Region:Global

Author(s):Dev

Product Code:KRAD0464

Pages:91

Published On:August 2025

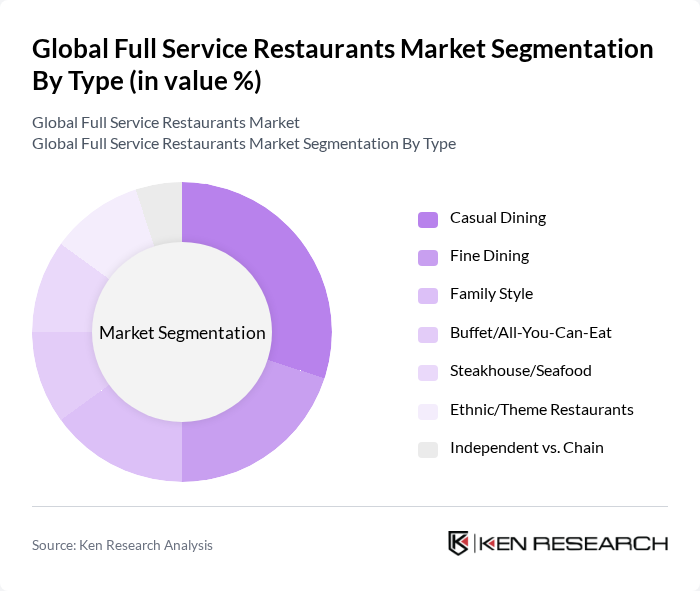

By Type:The full-service restaurant market can be segmented into various types, including Casual Dining, Fine Dining, Family Style, Buffet/All-You-Can-Eat, Steakhouse/Seafood, Ethnic/Theme Restaurants, and Independent vs. Chain. Each of these segments caters to different consumer preferences and dining occasions, influencing their market performance. Operators are emphasizing technology-enabled reservations and waitlist management, menu personalization, and immersive concepts across these formats to drive traffic and check growth .

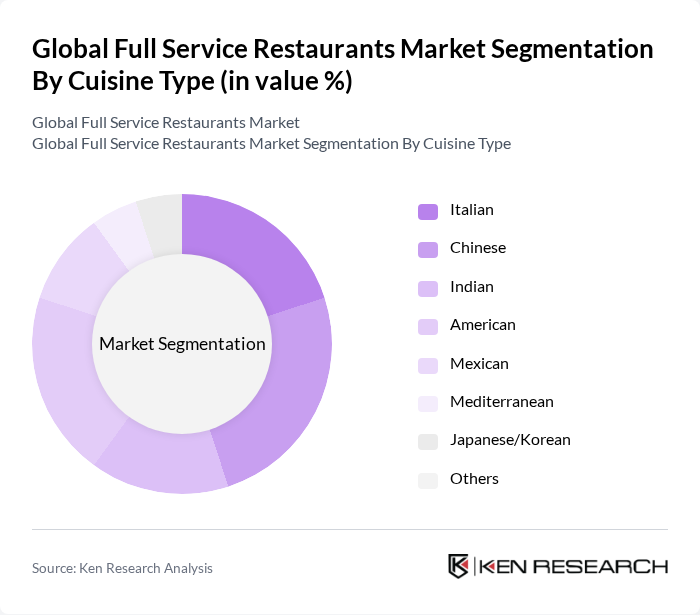

By Cuisine Type:The market can also be segmented by cuisine type, which includes Italian, Chinese, Indian, American, Mexican, Mediterranean, Japanese/Korean, and Others. Each cuisine type attracts different demographics and is influenced by cultural trends and consumer preferences. Growth is supported by rising demand for authentic regional flavors, healthier preparations (e.g., Mediterranean), and premiumization in Asian cuisines within full-service formats .

The Global Full Service Restaurants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Darden Restaurants, Inc. (Olive Garden, LongHorn Steakhouse), Brinker International, Inc. (Chili’s Grill & Bar, Maggiano’s Little Italy), Bloomin’ Brands, Inc. (Outback Steakhouse, Carrabba’s Italian Grill), The Cheesecake Factory Incorporated, Texas Roadhouse, Inc. (Texas Roadhouse, Bubba’s 33), Cracker Barrel Old Country Store, Inc., The Wendy’s Company – note: QSR, excluded from FSR scope, P.F. Chang’s China Bistro, Inc., Red Robin Gourmet Burgers, Inc., First Watch Restaurant Group, Inc., Mitchells & Butlers plc (Harvester, Miller & Carter), Haidilao International Holding Ltd., The Oetker Collection (Fine Dining Concepts), D.Ream (Do?u? Restaurant Entertainment and Management), Dine Brands Global, Inc. (Applebee’s, IHOP) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the full-service restaurant market in None appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, restaurants are likely to adopt eco-friendly practices, enhancing their appeal. Additionally, the integration of digital solutions for ordering and payment is expected to streamline operations and improve customer experiences. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual Dining Fine Dining Family Style Buffet/All-You-Can-Eat Steakhouse/Seafood Ethnic/Theme Restaurants Independent vs. Chain |

| By Cuisine Type | Italian Chinese Indian American Mexican Mediterranean Japanese/Korean Others |

| By Service Style | Full Table Service Counter + Table Hybrid Reservations-Only/Prepaid Delivery/Off-Premise from FSR Catering/Private Dining Others |

| By Target Market | Families Young Professionals Tourists Business Diners/Corporate Events Special Occasion Diners Others |

| By Location | Standalone/High Street Shopping Centers/Retail Travel Hubs (Airports/Stations) Leisure & Entertainment Districts Hotels/Resorts Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Dining Experience | Dine-In Takeaway Delivery (First-Party/Third-Party) Outdoor/Patio Dining Chef’s Table/Tasting Menu Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Casual Dining Restaurants | 140 | Restaurant Owners, General Managers |

| Fine Dining Establishments | 80 | Head Chefs, Operations Directors |

| Fast Casual Chains | 120 | Marketing Managers, Franchise Owners |

| Food Trucks and Pop-ups | 70 | Entrepreneurs, Event Coordinators |

| Family-style Restaurants | 90 | Customer Experience Managers, Service Staff |

The Global Full Service Restaurants Market is valued at approximately USD 1.6 trillion, reflecting a significant recovery and expansion in sit-down dining globally, driven by increased consumer spending and evolving dining preferences.