Region:Global

Author(s):Dev

Product Code:KRAD0546

Pages:93

Published On:August 2025

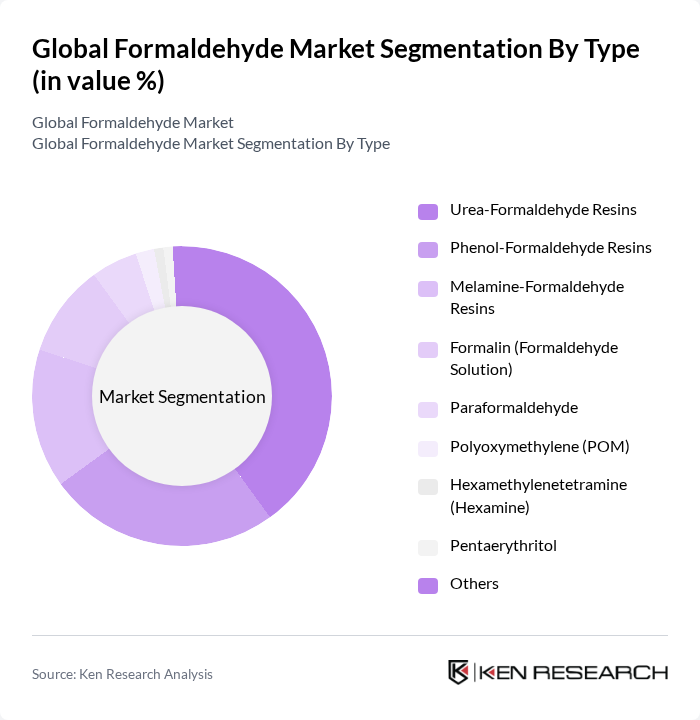

By Type:The formaldehyde market is segmented into various types, including Urea-Formaldehyde Resins, Phenol-Formaldehyde Resins, Melamine-Formaldehyde Resins, Formalin (Formaldehyde Solution), Paraformaldehyde, Polyoxymethylene (POM), Hexamethylenetetramine (Hexamine), Pentaerythritol, and Others. Among these, Urea-Formaldehyde Resins are the most dominant due to their extensive use in the production of particleboard and plywood, driven by the booming construction and furniture industries. The versatility and cost-effectiveness of these resins make them a preferred choice for manufacturers.

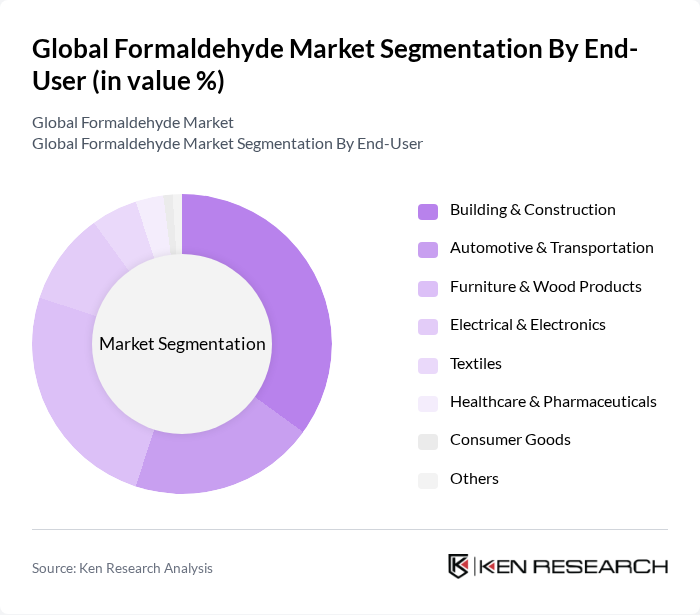

By End-User:The end-user segments of the formaldehyde market include Building & Construction, Automotive & Transportation, Furniture & Wood Products, Electrical & Electronics, Textiles, Healthcare & Pharmaceuticals, Consumer Goods, and Others. The Building & Construction sector is the largest consumer of formaldehyde, primarily due to its application in producing wood-based panels and insulation materials. The increasing construction activities globally, coupled with the demand for durable and cost-effective building materials, significantly drives this segment.

The Global Formaldehyde Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Hexion Inc., Georgia-Pacific Chemicals LLC, Celanese Corporation, Dynea AS, Formosa Plastics Corporation, China Petrochemical Corporation (Sinopec), INEOS Group, Perstorp Holding AB, OCI Company Ltd., Prefere Resins Holding GmbH, ARCL Organics Ltd. (formerly AICA India/ARCL), Chemiplastica S.p.A., Kanoria Chemicals & Industries Ltd., Shandong Shuangqi Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the formaldehyde market is poised for transformation, driven by a growing emphasis on sustainability and innovation. As industries increasingly adopt eco-friendly practices, the demand for bio-based formaldehyde is expected to rise, aligning with global sustainability goals. Additionally, advancements in production technologies will likely enhance efficiency and reduce environmental impact, creating new avenues for market growth. Strategic partnerships among key players will further facilitate the development of innovative solutions, ensuring the market remains competitive and responsive to evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Urea-Formaldehyde Resins Phenol-Formaldehyde Resins Melamine-Formaldehyde Resins Formalin (Formaldehyde Solution) Paraformaldehyde Polyoxymethylene (POM) Hexamethylenetetramine (Hexamine) Pentaerythritol Others |

| By End-User | Building & Construction Automotive & Transportation Furniture & Wood Products Electrical & Electronics Textiles Healthcare & Pharmaceuticals Consumer Goods Others |

| By Application | Resins (UF, PF, MF) Adhesives & Binders Engineering Plastics (POM/Polyacetal) Chemical Intermediates (MDI, BDO, etc.) Coatings Disinfectants & Preservatives Others |

| By Distribution Channel | Direct Sales (Contract/Offtake) Distributors Traders/Brokers Online B2B Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Regulatory Compliance | CARB/EPA TSCA Title VI (Composite Wood Emissions) REACH Compliance OSHA/NIOSH Workplace Exposure EN 13986/E1–E0–F???? Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 120 | Project Managers, Procurement Officers |

| Automotive Manufacturing | 100 | Production Managers, Quality Control Engineers |

| Textile and Furniture Sectors | 80 | Product Development Managers, Supply Chain Analysts |

| Healthcare and Pharmaceuticals | 70 | Regulatory Affairs Specialists, R&D Managers |

| Consumer Goods and Packaging | 90 | Marketing Managers, Sustainability Officers |

The Global Formaldehyde Market is valued at approximately USD 8.5 billion, driven by increasing demand in applications such as resins, adhesives, and coatings, alongside growth in the construction and automotive industries.