Region:Global

Author(s):Geetanshi

Product Code:KRAB0142

Pages:95

Published On:August 2025

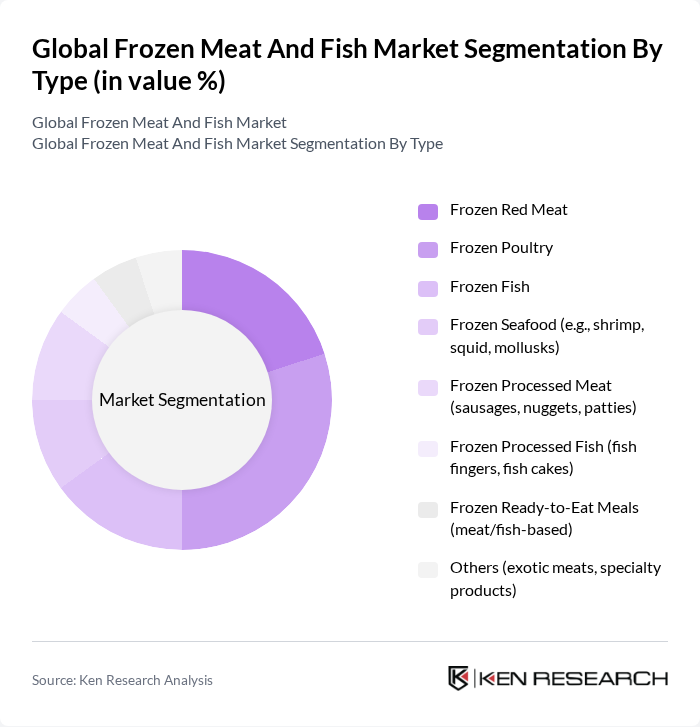

By Type:The frozen meat and fish market is segmented into various types, including frozen red meat, frozen poultry, frozen fish, frozen seafood, frozen processed meat, frozen processed fish, frozen ready-to-eat meals, and others. Among these, frozen poultry is currently the leading sub-segment, accounting for the highest market share due to its strong demand in both retail and food service sectors. The convenience of frozen poultry products, coupled with their affordability and versatility in meal preparation, has made them a staple in many households. Additionally, the growing trend of health-conscious eating has led to an increase in the consumption of frozen fish, which is perceived as a healthier protein option.

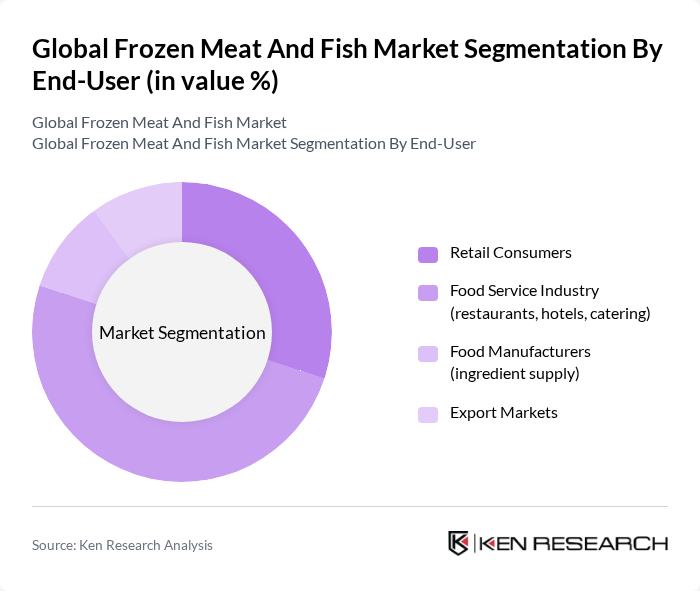

By End-User:The market is also segmented by end-user, which includes retail consumers, the food service industry, food manufacturers, and export markets. The food service industry is the dominant segment, driven by the increasing number of restaurants and catering services that rely on frozen products for their convenience and cost-effectiveness. Retail consumers are also a significant segment, as busy lifestyles lead to a growing preference for frozen meals and ingredients that save time in meal preparation. The trend towards online grocery shopping has further boosted the demand for frozen products among retail consumers.

The Global Frozen Meat and Fish Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tyson Foods, Inc., JBS S.A., Maruha Nichiro Corporation, Mitsubishi Corporation, Dongwon Industries Co., Ltd., Nomad Foods Limited, Pinnacle Foods Inc., Thai Union Group PCL, Mowi ASA, Clearwater Seafoods Inc., Perdue Farms Inc., Seaboard Foods LLC, Sysco Corporation, Conagra Brands, Inc., Sanderson Farms, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the frozen meat and fish market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, companies are likely to adopt eco-friendly practices, enhancing their market appeal. Additionally, innovations in freezing technology will improve product quality and shelf life, further attracting health-conscious consumers. The integration of smart logistics will streamline distribution, ensuring fresher products reach consumers efficiently, thereby supporting market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Red Meat Frozen Poultry Frozen Fish Frozen Seafood (e.g., shrimp, squid, mollusks) Frozen Processed Meat (sausages, nuggets, patties) Frozen Processed Fish (fish fingers, fish cakes) Frozen Ready-to-Eat Meals (meat/fish-based) Others (exotic meats, specialty products) |

| By End-User | Retail Consumers Food Service Industry (restaurants, hotels, catering) Food Manufacturers (ingredient supply) Export Markets |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail/E-commerce Convenience Stores Wholesale Distributors |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Rigid Packaging (trays, boxes) Flexible Packaging (bags, pouches) |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Price Range | Economy Mid-Range Premium |

| By Product Origin | Domestic Imported Organic Conventional |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Frozen Meat Retail Analysis | 150 | Retail Buyers, Category Managers |

| Frozen Fish Supply Chain Insights | 100 | Supply Chain Managers, Import/Export Specialists |

| Food Service Sector Demand | 80 | Restaurant Owners, Executive Chefs |

| Consumer Preferences in Frozen Foods | 120 | Household Consumers, Health-Conscious Shoppers |

| Market Trends in Frozen Seafood | 90 | Seafood Distributors, Retail Analysts |

The Global Frozen Meat and Fish Market is valued at approximately USD 52 billion, reflecting a significant growth trend driven by consumer demand for convenience, rising disposable incomes, and the expansion of the food service industry.