Region:Global

Author(s):Rebecca

Product Code:KRAB0302

Pages:80

Published On:August 2025

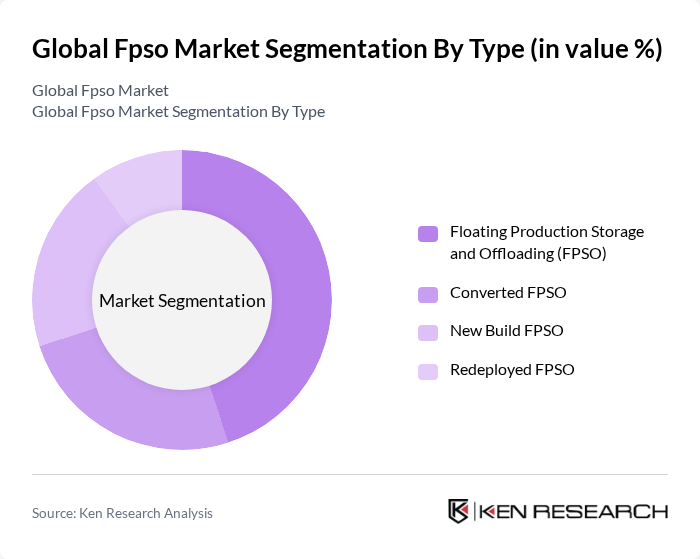

By Type:The FPSO market is segmented into four main types: Floating Production Storage and Offloading (FPSO), Converted FPSO, New Build FPSO, and Redeployed FPSO. The Floating Production Storage and Offloading (FPSO) segment remains the most dominant due to its versatility and efficiency in offshore oil and gas production, especially in deepwater and ultra-deepwater fields. The Converted FPSO segment also holds a significant share as companies increasingly repurpose existing vessels to optimize costs and reduce lead times. New Build FPSOs are favored for projects requiring advanced specifications, while Redeployed FPSOs offer flexibility for marginal or short-cycle fields .

By Ownership:The FPSO market is categorized into Operator-owned and Contractor-owned segments. The Operator-owned segment leads the market, reflecting a trend where oil and gas companies increasingly manage their own production facilities to enhance operational efficiency and maintain control over production processes. This approach is prevalent in regions with substantial offshore oil reserves, where direct oversight of FPSO assets is prioritized. Contractor-owned FPSOs remain important, particularly for independent operators and smaller fields, offering flexible leasing and operational models .

The Global FPSO market is characterized by a dynamic mix of regional and international players. Leading participants such as SBM Offshore N.V., TechnipFMC plc, MODEC, Inc., Bumi Armada Berhad, Hyundai Heavy Industries Co., Ltd., Saipem S.p.A., Yinson Holdings Berhad, Aker Solutions ASA, BW Offshore Limited, CNOOC Limited, Repsol S.A., Eni S.p.A., ExxonMobil Corporation, Chevron Corporation, TotalEnergies SE, Petrobras (Petróleo Brasileiro S.A.), Bluewater Energy Services B.V., MISC Berhad, Sembcorp Marine Ltd., Keppel Offshore & Marine Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The FPSO market is poised for significant transformation as it adapts to evolving energy demands and environmental regulations. The integration of digital technologies, such as AI and IoT, is expected to enhance operational efficiency and safety. Furthermore, the shift towards sustainable practices will drive innovation in eco-friendly FPSO designs. As companies increasingly focus on modular solutions, the market will likely see a rise in flexible FPSO configurations that can be rapidly deployed in response to changing market conditions and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Floating Production Storage and Offloading (FPSO) Converted FPSO New Build FPSO Redeployed FPSO |

| By Ownership | Operator-owned Contractor-owned |

| By Water Depth | Shallow Water Deep Water Ultra-deep Water |

| By Hull Type | Single Hull Double Hull |

| By Propulsion | Self-propelled Towed |

| By End-User | Oil and Gas Companies Engineering, Procurement, and Construction (EPC) Firms Government and Regulatory Bodies |

| By Region | North America Europe Asia-Pacific South America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FPSO Operational Efficiency | 100 | Operations Managers, Technical Directors |

| FPSO Design Innovations | 70 | Marine Engineers, Design Consultants |

| Regulatory Compliance in FPSO | 60 | Compliance Officers, Safety Managers |

| Market Trends in FPSO Investments | 80 | Investment Analysts, Financial Managers |

| Environmental Impact Assessments | 50 | Environmental Scientists, Sustainability Officers |

The Global FPSO market is valued at approximately USD 27 billion, driven by increasing offshore oil and gas production demands, significant investments in deepwater fields, and advancements in floating production technologies.