Global Functional Flour Market Overview

- The Global Functional Flour Market is valued at USD 95 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for gluten-free, high-protein, and fiber-enriched flour options as consumers become more health-conscious and seek alternatives to traditional wheat flour. The rise in the popularity of plant-based diets, clean-label products, and the expansion of the bakery, snacks, and ready-to-eat food industries further contribute to the market's expansion. Technological advancements in food processing and milling have enabled the development of functional flours with enhanced nutritional profiles, supporting broader adoption across food categories .

- Key players in this market include the United States, Germany, and China, which dominate due to their advanced food processing technologies, large consumer bases, and significant investments in research and development. The U.S. leads in innovation and product variety, while Germany is recognized for its high-quality standards and production efficiency. China’s expanding middle class, urbanization, and evolving dietary preferences are also propelling demand for functional flour products .

- In 2023, the U.S. Food and Drug Administration (FDA) updated the Food Labeling: Nutrition Labeling of Standard Menu Items in Restaurants and Similar Retail Food Establishments regulation, requiring manufacturers and retailers to provide clear, accessible nutritional information on packaging and menus, including for functional flour products. This regulation aims to empower consumers with transparent information, promote healthier choices, and encourage the consumption of functional flours that meet specific dietary needs .

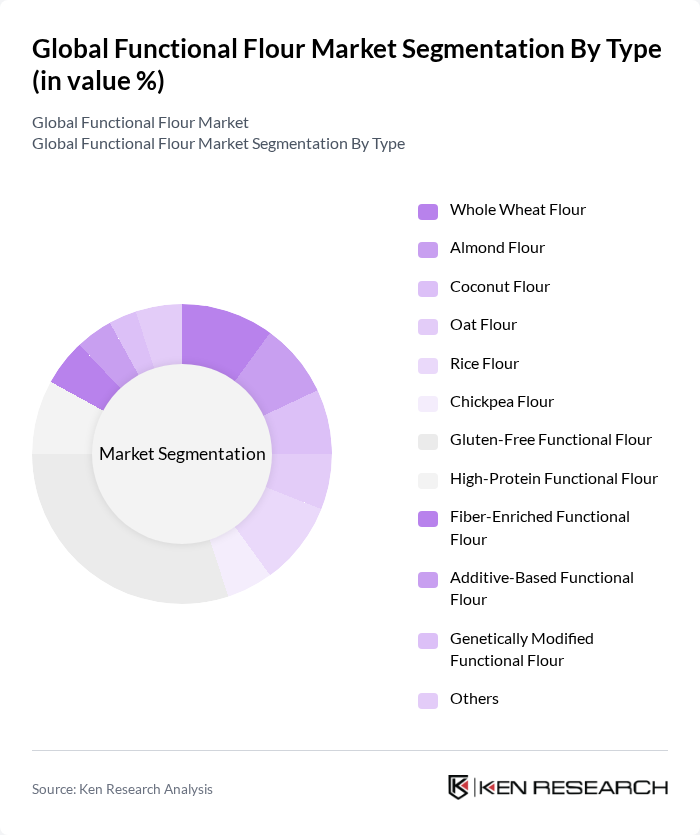

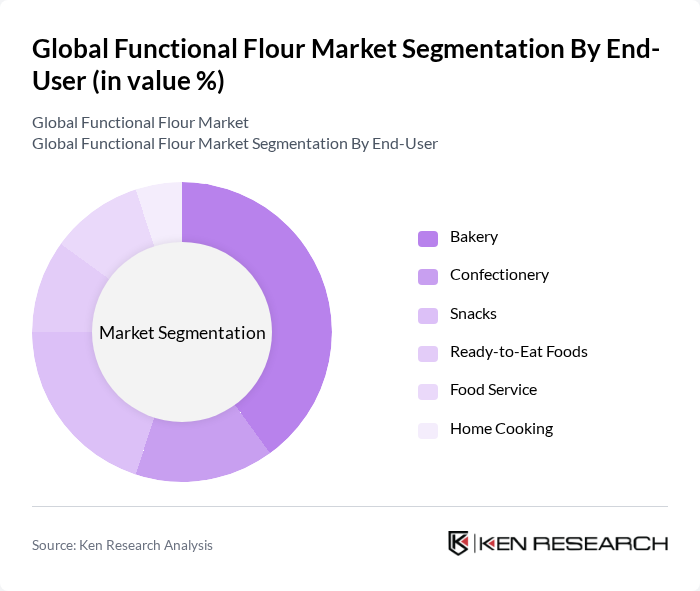

Global Functional Flour Market Segmentation

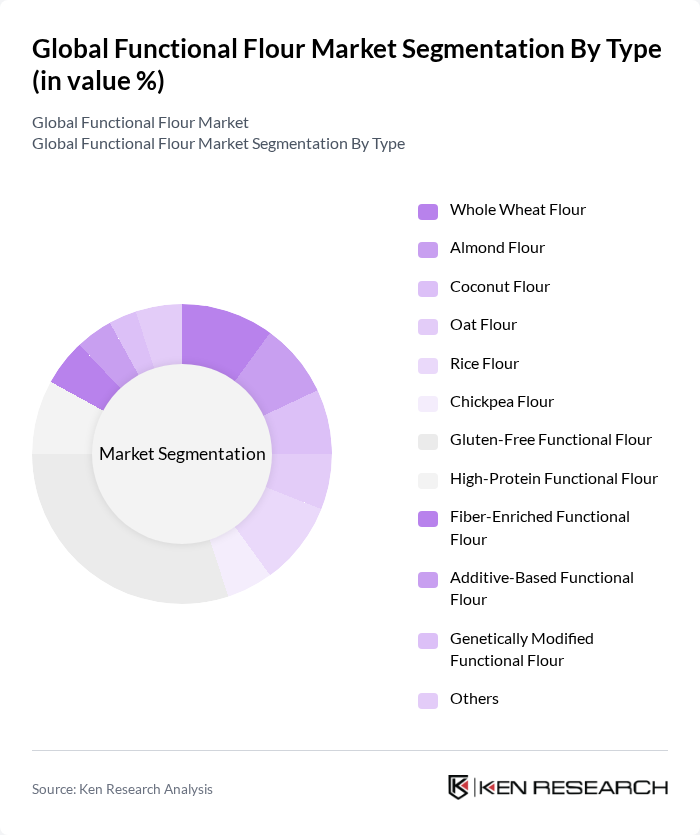

By Type:The functional flour market is segmented into Whole Wheat Flour, Almond Flour, Coconut Flour, Oat Flour, Rice Flour, Chickpea Flour, Gluten-Free Functional Flour, High-Protein Functional Flour, Fiber-Enriched Functional Flour, Additive-Based Functional Flour, Genetically Modified Functional Flour, and Others. Among these, Gluten-Free Functional Flour is currently dominating the market, driven by the rising prevalence of gluten intolerance, celiac disease, and a broader trend toward healthier, plant-based eating habits. Consumers are increasingly opting for gluten-free and clean-label options, leading to a surge in demand for this sub-segment .

By End-User:The market is also segmented by end-user applications, including Bakery, Confectionery, Snacks, Ready-to-Eat Foods, Food Service, and Home Cooking. The Bakery segment is the leading end-user, propelled by the increasing demand for baked goods with enhanced nutritional profiles. The shift toward artisanal, clean-label, and health-focused baked products has led to a significant rise in the use of functional flours, making this segment a primary driver of market growth .

Global Functional Flour Market Competitive Landscape

The Global Functional Flour Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company, Cargill, Incorporated, General Mills, Inc., King Arthur Baking Company, Inc., Bob's Red Mill Natural Foods, Inc., Conagra Brands, Inc., Bunge Limited, Ingredion Incorporated, SunOpta Inc., The Hain Celestial Group, Inc., Glanbia plc, Ebro Foods, S.A., Tereos S.A., Associated British Foods plc, and The Supplant Company contribute to innovation, geographic expansion, and service delivery in this space .

Global Functional Flour Market Industry Analysis

Growth Drivers

- Increasing Demand for Gluten-Free Products:The global gluten-free food market is projected to reach $8.5 billion by the future, driven by a growing number of consumers diagnosed with celiac disease, which affects approximately 1% of the global population. This rising demand for gluten-free options is pushing manufacturers to innovate and expand their functional flour offerings, catering to health-conscious consumers seeking alternatives. The increasing prevalence of gluten intolerance is a significant factor fueling this trend, particularly in regions like North America and Europe.

- Rising Health Consciousness Among Consumers:A recent survey indicated that 70% of consumers are actively seeking healthier food options, leading to a surge in demand for functional flours that offer nutritional benefits. The global health and wellness food market is expected to reach $1.2 trillion by the future, with functional flours playing a crucial role in this growth. This trend is particularly evident in urban areas where consumers prioritize health, driving manufacturers to develop flours enriched with proteins, fibers, and vitamins to meet these needs.

- Expansion of the Bakery and Confectionery Sector:The global bakery market is projected to reach $600 billion by the future, with functional flours becoming increasingly popular in this sector. Innovations in product formulations are enabling bakers to create healthier options without compromising taste. The rise of artisanal and specialty bakeries, which often emphasize quality ingredients, is further driving the demand for functional flours. This growth is particularly pronounced in regions with a strong baking culture, such as Europe and North America, where consumers are willing to pay a premium for quality.

Market Challenges

- Fluctuating Raw Material Prices:The prices of key raw materials for functional flours, such as grains and legumes, have shown significant volatility, with wheat prices fluctuating between $6.00 and $8.00 per bushel in recent periods. This instability can impact production costs and profit margins for manufacturers, making it challenging to maintain competitive pricing. Additionally, adverse weather conditions and geopolitical factors can further exacerbate these fluctuations, creating uncertainty in supply chains and pricing strategies.

- Limited Awareness of Functional Flours:Despite the growing market, consumer awareness of functional flours remains limited, with only 35% of consumers familiar with their benefits. This lack of knowledge can hinder market growth, as consumers may opt for traditional flours due to familiarity. Educational initiatives and marketing strategies are essential to bridge this gap, but they require investment and time, posing a challenge for manufacturers looking to expand their market share in a competitive landscape.

Global Functional Flour Market Future Outlook

The future of the functional flour market appears promising, driven by evolving consumer preferences and increasing health awareness. As more individuals adopt plant-based diets, the demand for alternative flours is expected to rise significantly. Additionally, technological advancements in production processes will likely enhance product quality and variety, catering to diverse consumer needs. Companies that prioritize sustainability and transparency in sourcing will also gain a competitive edge, aligning with the growing trend towards clean label products and responsible consumption.

Market Opportunities

- Growth in E-commerce for Food Products:The e-commerce food market is projected to reach $400 billion by the future, providing a significant opportunity for functional flour brands to expand their reach. Online platforms allow for targeted marketing and direct consumer engagement, enabling brands to educate potential customers about the benefits of functional flours. This shift towards online shopping is particularly appealing to younger consumers who prefer convenience and variety in their food choices.

- Increasing Use in Nutraceuticals:The global nutraceutical market is expected to surpass $600 billion by the future, with functional flours being integrated into various health products. This trend presents an opportunity for manufacturers to collaborate with nutraceutical companies to develop innovative products that combine the health benefits of functional flours with other nutritional ingredients. Such partnerships can enhance product offerings and cater to the growing consumer demand for health-oriented food solutions.