Region:Global

Author(s):Shubham

Product Code:KRAD0721

Pages:89

Published On:August 2025

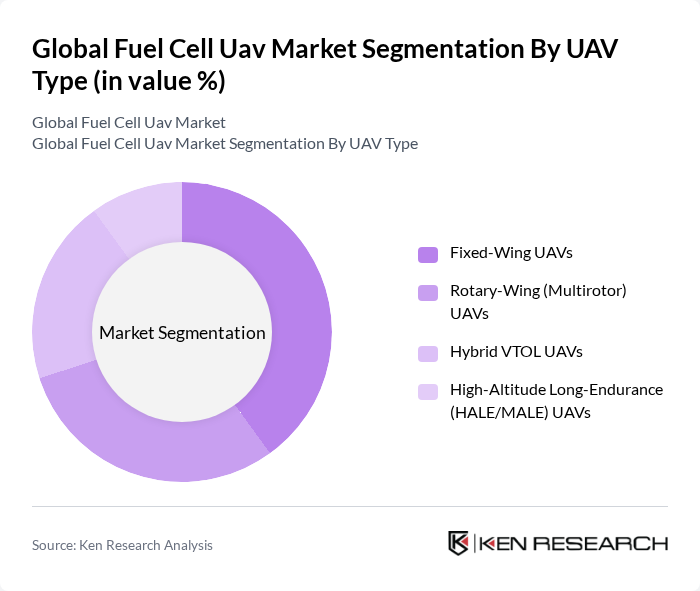

By UAV Type:The UAV type segmentation includes Fixed-Wing UAVs, Rotary-Wing (Multirotor) UAVs, Hybrid VTOL UAVs, and High-Altitude Long-Endurance (HALE/MALE) UAVs. Each type serves distinct operational needs, with Fixed-Wing UAVs being favored for long-range missions due to superior lift-to-drag and endurance; Rotary-Wing UAVs are preferred for maneuverability and vertical takeoff/landing in confined sites; Hybrid VTOL UAVs combine runway-free VTOL with efficient wing-borne cruise for versatile missions; HALE/MALE platforms are used for persistent ISR where long endurance is critical. Market analyses for fuel cell UAVs commonly segment by fixed-wing, rotary-wing, and hybrid VTOL; HALE/MALE fuel cell adoption is emergent and generally concentrated in long-endurance ISR and demonstration programs.

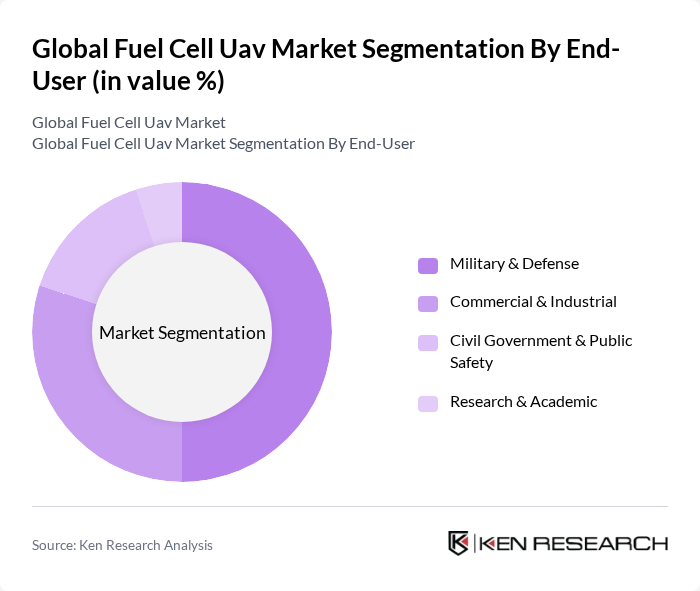

By End-User:The end-user segmentation encompasses Military & Defense, Commercial & Industrial, Civil Government & Public Safety, and Research & Academic sectors. The Military & Defense segment is the largest, reflecting adoption for long-endurance ISR and communications relay; Commercial & Industrial demand is growing in energy, utilities, and infrastructure inspection where multi-hour flights cut downtime; Civil Government & Public Safety employ fuel cell UAVs for disaster response and wide-area monitoring; Research & Academic users focus on hydrogen system integration and endurance testing. Published market structures consistently cite Military & Defense, Commercial & Industrial, and Civil/Government as primary end uses for fuel cell UAVs.

The Global Fuel Cell UAV Market is characterized by a dynamic mix of regional and international players. Leading participants such as Doosan Mobility Innovation (DMI), Ballard Power Systems Inc., Intelligent Energy Ltd., H3 Dynamics, Protonex LLC (a Ballard company), Plug Power Inc. (Energy Vault/ProGen for UAV), Elbit Systems Ltd., AeroVironment Inc., Aurora Flight Sciences (a Boeing Company), JOUAV (Chengdu JOUAV Automation Tech Co., Ltd.), MMC UAV (MicroMultiCopter Aero Technology), HyPoint, Inc., Horizon Fuel Cell Technologies, Hylium Industries Inc., Honeywell Aerospace contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fuel cell UAV market appears promising, driven by technological advancements and increasing environmental awareness. As governments implement stricter emission regulations, the demand for cleaner aviation solutions will rise. Additionally, the integration of AI and machine learning into UAV operations is expected to enhance efficiency and operational capabilities. These trends indicate a shift towards more sustainable and technologically advanced UAV solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By UAV Type | Fixed-Wing UAVs Rotary-Wing (Multirotor) UAVs Hybrid VTOL UAVs High-Altitude Long-Endurance (HALE/MALE) UAVs |

| By End-User | Military & Defense Commercial & Industrial Civil Government & Public Safety Research & Academic |

| By Application | Intelligence, Surveillance, and Reconnaissance (ISR) Cargo and Last-Mile Delivery Environmental and Infrastructure Monitoring Mapping, Inspection, and Surveying |

| By Powertrain/Component | Fuel Cell Stack (PEM, SOFC) Hydrogen Storage & Refueling Systems Balance of Plant (Compressors, Humidifiers, Controllers) Hybridization Components (Battery Buffer, Power Electronics) |

| By Range | Short Range (?50 km) Medium Range (50–200 km) Long Range (>200 km) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy Support | Hydrogen Strategies and Subsidies Tax Incentives & Carbon Credits R&D Grants and Pilot Programs Dual-Use/Defense Procurement Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military UAV Applications | 120 | Defense Procurement Officers, Military Technology Analysts |

| Agricultural UAV Usage | 85 | Agronomists, Farm Equipment Managers |

| Commercial Delivery Drones | 95 | Logistics Managers, E-commerce Operations Heads |

| Environmental Monitoring UAVs | 75 | Environmental Scientists, Policy Makers |

| Research and Development in UAVs | 65 | R&D Directors, Innovation Managers |

The Global Fuel Cell UAV Market is valued at approximately USD 6.0 billion, driven by advancements in hydrogen fuel cell technology and increasing demand for low-emission UAV operations across various sectors, including defense, industrial inspection, and public safety.