Region:Global

Author(s):Geetanshi

Product Code:KRAA0314

Pages:86

Published On:August 2025

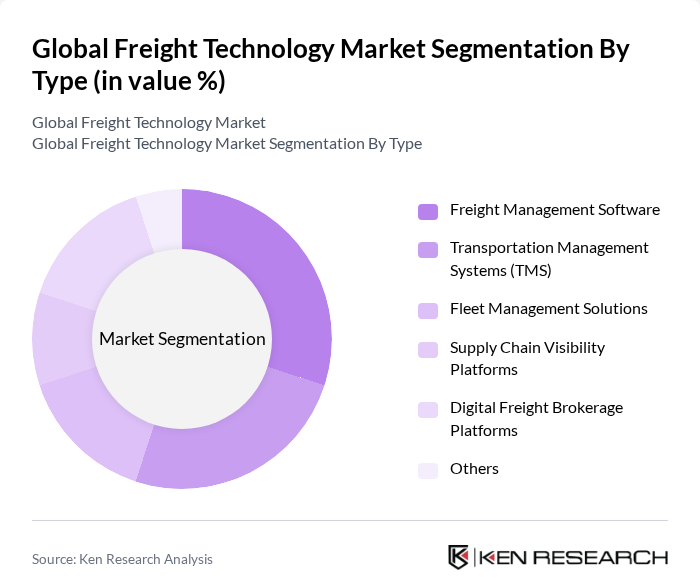

By Type:The market is segmented into Freight Management Software, Transportation Management Systems (TMS), Fleet Management Solutions, Supply Chain Visibility Platforms, Digital Freight Brokerage Platforms, and Others. Each of these sub-segments is essential for improving operational efficiency, automating workflows, and enhancing real-time visibility and decision-making in freight logistics .

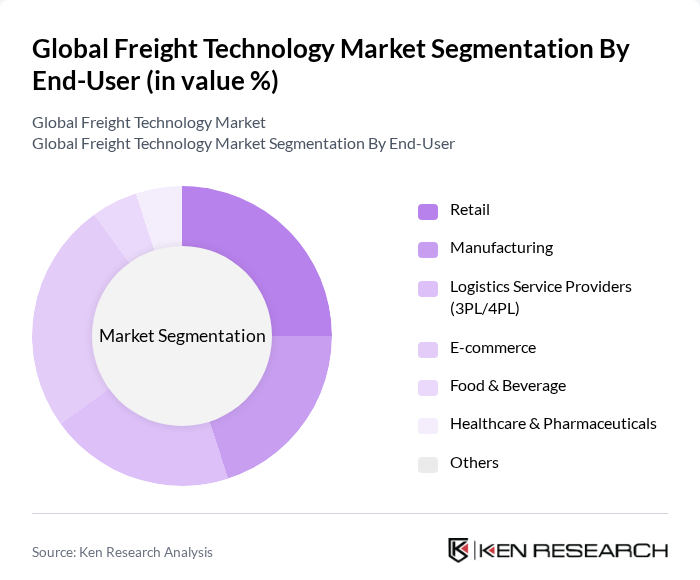

By End-User:The end-user segmentation includes Retail, Manufacturing, Logistics Service Providers (3PL/4PL), E-commerce, Food & Beverage, Healthcare & Pharmaceuticals, and Others. Each sector has unique logistics requirements, with retail and e-commerce driving demand for real-time tracking and last-mile delivery, manufacturing focusing on supply chain optimization, and healthcare emphasizing regulatory compliance and temperature-controlled logistics .

The Global Freight Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, C.H. Robinson Worldwide, Inc., J.B. Hunt Transport Services, Inc., XPO, Inc., DHL Supply Chain (Deutsche Post DHL Group), Kuehne + Nagel International AG, FedEx Corporation, UPS Supply Chain Solutions, Siemens AG, Trimble Inc., Descartes Systems Group Inc., Project44, FourKites, Inc., Flexport Inc., Convoy, Inc., Transporeon (A Trimble Company), BluJay Solutions (now part of E2open), Uber Freight contribute to innovation, geographic expansion, and service delivery in this space.

The future of the freight technology market is poised for significant transformation, driven by advancements in automation and sustainability. As companies increasingly adopt automated solutions, operational efficiencies are expected to improve, reducing costs and enhancing service delivery. Additionally, the focus on sustainable practices will likely lead to innovations in green technologies, aligning with global environmental goals. The integration of data analytics will further empower businesses to make informed decisions, optimizing logistics operations and enhancing customer satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Management Software Transportation Management Systems (TMS) Fleet Management Solutions Supply Chain Visibility Platforms Digital Freight Brokerage Platforms Others |

| By End-User | Retail Manufacturing Logistics Service Providers (3PL/4PL) E-commerce Food & Beverage Healthcare & Pharmaceuticals Others |

| By Freight Mode | Road Freight Rail Freight Air Freight Sea Freight Multimodal/Intermodal Others |

| By Technology | IoT Solutions AI and Machine Learning Blockchain Technology Big Data Analytics Cloud Computing Automation & Robotics Others |

| By Application | Freight Tracking & Visibility Route Optimization Inventory & Warehouse Management Demand Forecasting Freight Rate Management Compliance & Documentation Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Others |

| By Policy Support | Subsidies for Technology Adoption Tax Incentives Grants for Research and Development Regulatory Support for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Technology Adoption in SMEs | 100 | IT Managers, Operations Directors |

| Impact of AI on Freight Efficiency | 70 | Data Analysts, Logistics Coordinators |

| Blockchain in Supply Chain Transparency | 60 | Supply Chain Managers, Compliance Officers |

| IoT Solutions for Fleet Management | 80 | Fleet Managers, Technology Officers |

| Regulatory Impact on Freight Operations | 75 | Policy Advisors, Regulatory Affairs Managers |

The Global Freight Technology Market is valued at approximately USD 60 billion, driven by the demand for efficient logistics solutions, the growth of e-commerce, and advancements in technologies like IoT, AI, and automation.