Region:Global

Author(s):Shubham

Product Code:KRAC0617

Pages:94

Published On:August 2025

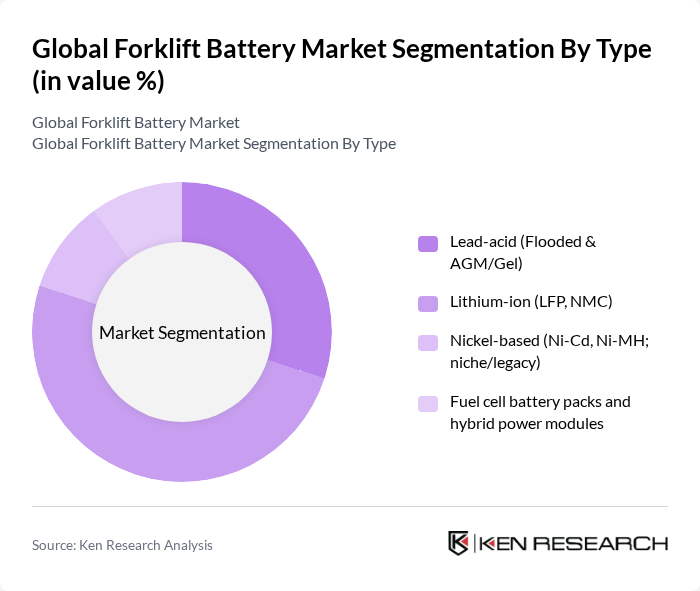

By Type:The market is segmented into Lead-acid (Flooded & AGM/Gel), Lithium-ion (LFP, NMC), Nickel-based (Ni-Cd, Ni-MH; niche/legacy), and Fuel cell battery packs and hybrid power modules. Lithium-ion batteries are gaining significant traction due to higher usable energy, faster charging, opportunity/fast charging compatibility, longer cycle life, and reduced maintenance versus traditional lead-acid batteries, driving broader adoption in multi-shift warehouse operations.

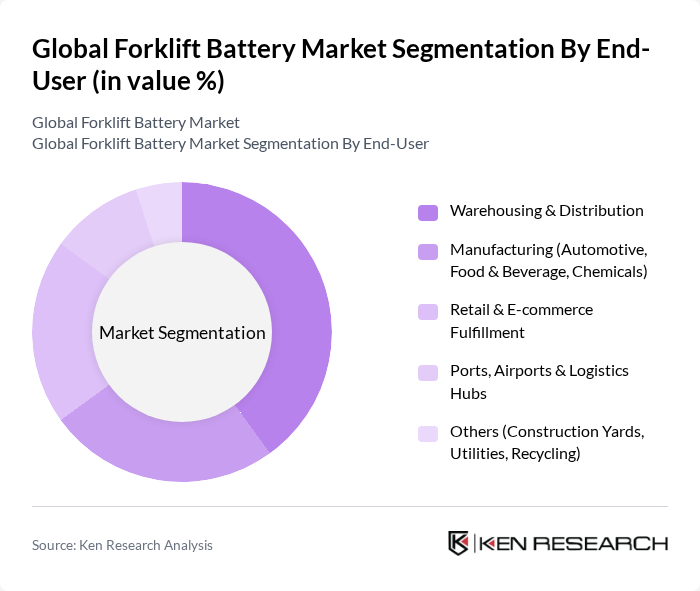

By End-User:The end-user segmentation includes Warehousing & Distribution, Manufacturing (Automotive, Food & Beverage, Chemicals), Retail & E-commerce Fulfillment, Ports, Airports & Logistics Hubs, and Others (Construction Yards, Utilities, Recycling). Warehousing and distribution remains the dominant end-user, supported by rapid e-commerce expansion, high-throughput fulfillment centers, and increased automation that favors electric fleets and lithium-ion batteries for multi-shift uptime.

The Global Forklift Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as EnerSys, GS Yuasa Corporation, East Penn Manufacturing (Deka), Exide Industries Ltd., Amara Raja Energy & Mobility Ltd. (Amaron), Saft (TotalEnergies), Crown Battery Manufacturing Company, Storage Battery Systems, LLC (SBS), GNB Industrial Power (Exide Technologies), Flux Power Holdings, Inc., Electrovaya Inc., Navitasys (TDSG) / Amperex Technology Limited (ATL), BYD Company Limited, Contemporary Amperex Technology Co., Limited (CATL), Panasonic Energy Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the forklift battery market appears promising, driven by technological innovations and a shift towards electric solutions. As companies increasingly prioritize sustainability, the demand for efficient, eco-friendly batteries is expected to rise. Additionally, the integration of smart technologies in battery management systems will enhance operational efficiency. The market is likely to witness significant growth as businesses adapt to evolving regulations and consumer preferences, positioning themselves for a more sustainable future.

| Segment | Sub-Segments |

|---|---|

| By Type | Lead-acid (Flooded & AGM/Gel) Lithium-ion (LFP, NMC) Nickel-based (Ni-Cd, Ni-MH; niche/legacy) Fuel cell battery packs and hybrid power modules |

| By End-User | Warehousing & Distribution Manufacturing (Automotive, Food & Beverage, Chemicals) Retail & E-commerce Fulfillment Ports, Airports & Logistics Hubs Others (Construction Yards, Utilities, Recycling) |

| By Application (Forklift Class) | Class I (Electric rider forklifts, counterbalanced) Class II (Narrow-aisle: reach trucks, order pickers) Class III (Electric pallet trucks, stackers) Class IV/V electric conversions and heavy-duty electrics |

| By Sales Channel | OEM Aftermarket/Replacement Distributors/Dealers Online/Direct |

| By Voltage | V V V V & Above |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Battery Capacity (kWh) | Below 10 kWh –25 kWh Above 25 kWh |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturers of Forklift Batteries | 90 | Product Managers, R&D Directors |

| Logistics and Warehouse Operators | 120 | Operations Managers, Fleet Supervisors |

| Battery Recycling Facilities | 80 | Environmental Compliance Officers, Operations Managers |

| Forklift Rental Companies | 70 | Business Development Managers, Fleet Managers |

| Industry Experts and Consultants | 50 | Market Analysts, Industry Consultants |

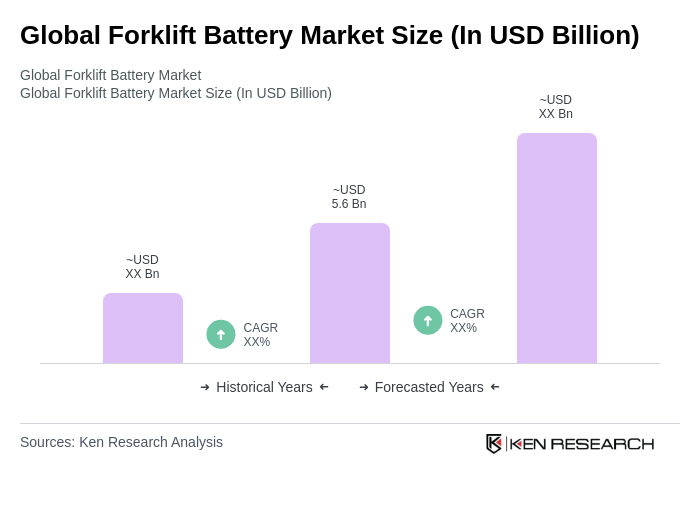

The Global Forklift Battery Market is valued at approximately USD 5.6 billion, driven by the transition from internal combustion engine forklifts to electric models, which offer benefits like lower emissions and improved energy efficiency.