Region:Global

Author(s):Dev

Product Code:KRAD0556

Pages:91

Published On:August 2025

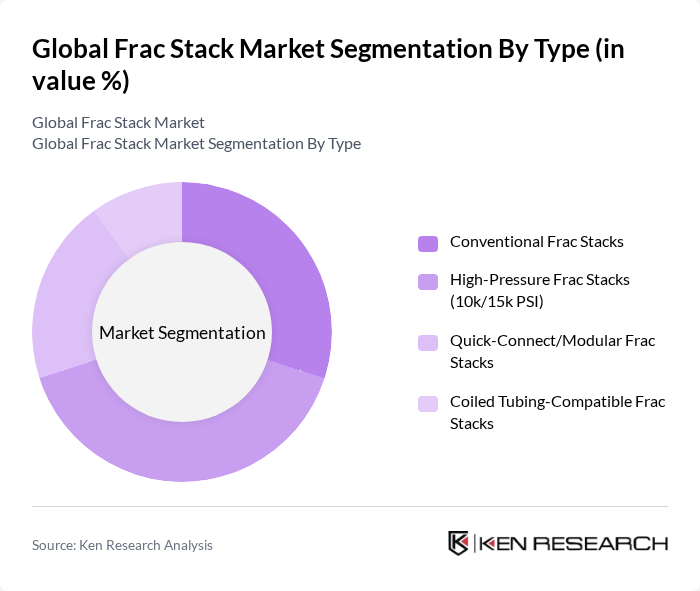

By Type:The market is segmented into various types of frac stacks, including Conventional Frac Stacks, High-Pressure Frac Stacks (10k/15k PSI), Quick-Connect/Modular Frac Stacks, and Coiled Tubing-Compatible Frac Stacks. Each type serves specific operational needs and is designed to enhance efficiency in hydraulic fracturing processes.

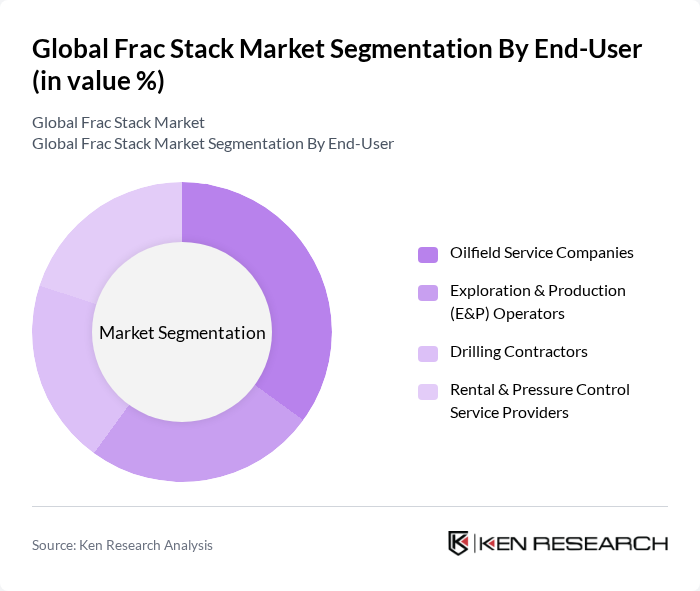

By End-User:The end-user segmentation includes Oilfield Service Companies, Exploration & Production (E&P) Operators, Drilling Contractors, and Rental & Pressure Control Service Providers. Each segment plays a crucial role in the overall market dynamics, with varying demands based on operational requirements and market conditions.

The Global Frac Stack Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton Company, SLB (Schlumberger Limited), Baker Hughes Company, NOV Inc. (formerly National Oilwell Varco), Weatherford International plc, Oil States International, Inc. (Oil States Energy Services), The Weir Group PLC (Weir Oil & Gas legacy), Cameron (a Schlumberger company), TechnipFMC plc, Forum Energy Technologies, Inc., Calfrac Well Services Ltd., ProPetro Holding Corp., Trican Well Service Ltd., NexTier Oilfield Solutions (now part of Patterson-UTI), Patterson-UTI Energy, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the frac stack market appears promising, driven by technological advancements and increasing energy demands. As companies adopt digitalization and automation, operational efficiencies are expected to improve significantly. Furthermore, the integration of renewable energy sources into traditional fracking operations is likely to enhance sustainability. With a focus on eco-friendly practices, the market is poised for growth, particularly in emerging economies where energy infrastructure investments are on the rise.

| Segment | Sub-Segments |

|---|---|

| By Type | Conventional Frac Stacks High-Pressure Frac Stacks (10k/15k PSI) Quick-Connect/Modular Frac Stacks Coiled Tubing-Compatible Frac Stacks |

| By End-User | Oilfield Service Companies Exploration & Production (E&P) Operators Drilling Contractors Rental & Pressure Control Service Providers |

| By Application | Hydraulic Fracturing (Multi-Stage) Well Stimulation & Workover Plug-and-Perf Operations Sand Control & Flowback |

| By Component | Blowout Preventers (BOPs) Frac Heads/GOAT Heads Isolation Valves & Spools Manifolds & Flow Iron |

| By Sales Channel | Direct Sales (OEM) Authorized Distributors & Agents Rental/Leasing Aftermarket & MRO Services |

| By Distribution Mode | Onshore Offshore Remote/Harsh Environments |

| By Price Range | Entry (?10k PSI/Standard Configurations) Mid (10k–15k PSI/Enhanced Features) Premium (15k+ PSI/High-Spec Automation) Custom/Engineered-to-Order |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Exploration Companies | 120 | Drilling Engineers, Operations Managers |

| Frac Stack Equipment Manufacturers | 90 | Product Managers, Sales Directors |

| Service Providers in Hydraulic Fracturing | 80 | Field Supervisors, Technical Consultants |

| Regulatory Bodies and Environmental Agencies | 50 | Policy Analysts, Environmental Scientists |

| Industry Analysts and Market Researchers | 60 | Market Analysts, Research Directors |

The Global Frac Stack Market is valued at approximately USD 7 billion, reflecting sustained activity in unconventional oil and gas sectors and equipment upgrades across major basins, according to recent industry assessments.