Region:Global

Author(s):Dev

Product Code:KRAC0465

Pages:85

Published On:August 2025

By Type:The freeze-dried food market is segmented into various types, including fruits, vegetables, dairy products, meat & poultry, seafood, complete meals & entrees, snacks & ingredients, beverages, pet food & treats, and others. Among these, fruits and vegetables are particularly popular due to their versatility and health benefits. The demand for complete meals and entrees is also rising, driven by busy lifestyles and the need for convenient meal solutions.

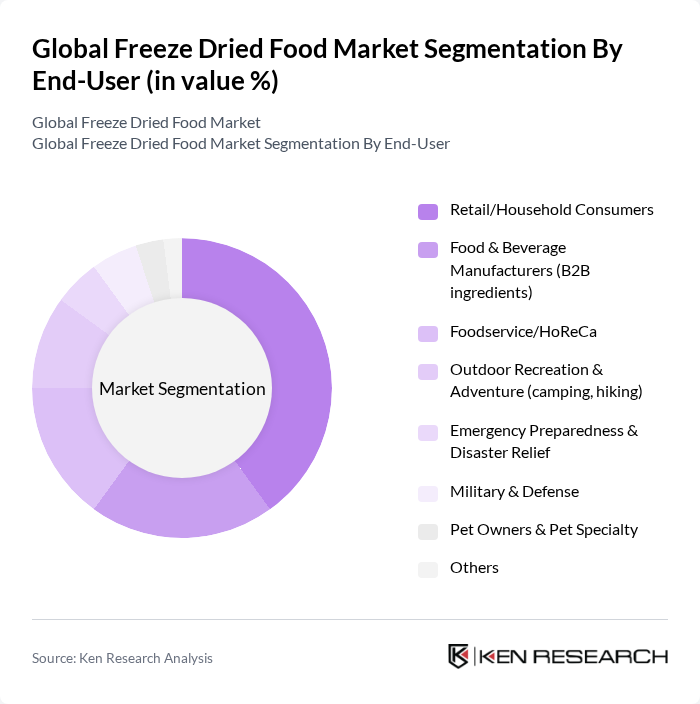

By End-User:The end-user segmentation includes retail/household consumers, food & beverage manufacturers, foodservice/HoReCa, outdoor recreation & adventure, emergency preparedness & disaster relief, military & defense, pet owners & pet specialty, and others. Retail consumers are the largest segment, driven by the increasing popularity of freeze-dried snacks and meals for convenience and portability.

The Global Freeze Dried Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A. (Nescafé, Nesquik, dairy powders), The Kraft Heinz Company, Mountain House (OFD Foods, LLC), Harmony House Foods, Inc., OvaEasy (Nutriom, LLC), Thrive Life, LLC, Augason Farms, Backpacker’s Pantry (American Outdoor Products), ReadyWise (formerly Wise Company), Emergency Essentials (BePrepared.com), Nutristore (Saratoga Trading Company), European Freeze Dry Ltd., Chaucer Foods Ltd., Mercer Foods, LLC (a 3i-backed company), Freeze-Dry Foods GmbH, Asahi Group Holdings, Ltd. (Calbee/partnered snacks & FD beverages), Ajinomoto Co., Inc. (FD soups and meals, Japan), Kirin Holdings Company, Limited (FD beverages/ingredients), Mondelez International, Inc. (snacks using FD inclusions), Tata Consumer Products Limited (instant beverages, India) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the freeze-dried food market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for nutritious, convenient food options will likely increase. Additionally, the integration of e-commerce platforms is expected to enhance accessibility, allowing consumers to purchase freeze-dried products more easily. Companies that innovate and adapt to these trends will be well-positioned to capture market share and meet the growing demand for freeze-dried foods.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruits Vegetables Dairy Products (e.g., milk, yogurt, cheese) Meat & Poultry Seafood Complete Meals & Entrees Snacks & Ingredients (herbs, cheese bites, powders) Beverages (coffee, teas, smoothie powders) Pet Food & Treats Others |

| By End-User | Retail/Household Consumers Food & Beverage Manufacturers (B2B ingredients) Foodservice/HoReCa Outdoor Recreation & Adventure (camping, hiking) Emergency Preparedness & Disaster Relief Military & Defense Pet Owners & Pet Specialty Others |

| By Distribution Channel | Online Retail (brand DTC and marketplaces) Supermarkets/Hypermarkets Convenience & Specialty Stores (outdoor, health, pet) B2B/Direct to Manufacturers Foodservice Distributors Others |

| By Packaging Type | Pouches (multi-layer, nitrogen-flushed) Cans & Tins Bulk Bags/Drums Single-Serve Packs Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Nutritional/Label Claim | High Protein Low Calorie Gluten-Free Organic Clean Label/No Additives Others |

| By Form | Whole Cuts & Flakes Powdered |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market for Freeze-Dried Foods | 140 | Retail Managers, Category Buyers |

| Military Procurement of Freeze-Dried Meals | 90 | Defense Logistics Officers, Procurement Specialists |

| Outdoor and Camping Food Products | 70 | Product Managers, Outdoor Retailers |

| Consumer Preferences for Freeze-Dried Snacks | 120 | Health-Conscious Consumers, Snack Product Developers |

| Food Service Industry Usage of Freeze-Dried Ingredients | 80 | Chefs, Restaurant Owners |

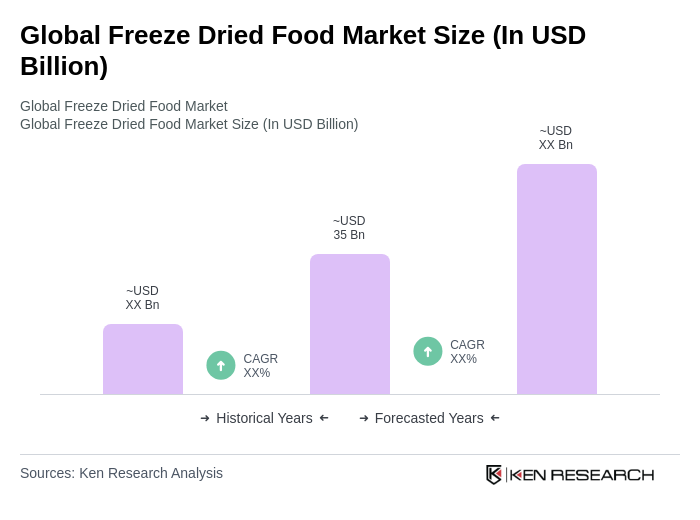

The Global Freeze Dried Food Market is valued at approximately USD 35 billion, driven by the demand for convenient, nutrient-dense foods with long shelf life across various applications, including retail and B2B sectors.