Region:Global

Author(s):Shubham

Product Code:KRAC0866

Pages:89

Published On:August 2025

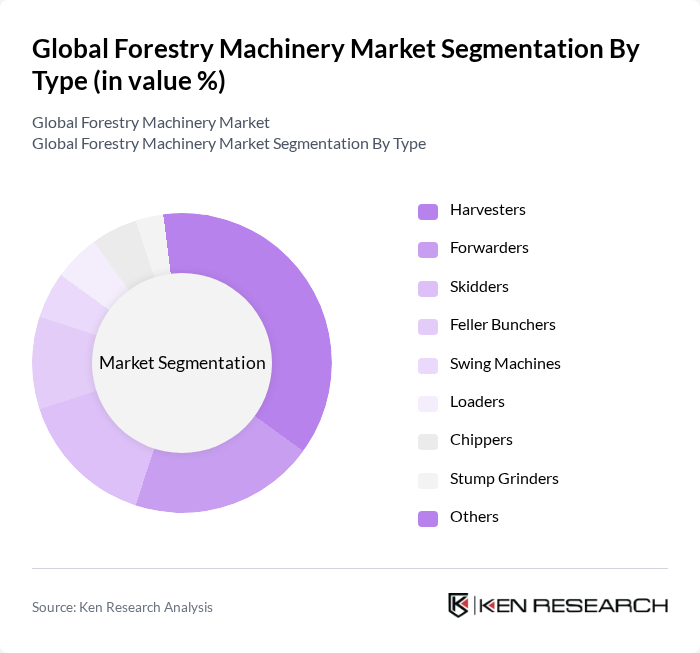

By Type:The market is segmented into various types of machinery, including harvesters, forwarders, skidders, feller bunchers, swing machines, loaders, chippers, stump grinders, and others. Among these, harvesters are the most dominant due to their versatility and efficiency in timber harvesting operations. The increasing adoption of advanced harvesting technologies, automation, and remote monitoring in forestry practices has further solidified their market leadership.

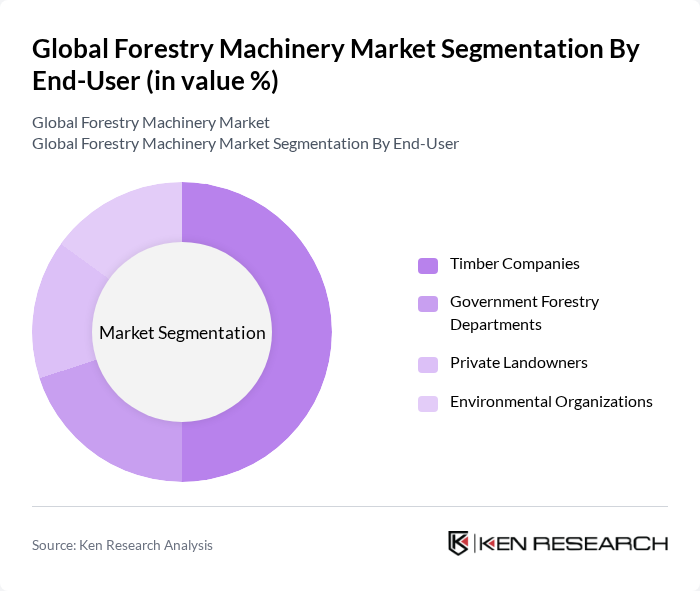

By End-User:The end-user segmentation includes timber companies, government forestry departments, private landowners, and environmental organizations. Timber companies are the leading end-users, driven by the increasing demand for timber, wood products, and biomass for energy production. Their need for efficient, high-capacity machinery to meet production targets and sustainability requirements has led to significant investment in advanced forestry equipment.

The Global Forestry Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., John Deere, Komatsu Ltd., Volvo Construction Equipment, Tigercat Industries Inc., Ponsse Plc, Liebherr Group, Hitachi Construction Machinery Co., Ltd., SANY Group, Doosan Infracore Co., Ltd., CNH Industrial N.V., JCB, Hyundai Construction Equipment Co., Ltd., Wirtgen Group, Kesla Oyj contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the forestry machinery market appears promising, driven by technological advancements and a growing emphasis on sustainability. As automation and precision forestry techniques gain traction, companies are expected to invest in innovative solutions that enhance efficiency and reduce environmental impact. Furthermore, the integration of IoT technologies will likely revolutionize forest management practices, providing real-time data for better decision-making. This evolving landscape presents significant opportunities for growth and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Harvesters Forwarders Skidders Feller Bunchers Swing Machines Loaders Chippers Stump Grinders Others |

| By End-User | Timber Companies Government Forestry Departments Private Landowners Environmental Organizations |

| By Application | Logging Land Clearing Reforestation Maintenance of Forest Health |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Low-End Machinery Mid-Range Machinery High-End Machinery |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Logging Operations | 60 | Operations Managers, Forestry Engineers |

| Forestry Equipment Manufacturers | 40 | Product Development Managers, Sales Directors |

| Government Forestry Agencies | 50 | Policy Makers, Environmental Analysts |

| Research Institutions in Forestry | 40 | Research Scientists, Academic Professors |

| End-Users of Forestry Machinery | 50 | Logistics Coordinators, Equipment Operators |

The Global Forestry Machinery Market is valued at approximately USD 11 billion, driven by increasing demand for wood products, technological advancements, and sustainable forestry practices. This valuation is based on a comprehensive five-year historical analysis.