Region:Global

Author(s):Geetanshi

Product Code:KRAD0130

Pages:95

Published On:August 2025

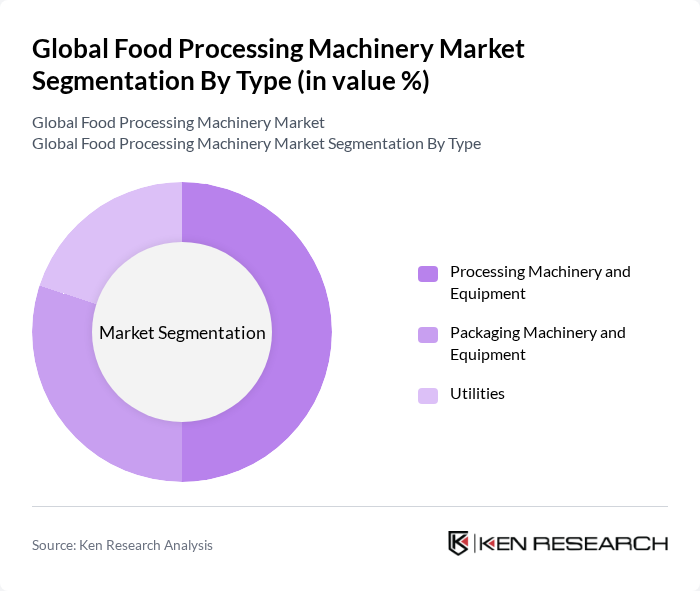

By Type:The market is segmented into Processing Machinery and Equipment, Packaging Machinery and Equipment, and Utilities. Among these, Processing Machinery and Equipment is the leading sub-segment, driven by the increasing demand for efficient food processing solutions that enhance productivity and reduce waste. The trend towards automation, artificial intelligence, and smart manufacturing is also contributing to the growth of this segment, as manufacturers seek to optimize their operations and adapt to changing consumer preferences.

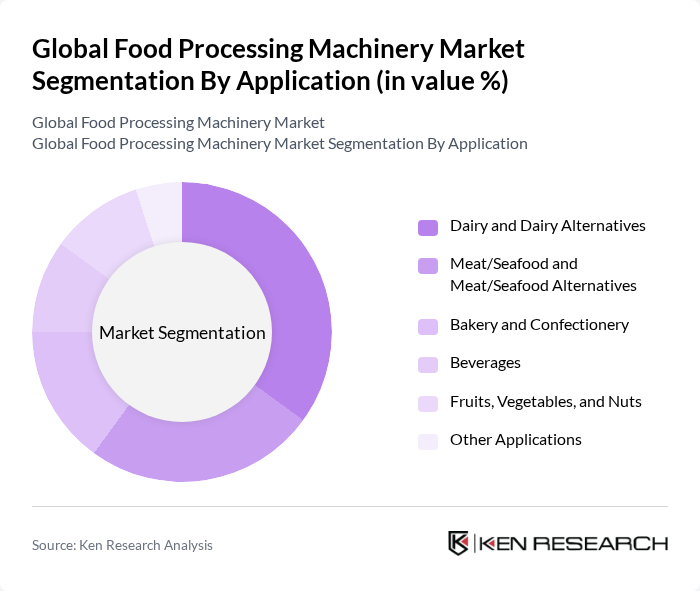

By Application:The applications of food processing machinery include Dairy and Dairy Alternatives, Meat/Seafood and Meat/Seafood Alternatives, Bakery and Confectionery, Beverages, Fruits, Vegetables, and Nuts, and Other Applications. The Dairy and Dairy Alternatives segment is currently the most dominant, driven by the growing consumer preference for dairy products and plant-based alternatives. This segment benefits from innovations in processing technologies that enhance product quality, shelf life, and sustainability. The Meat/Seafood and Meat/Seafood Alternatives segment is also significant, supported by advancements in equipment that improve food safety and processing efficiency.

The Global Food Processing Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bühler AG, Tetra Pak International S.A., JBT Corporation, GEA Group AG, Marel hf., Alfa Laval AB, Multivac Sepp Haggenmüller SE & Co. KG, Krones AG, Scholle IPN, Odenberg Engineering, Heat and Control, Inc., Sidel S.A., SPX FLOW, Inc., FENCO Food Machinery s.r.l., ANKO Food Machine Co., Ltd., Duravant LLC, Hosokawa Micron Corporation, Bucher Industries AG, Bigtem Makine A.?., LEHUI, Nichimo Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the food processing machinery market in None is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As automation and smart technologies become more prevalent, manufacturers will increasingly adopt these innovations to enhance efficiency and reduce costs. Additionally, the growing demand for sustainable practices will push companies to invest in eco-friendly machinery, aligning with global trends towards sustainability and health-conscious food production. This dynamic environment presents both challenges and opportunities for industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Processing Machinery and Equipment Packaging Machinery and Equipment Utilities |

| By Application | Dairy and Dairy Alternatives Meat/Seafood and Meat/Seafood Alternatives Bakery and Confectionery Beverages Fruits, Vegetables, and Nuts Other Applications |

| By End-User | Food Manufacturers Beverage Producers Snack Food Companies Dairy Processors Meat and Poultry Processors Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America Europe Asia-Pacific South America Middle East & Africa Others |

| By Price Range | Low Range Mid Range High Range |

| By Technology | Automated Machinery Semi-Automated Machinery Manual Machinery |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Equipment Manufacturers | 80 | Product Managers, R&D Directors |

| Food Safety Compliance Officers | 60 | Quality Assurance Managers, Compliance Specialists |

| End-users in Food Production | 70 | Operations Managers, Plant Supervisors |

| Distributors of Food Processing Machinery | 40 | Sales Managers, Supply Chain Coordinators |

| Industry Experts and Consultants | 40 | Market Analysts, Industry Advisors |

The Global Food Processing Machinery Market is valued at approximately USD 107 billion, driven by increasing demand for processed food products, technological advancements, and a focus on food safety and quality.