Region:Global

Author(s):Geetanshi

Product Code:KRAA0074

Pages:82

Published On:August 2025

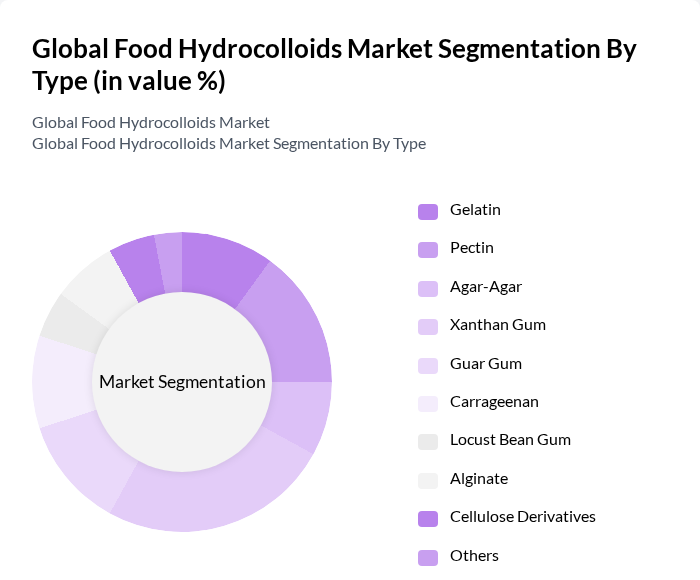

By Type:The market is segmented into various types of hydrocolloids, including Gelatin, Pectin, Agar-Agar, Xanthan Gum, Guar Gum, Carrageenan, Locust Bean Gum, Alginate, Cellulose Derivatives, and Others. Among these,Xanthan GumandPectinare particularly dominant due to their extensive use in food and beverage applications, driven by consumer preferences for natural and clean-label products. The demand for these hydrocolloids is also bolstered by their functional properties, such as thickening, stabilizing, and gelling, which are essential in modern food formulations.

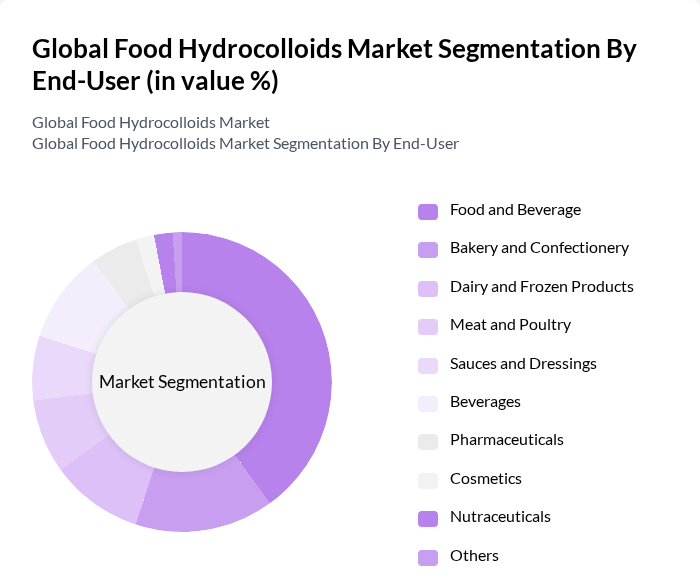

By End-User:The end-user segmentation includes Food and Beverage, Bakery and Confectionery, Dairy and Frozen Products, Meat and Poultry, Sauces and Dressings, Beverages, Pharmaceuticals, Cosmetics, Nutraceuticals, and Others. TheFood and Beveragesector is the largest consumer of hydrocolloids, driven by the increasing demand for processed foods and beverages that require stabilizers, thickeners, and texturizers. Additionally, the growing trend toward healthier, organic, and plant-based food options is pushing manufacturers to incorporate natural hydrocolloids into their products to meet clean-label and sustainability requirements.

The Global Food Hydrocolloids Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont de Nemours, Inc., Kerry Group plc, Ingredion Incorporated, Cargill, Incorporated, Ashland Global Holdings Inc., Tate & Lyle PLC, DSM-Firmenich AG, Fufeng Group Company Limited, CP Kelco (Huber Corporation), Nexira, W Hydrocolloids, Inc., Jungbunzlauer Suisse AG, Gelita AG, Rousselot (Darling Ingredients Inc.), and Seppic (Air Liquide Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the food hydrocolloids market appears promising, driven by increasing consumer demand for natural and health-oriented products. Innovations in hydrocolloid applications are expected to enhance product functionality, catering to evolving consumer preferences. Additionally, the growth of e-commerce platforms is likely to facilitate wider distribution of hydrocolloid-based products, making them more accessible to consumers. As sustainability becomes a priority, companies focusing on eco-friendly sourcing and production methods will likely gain a competitive edge in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Gelatin Pectin Agar-Agar Xanthan Gum Guar Gum Carrageenan Locust Bean Gum Alginate Cellulose Derivatives Others |

| By End-User | Food and Beverage Bakery and Confectionery Dairy and Frozen Products Meat and Poultry Sauces and Dressings Beverages Pharmaceuticals Cosmetics Nutraceuticals Others |

| By Application | Thickening Agents Stabilizers Gelling Agents Emulsifiers Coating Agents Others |

| By Source | Plant-Based Hydrocolloids Seaweed-Based Hydrocolloids Animal-Based Hydrocolloids Microbial Hydrocolloids Synthetic Hydrocolloids Others |

| By Form | Powder Liquid Granules Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Oceania Japan Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Product Manufacturers | 100 | Product Development Managers, Quality Control Analysts |

| Bakery Ingredient Suppliers | 80 | Procurement Managers, R&D Specialists |

| Food Processing Equipment Providers | 60 | Sales Directors, Technical Support Engineers |

| Health Food Brands | 50 | Marketing Managers, Nutritionists |

| Food Safety Regulatory Bodies | 40 | Compliance Officers, Regulatory Affairs Managers |

The Global Food Hydrocolloids Market is valued at approximately USD 10.5 billion, reflecting a significant growth trend driven by increasing demand for natural food additives and the expanding food and beverage industry.