Region:Global

Author(s):Shubham

Product Code:KRAB0803

Pages:83

Published On:August 2025

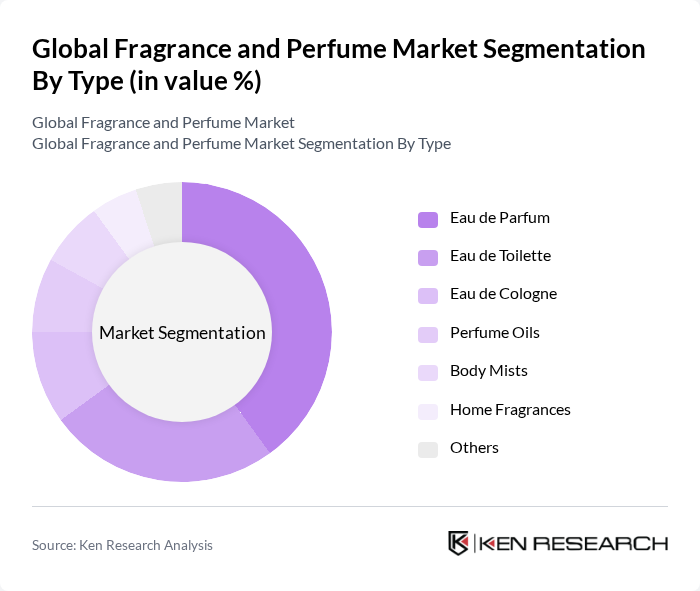

By Type:The fragrance market is segmented into various types, including Eau de Parfum, Eau de Toilette, Eau de Cologne, Perfume Oils, Body Mists, Home Fragrances, and Others. Among these,Eau de Parfumis the leading segment, favored for its long-lasting scent and higher concentration of fragrance oils. Consumers are increasingly gravitating towards products that offer a luxurious experience, which has propelled the demand for Eau de Parfum. The rise of niche brands and the growing popularity of personalized and exclusive scents have further enhanced the popularity of this segment, as consumers seek unique and individualized fragrance options .

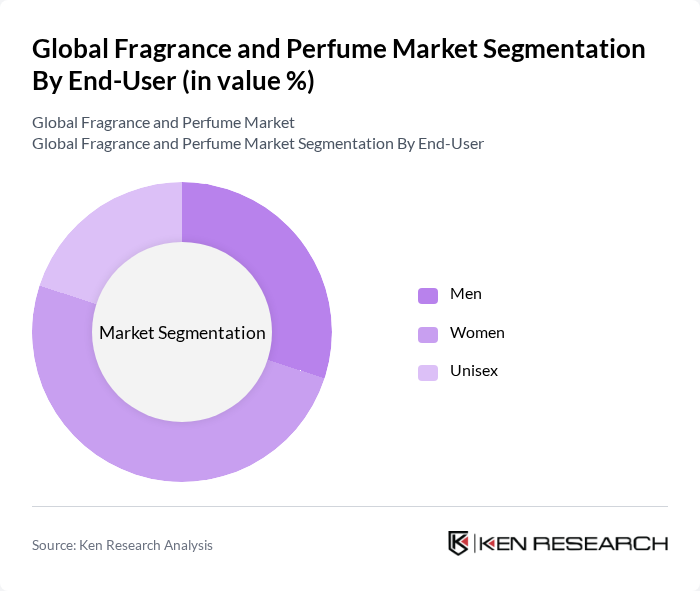

By End-User:The market is categorized by end-users into Men, Women, and Unisex. Thewomen's segmentdominates the market, driven by a strong inclination towards personal grooming and luxury products. Women are more likely to invest in fragrances as part of their daily beauty routines, leading to a higher market share. The growing trend of gender-neutral and unisex fragrances is also gaining traction, appealing to a broader audience and contributing to the growth of the unisex segment. Unisex fragrances are particularly popular among younger consumers who value inclusivity and versatility in scent choices .

The Global Fragrance and Perfume Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal S.A., Coty Inc., The Estée Lauder Companies Inc., Procter & Gamble Co., Shiseido Company, Limited, Chanel S.A., Parfums Christian Dior (LVMH Moët Hennessy Louis Vuitton SE), Unilever PLC, Puig S.L., Revlon, Inc., Avon Products, Inc., Mary Kay Inc., Amway Corporation, Hermès International S.A., Jo Malone London (Estée Lauder Companies Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The fragrance market is poised for transformative growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are increasingly adopting eco-friendly practices, which will likely reshape product offerings. Additionally, the integration of AI in fragrance development is expected to enhance personalization, catering to individual consumer tastes. These trends indicate a dynamic market landscape, where innovation and sustainability will play crucial roles in shaping future growth trajectories.

| Segment | Sub-Segments |

|---|---|

| By Type | Eau de Parfum Eau de Toilette Eau de Cologne Perfume Oils Body Mists Home Fragrances Others |

| By End-User | Men Women Unisex |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Supermarkets/Hypermarkets Duty-Free Shops Others |

| By Fragrance Family | Floral Woody Oriental Fresh Fruity Others |

| By Packaging Type | Glass Bottles Plastic Bottles Metal Containers Others |

| By Price Range | Premium Mid-Range Economy |

| By Occasion | Everyday Use Special Occasions Gifting Others |

| By Ingredient Type | Natural Synthetic |

| By Region | North America Europe Asia-Pacific South America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Perfume Retailers | 100 | Store Managers, Brand Representatives |

| Mass Market Fragrance Producers | 80 | Product Managers, Marketing Directors |

| Online Fragrance Retailers | 70 | E-commerce Managers, Digital Marketing Specialists |

| Fragrance Ingredient Suppliers | 60 | Supply Chain Managers, R&D Directors |

| Consumer Focus Groups | 40 | Fragrance Enthusiasts, General Consumers |

The Global Fragrance and Perfume Market is valued at approximately USD 56.6 billion, driven by increasing consumer demand for personal grooming products, rising disposable incomes, and a growing trend towards self-care and wellness.