Region:Global

Author(s):Dev

Product Code:KRAD0435

Pages:83

Published On:August 2025

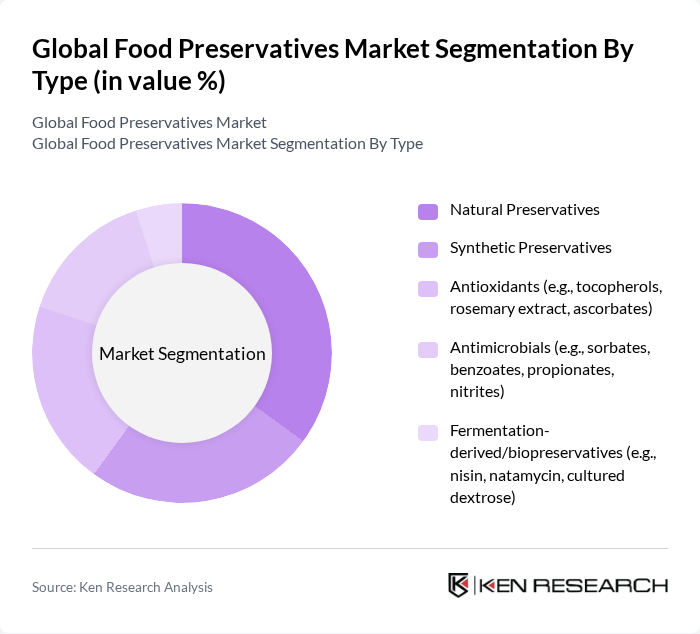

By Type:The market is segmented into various types of preservatives, including natural preservatives, synthetic preservatives, antioxidants, antimicrobials, and fermentation-derived/biopreservatives. Among these, natural preservatives are gaining traction due to the increasing consumer preference for clean-label products and health-conscious choices, with clean-label/natural solutions increasingly prioritized by manufacturers and retailers. Synthetic preservatives, while still significant, face scrutiny due to health concerns and retailer reformulation pressure in developed markets. Antioxidants and antimicrobials are essential for extending shelf life and maintaining food quality, making them critical in the food industry; commonly used examples include sorbates, benzoates, propionates, tocopherols, and rosemary extract.

By Application:The applications of preservatives span across various food categories, including bakery and confectionery, dairy and frozen desserts, meat, poultry, and seafood, beverages, oils, fats, and margarines, snacks and ready-to-eat meals, sauces, dressings, and condiments, as well as fruits, vegetables, and canned foods. The bakery and confectionery segment is particularly dominant due to the high demand for shelf-stable products and the need for extended freshness; breads, cakes, and snack cakes often rely on antimicrobials to control molds and yeasts. The meat and poultry segment also plays a crucial role, driven by the necessity for food safety and preservation, with lactates/diacetates, nitrites, and natural fermentates commonly used to control pathogens and extend shelf life.

The Global Food Preservatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Cargill, Incorporated, Corbion N.V., Kerry Group plc, BASF SE, Tate & Lyle PLC, Ingredion Incorporated, Chr. Hansen Holding A/S, Celanese Corporation, Sensient Technologies Corporation, Kemin Industries, Inc., Univar Solutions Inc., DSM-Firmenich AG, Galactic S.A., and Jungbunzlauer Suisse AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the food preservatives market in None appears promising, driven by a growing preference for natural and organic products. As consumers increasingly demand transparency and clean label options, manufacturers are likely to invest in innovative preservation solutions that align with these trends. Additionally, the expansion of e-commerce platforms will facilitate broader distribution of preserved food products, enhancing market accessibility and driving growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Preservatives Synthetic Preservatives Antioxidants (e.g., tocopherols, rosemary extract, ascorbates) Antimicrobials (e.g., sorbates, benzoates, propionates, nitrites) Fermentation-derived/biopreservatives (e.g., nisin, natamycin, cultured dextrose) |

| By Application | Bakery and Confectionery Dairy and Frozen Desserts Meat, Poultry, and Seafood Beverages (non-alcoholic and low-alcohol) Oils, Fats, and Margarines Snacks and Ready-to-Eat Meals Sauces, Dressings, and Condiments Fruits, Vegetables, and Canned Foods |

| By End-User | Food and Beverage Manufacturers Contract Packagers/Co-manufacturers Foodservice and QSR Chains Retail and Private Label Producers |

| By Distribution Channel | Direct Sales (B2B) Distributors and Specialty Chemical Suppliers Online B2B Platforms Integrated Ingredient Solutions (bundled with blends/systems) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Drums and IBCs Bags and Sacks Bottles and Jerrycans Sachets and Pouches Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 150 | Production Managers, Quality Assurance Specialists |

| Retail Food Chains | 100 | Procurement Managers, Category Buyers |

| Food Safety Regulatory Bodies | 60 | Regulatory Affairs Officers, Compliance Managers |

| Food Technology Research Institutions | 80 | Research Scientists, Academic Professors |

| Consumer Insights and Trends | 120 | Market Analysts, Consumer Behavior Researchers |

The Global Food Preservatives Market is valued at approximately USD 3.2 billion, reflecting a significant growth trend driven by the increasing demand for processed and packaged foods, as well as heightened consumer awareness regarding food safety and shelf life.