Region:Global

Author(s):Shubham

Product Code:KRAA1932

Pages:89

Published On:August 2025

By Type:The market is segmented into various types of food intolerance products, including gluten-free bakery and staples, lactose-free and dairy-alternative products, low-FODMAP and digestive-friendly products, sugar/substitute-free and low-lactose formulations, nut-free and allergen-free snacks/confectionery, soy-free and egg-free alternatives, and others. Each of these subsegments caters to specific dietary needs and preferences, reflecting the diverse requirements of consumers with food intolerances.

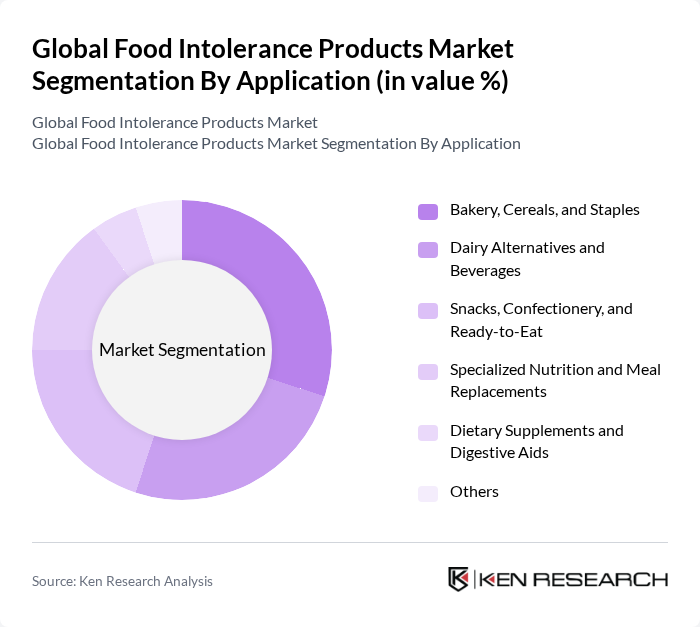

By Application:The applications of food intolerance products include bakery, cereals, and staples; dairy alternatives and beverages; snacks, confectionery, and ready-to-eat items; specialized nutrition and meal replacements; dietary supplements and digestive aids; and others. This segmentation highlights the versatility of food intolerance products across various meal types and consumer needs. Growth is particularly visible in dairy-alternative beverages, gluten-free bakery, and ready-to-eat allergy-friendly snacks driven by convenience and broader omnichannel distribution.

The Global Food Intolerance Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Unilever PLC, Danone S.A., General Mills, Inc., The Kraft Heinz Company, Mondel?z International, Inc., Kellogg Company, Conagra Brands, Inc., The Hain Celestial Group, Inc., Enjoy Life Foods, LLC, Dr. Schär AG/SPA, Amy’s Kitchen, Inc., free2b Foods, LLC, Banza LLC, Tofutti Brands, Inc., Valio Ltd, Arla Foods amba, Lactalis Group (incl. Parmalat S.p.A.), The Hershey Company (Lily’s Sweets), Doves Farm Foods Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the food intolerance products market appears promising, driven by increasing consumer demand for healthier options and innovative product development. As awareness of food intolerances continues to grow, manufacturers are likely to invest in research and development to create more effective solutions. Additionally, the expansion of online retail channels will facilitate greater access to these products, particularly in emerging markets, where health trends are rapidly evolving and consumer preferences are shifting towards specialized dietary needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Gluten-Free Bakery and Staples (bread, pasta, mixes) Lactose-Free and Dairy-Alternative Products (milk, yogurt, cheese) Low-FODMAP and Digestive-Friendly Products Sugar/Substitute-Free and Low-Lactose Formulations Nut-Free and Allergen-Free Snacks/Confectionery Soy-Free and Egg-Free Alternatives Others (corn-free, nightshade-free, specialty blends) |

| By Application | Bakery, Cereals, and Staples Dairy Alternatives and Beverages Snacks, Confectionery, and Ready-to-Eat Specialized Nutrition and Meal Replacements Dietary Supplements and Digestive Aids Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail and D2C Health Food Stores and Specialty Retailers Pharmacies and Drugstores Convenience Stores and Others |

| By Consumer Demographics | Children and Adolescents Adults Seniors Athletes and Fitness-Oriented Consumers Pregnant/Medical-Need Consumers Others |

| By Packaging Type | Rigid Packaging Flexible Packaging Bulk and Foodservice Packaging Eco-Friendly and Recyclable Packaging Others |

| By Price Range | Premium Mid-Range Economy Private Label/Value Others |

| By Intolerance Category | Dairy and Lactose Intolerance Gluten Intolerance/Celiac Disease Sugar Intolerance (e.g., fructose, sucrose) FODMAP Sensitivities Nut, Soy, and Egg Intolerances Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gluten-Free Product Consumers | 140 | Individuals with Celiac Disease, Health-Conscious Consumers |

| Lactose-Free Product Users | 120 | Individuals with Lactose Intolerance, Nutrition Enthusiasts |

| Vegan and Plant-Based Diet Adopters | 100 | Health Coaches, Vegan Lifestyle Advocates |

| Food Allergy Awareness Groups | 80 | Parents of Children with Food Allergies, Advocacy Group Members |

| Retailers of Specialty Food Products | 90 | Store Managers, Product Buyers in Health Food Stores |

The Global Food Intolerance Products Market is valued at approximately USD 20.5 billion, reflecting a significant growth trend driven by increasing food intolerances and consumer demand for specialized food options.