Region:Global

Author(s):Shubham

Product Code:KRAC0698

Pages:87

Published On:August 2025

By Type:The food stabilizers market is segmented into various types, including Hydrocolloids, Emulsifiers, Gelling Agents, Thickening Agents, Blends & Systems, and Clean-Label/Natural Stabilizers. Among these,Hydrocolloidsare particularly dominant due to their versatility (e.g., pectin, xanthan gum, carrageenan, guar gum) and wide application in dairy, bakery, confectionery, beverages, and sauces. The increasing consumer demand for natural and organic ingredients has also led to a rise in the use ofclean-labelstabilizers and nature-derived systems, which are gaining traction as brands reformulate away from synthetic additives.

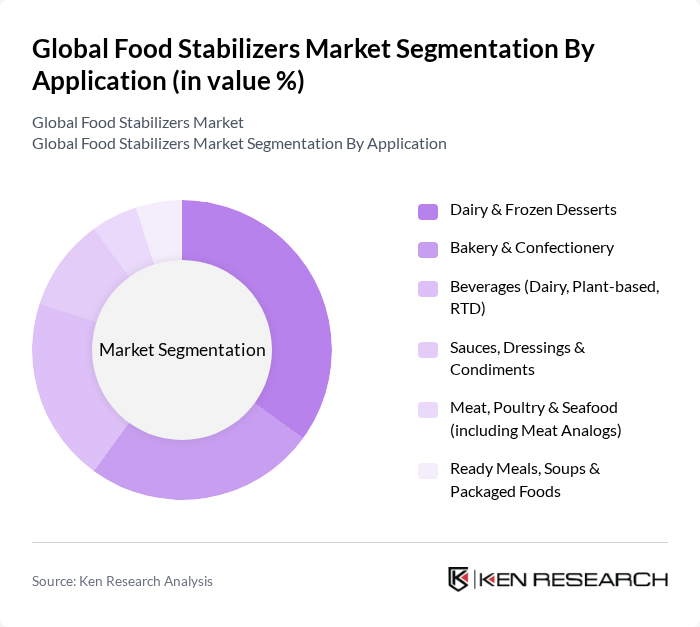

By Application:The applications of food stabilizers are diverse, including Dairy & Frozen Desserts, Bakery & Confectionery, Beverages, Sauces, Dressings & Condiments, Meat, Poultry & Seafood, and Ready Meals, Soups & Packaged Foods. TheDairy & Frozen Dessertssegment is the largest due to the need for texture, emulsification, and freeze–thaw stability in products such as yogurt, ice cream, and cheese. Additionally, the growing trend ofplant-baseddiets is boosting demand for stabilizers in dairy alternatives and beverages, where hydrocolloids and emulsifiers help with suspension, mouthfeel, and protein stabilization.

The Global Food Stabilizers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Ingredion Incorporated, Kerry Group plc, Tate & Lyle PLC, Archer Daniels Midland Company (ADM), CP Kelco U.S., Inc. (A Huber Company), Givaudan SA (including Naturex), IFF (International Flavors & Fragrances Inc., including DuPont Nutrition & Biosciences), DSM-Firmenich AG, Ashland Inc., BASF SE, Solvay S.A., Wacker Chemie AG, Fufeng Group Company Limited, Jungbunzlauer Suisse AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the food stabilizers market in None appears promising, driven by ongoing trends towards health and sustainability. As consumers increasingly demand transparency in food production, manufacturers are likely to invest in clean label products and natural stabilizers. Additionally, the integration of digital technologies in supply chains will enhance efficiency and traceability, further supporting market growth. These trends indicate a dynamic shift towards more responsible and health-oriented food production practices in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrocolloids (e.g., Pectin, Carrageenan, Xanthan Gum, Guar Gum) Emulsifiers (e.g., Mono- & Diglycerides, Lecithin) Gelling Agents (e.g., Gelatin, Agar, Alginate) Thickening Agents (e.g., Starch Derivatives, Cellulose Gum) Blends & Systems (Custom Stabilizer Systems) Clean-Label/Natural Stabilizers |

| By Application | Dairy & Frozen Desserts Bakery & Confectionery Beverages (Dairy, Plant-based, RTD) Sauces, Dressings & Condiments Meat, Poultry & Seafood (including Meat Analogs) Ready Meals, Soups & Packaged Foods |

| By End-User | Food & Beverage Manufacturers Contract Manufacturers (Co-packers) Foodservice & QSR Chains Private Label/Store Brands Others |

| By Distribution Channel | Direct Sales (B2B) Distributors & Ingredient Traders Online B2B Platforms Specialty Ingredient Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Product Manufacturers | 100 | Product Development Managers, Quality Assurance Specialists |

| Bakery Ingredient Suppliers | 80 | Sales Managers, Technical Support Staff |

| Beverage Producers | 90 | Operations Managers, R&D Directors |

| Food Safety Regulators | 40 | Compliance Officers, Regulatory Affairs Managers |

| Food Industry Consultants | 70 | Market Analysts, Business Development Executives |

The Global Food Stabilizers Market is valued at approximately USD 7.5 billion, driven by the increasing demand for processed foods and consumer preferences for clean-label products that enhance texture, mouthfeel, and shelf-life.