Region:Global

Author(s):Dev

Product Code:KRAA1568

Pages:93

Published On:August 2025

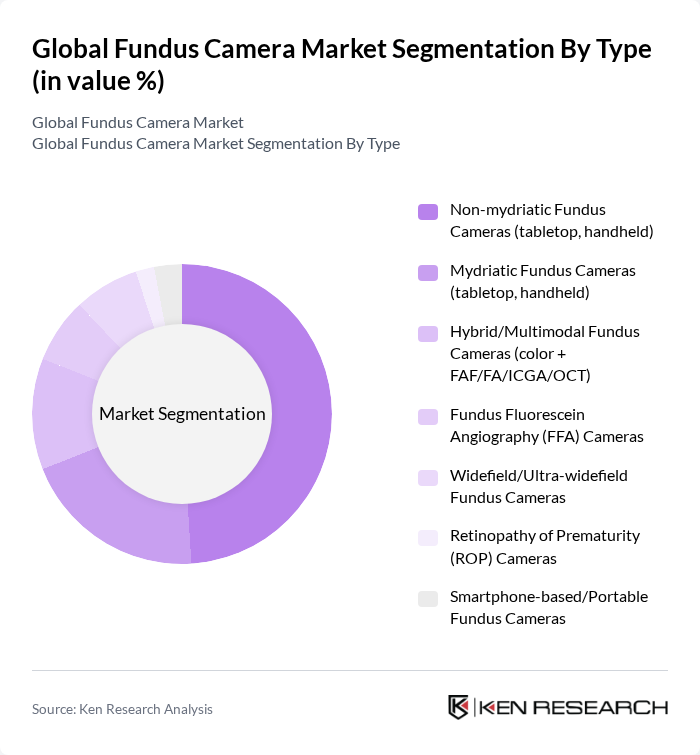

By Type:The market is segmented into various types of fundus cameras, including Non-mydriatic Fundus Cameras (tabletop, handheld), Mydriatic Fundus Cameras (tabletop, handheld), Hybrid/Multimodal Fundus Cameras (color + FAF/FA/ICGA/OCT), Fundus Fluorescein Angiography (FFA) Cameras, Widefield/Ultra-widefield Fundus Cameras, Retinopathy of Prematurity (ROP) Cameras, and Smartphone-based/Portable Fundus Cameras. Among these, Non-mydriatic Fundus Cameras are gaining traction due to their ease of use and ability to capture high-quality images without the need for pupil dilation, making them ideal for screening programs and teleophthalmology applications.

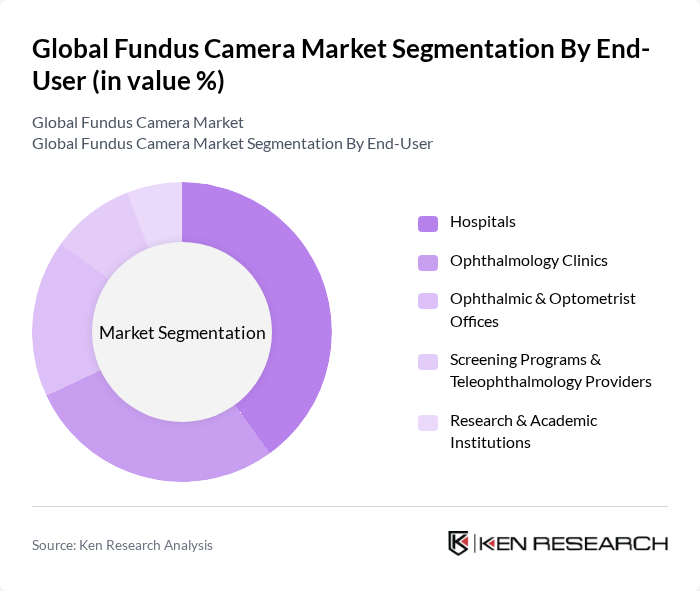

By End-User:The end-user segmentation includes Hospitals, Ophthalmology Clinics, Ophthalmic & Optometrist Offices, Screening Programs & Teleophthalmology Providers, and Research & Academic Institutions. Hospitals are the leading end-user segment due to their comprehensive facilities and the need for advanced diagnostic tools to manage a wide range of eye conditions. The increasing number of outpatient procedures and the integration of telemedicine in ophthalmology are also contributing to the growth of this segment.

The Global Fundus Camera Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canon Inc., Carl Zeiss Meditec AG, Topcon Corporation, Heidelberg Engineering GmbH, Optovue, Inc. (now part of Visionix/TechnoGroup), NIDEK Co., Ltd., Kowa Company, Ltd., Optos plc (a Nikon company), Rexxam Co., Ltd. (Rexxam Eye Care/Right MFG.), Sonomed Escalon, Welch Allyn, Inc. (Hillrom/Baxter), Visionix (Luneau Technology Group), Medmont International Pty Ltd, iCare Finland Oy (iCare USA), Clarity Medical Systems, Inc., CenterVue S.p.A. (part of Visionix), Optomed Plc, Volk Optical, Inc. (a Halma company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fundus camera market in None appears promising, driven by technological innovations and an increasing focus on preventive healthcare. The integration of artificial intelligence in imaging technology is expected to enhance diagnostic accuracy and efficiency. Additionally, the shift towards telemedicine will facilitate remote consultations, making eye care more accessible. As healthcare providers adapt to these trends, the demand for advanced fundus cameras is likely to grow, improving patient outcomes and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Non-mydriatic Fundus Cameras (tabletop, handheld) Mydriatic Fundus Cameras (tabletop, handheld) Hybrid/Multimodal Fundus Cameras (color + FAF/FA/ICGA/OCT) Fundus Fluorescein Angiography (FFA) Cameras Widefield/Ultra-widefield Fundus Cameras Retinopathy of Prematurity (ROP) Cameras Smartphone-based/Portable Fundus Cameras |

| By End-User | Hospitals Ophthalmology Clinics Ophthalmic & Optometrist Offices Screening Programs & Teleophthalmology Providers Research & Academic Institutions |

| By Application | Diabetic Retinopathy Screening Glaucoma Evaluation (optic nerve head assessment) Age-related Macular Degeneration (AMD) Detection Retinal Vascular Diseases (vein/artery occlusions) ROP & Pediatric Retinal Assessment Tele-screening & Population Health Programs |

| By Distribution Channel | Direct Sales (manufacturers) Authorized Distributors/Dealers Online/EDI & Tender-based Procurement Group Purchasing Organizations (GPOs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Range (entry, smartphone-based/handheld) Mid Range (compact non-mydriatic/hybrid) High Range (tabletop hybrid, ultra-widefield) |

| By Technology | Digital Fundus Cameras Analog Fundus Cameras AI-enabled/Cloud-connected Fundus Cameras |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmology Clinics | 100 | Ophthalmologists, Clinic Managers |

| Hospital Eye Departments | 80 | Department Heads, Medical Directors |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Research Institutions | 50 | Research Scientists, Clinical Researchers |

| Healthcare Policy Makers | 40 | Health Administrators, Policy Analysts |

The Global Fundus Camera Market is valued at approximately USD 620 million, driven by the increasing prevalence of eye diseases and advancements in imaging technology, which support early diagnosis and treatment of retinal disorders.