acid). The 75–85% Food Grade Phosphoric Acid (Liquid) is the most widely used type in food and beverage processing due to dosing precision and ease of integration in production lines, aligning with industry reporting that the liquid form holds the largest share. Anhydrous/Crystalline Food Grade Phosphoric Acid is used where concentrated inputs are preferred, while Food Grade Phosphates (downstream) serve as functional ingredients across bakery, meat processing, and supplements .

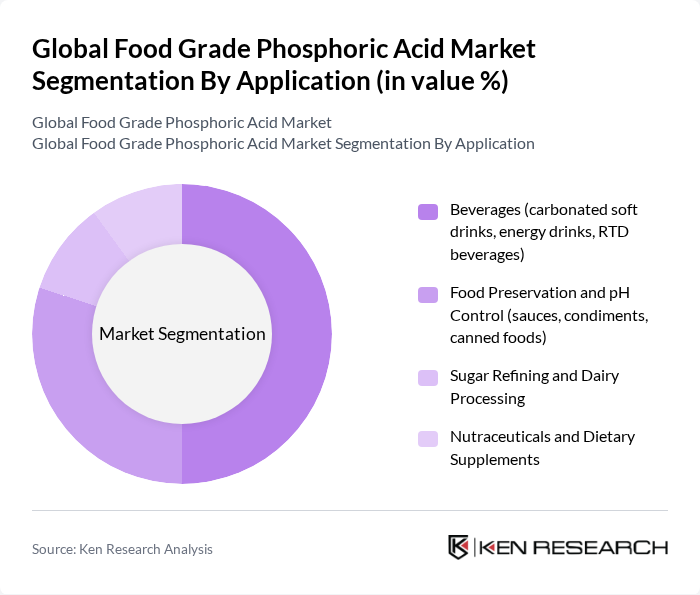

By Application:The applications of food-grade phosphoric acid are diverse, including beverages (carbonated soft drinks, energy drinks, RTD beverages), food preservation and pH control (sauces, condiments, canned foods), sugar refining and dairy processing, and nutraceuticals and dietary supplements. The beverage sector is a leading application area given phosphoric acid’s role as an acidulant and flavor enhancer in carbonated soft drinks, while food preservation/pH control is also significant due to stability and safety needs in processed foods. Sugar refining and dairy processing use phosphoric acid for clarification and pH adjustment, and nutraceuticals/dietary supplements leverage downstream phosphates for functional and nutritional roles .

The Global Food Grade Phosphoric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Innophos Holdings, Inc., Prayon S.A., OCP Group, Wengfu & Zijin Chemical Industry Co., Ltd., Yunnan Phosphate Haikou Co., Ltd., Guizhou Chanhen Chemical Corporation, Hubei Xingfa Chemicals Group Co., Ltd., Chengxing Group Co., Ltd., Spectrum Chemical Mfg. Corp., Brenntag SE (Brenntag Specialties), Solvay S.A., Arkema S.A., ICL Group Ltd., Nutrien Ltd. (phosphate ingredients), EuroChem Group AG contribute to innovation, geographic expansion, and service delivery in this space .

The future of the food grade phosphoric acid market appears promising, driven by increasing consumer demand for processed and health-oriented food products. Innovations in food preservation techniques and a growing emphasis on sustainable production practices are expected to shape the market landscape. Additionally, the expansion of the organic food sector will likely create new avenues for growth, as manufacturers seek to meet the evolving preferences of health-conscious consumers while adhering to regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | –85% Food Grade Phosphoric Acid (Liquid) Anhydrous/Crystalline Food Grade Phosphoric Acid Food Grade Phosphates (downstream from phosphoric acid) |

| By Application | Beverages (carbonated soft drinks, energy drinks, RTD beverages) Food Preservation and pH Control (sauces, condiments, canned foods) Sugar Refining and Dairy Processing Nutraceuticals and Dietary Supplements |

| By End-User | Beverage Producers Food Manufacturers and Processors Nutraceutical and Supplement Companies Food Ingredient Distributors and Blenders |

| By Distribution Channel | Direct Sales (manufacturers to F&B enterprises) Chemical Distributors Online/Procurement Portals Contract Manufacturing/ Tolling Partners |

| By Packaging Type | Bulk Packaging (IBCs, tankers, drums) Intermediate Packaging (carboys, totes) Small Packs for Labs and Pilot Plants |

| By Region | North America Europe Asia-Pacific Latin America |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 120 | Procurement Managers, Quality Assurance Officers |

| Beverage Manufacturing | 100 | Production Supervisors, R&D Managers |

| Food Additives Sector | 80 | Product Development Managers, Regulatory Affairs Specialists |

| Pharmaceutical Applications | 70 | Quality Control Managers, Compliance Officers |

| Export and Import Trade | 60 | Logistics Coordinators, Trade Compliance Managers |

The Global Food Grade Phosphoric Acid Market is valued at approximately USD 2.5 billion, reflecting demand primarily from the food and beverage sectors for applications such as acidity regulation and flavor enhancement.