Region:Global

Author(s):Shubham

Product Code:KRAD0702

Pages:95

Published On:August 2025

By Type:The frozen snacks market is segmented into various types, including frozen appetizers & finger foods, frozen potato snacks, frozen pizza & mini pizzas, frozen savory bakery & dough-based snacks, frozen meat & poultry snacks, frozen seafood snacks, frozen plant-based/vegan snacks, frozen sweet snacks & desserts, and others. Among these, frozen appetizers & finger foods hold a leading position due to convenience and versatility for both at-home and foodservice occasions, with sustained demand for items like mini pizzas, fries, and bite-sized appetizers driven by social gatherings and snacking between meals.

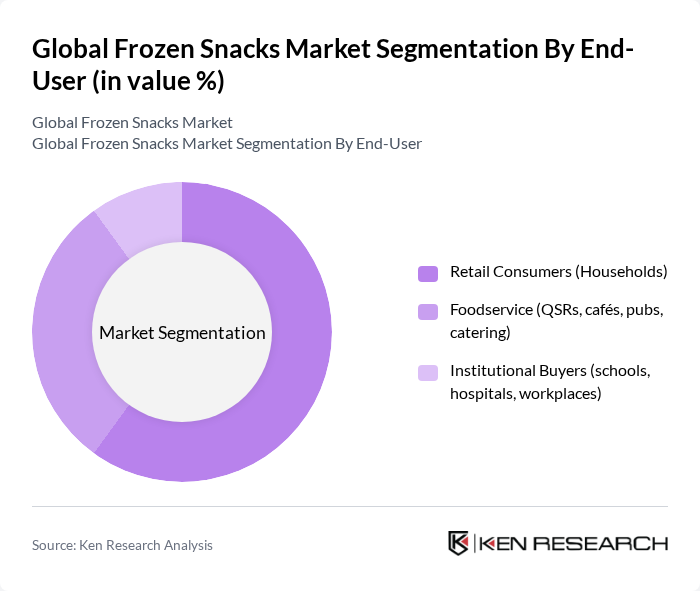

By End-User:The market is segmented by end-user into retail consumers (households), foodservice (QSRs, cafés, pubs, catering), and institutional buyers (schools, hospitals, workplaces). The retail consumer segment dominates the market, supported by higher in-home consumption of convenient frozen options, growth in modern trade and e-grocery, and broad product availability; foodservice demand is also robust as chains standardize menus and rely on frozen SKUs for consistency and speed.

The Global Frozen Snacks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Conagra Brands, Inc., The Kraft Heinz Company, General Mills, Inc., McCain Foods Limited, Unilever PLC, Tyson Foods, Inc., Dr. Oetker GmbH, Ajinomoto Co., Inc., Schwan’s Company, Iceland Foods Ltd, Nomad Foods Limited, Bellisio Foods, Inc., Rich Products Corporation, Goya Foods, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the frozen snacks market in None appears promising, driven by evolving consumer preferences and technological advancements. The increasing integration of smart freezing technologies is expected to enhance product quality and shelf life, while the demand for plant-based options is likely to grow, reflecting broader dietary trends. Additionally, the expansion of e-commerce platforms will facilitate greater market penetration, allowing brands to reach a wider audience and adapt to changing consumer behaviors effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Appetizers & Finger Foods (e.g., spring rolls, mozzarella sticks, samosas) Frozen Potato Snacks (e.g., fries, wedges, tater tots, hash browns) Frozen Pizza & Mini Pizzas Frozen Savory Bakery & Dough-Based Snacks (e.g., pretzels, empanadas, pockets) Frozen Meat & Poultry Snacks (e.g., nuggets, tenders, meatballs) Frozen Seafood Snacks (e.g., fish sticks, shrimp bites) Frozen Plant-based/Vegan Snacks (meat-free nuggets, patties, bites) Frozen Sweet Snacks & Desserts (e.g., waffles, churros, cookie dough bites) Others |

| By End-User | Retail Consumers (Households) Foodservice (QSRs, cafés, pubs, catering) Institutional Buyers (schools, hospitals, workplaces) |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail & Quick Commerce Convenience Stores Specialty & Club Stores |

| By Packaging Type | Bags & Pouches Boxes & Cartons Trays & Tubs Multipacks & Single-Serve Packs |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Frozen Snacks Sales | 150 | Category Managers, Grocery Store Owners |

| Consumer Preferences for Frozen Snacks | 140 | Household Decision Makers, Snack Enthusiasts |

| Frozen Snack Production Insights | 100 | Production Managers, Quality Control Specialists |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends and Innovations | 70 | Food Technologists, R&D Managers |

The Global Frozen Snacks Market is valued at approximately USD 112 billion, with estimates ranging between USD 108 billion and USD 115 billion based on recent analyses. This growth is driven by increasing demand for convenient food options and the trend of at-home consumption.