Region:Global

Author(s):Dev

Product Code:KRAB0458

Pages:91

Published On:August 2025

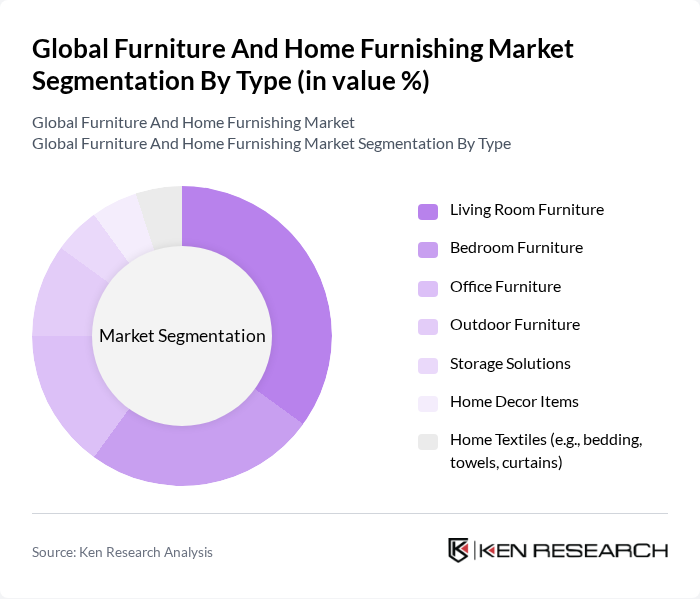

By Type:The furniture and home furnishing market is segmented into various types, including Living Room Furniture, Bedroom Furniture, Office Furniture, Outdoor Furniture, Storage Solutions, Home Decor Items, and Home Textiles. Among these, Living Room Furniture is the most dominant segment in retail mix and consumer focus, supported by ongoing home entertainment, hybrid working, and socializing at home, which elevate demand for sofas, sectionals, coffee tables, entertainment units, and media storage .

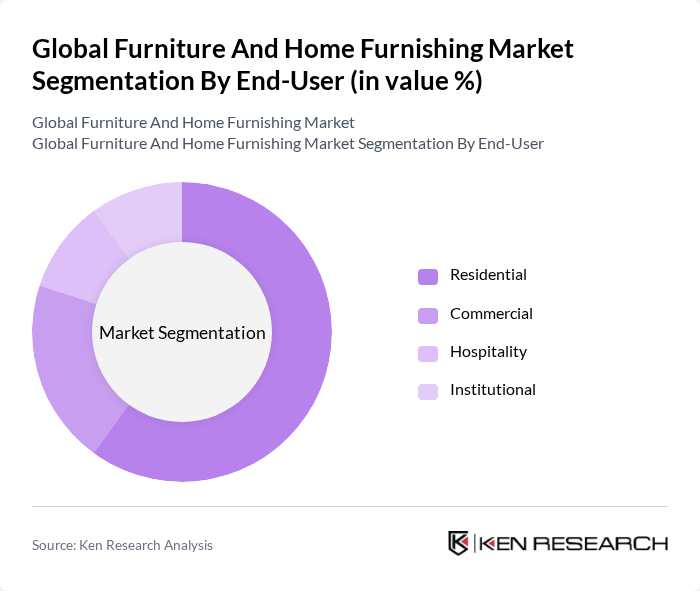

By End-User:The market is segmented by end-user into Residential, Commercial, Hospitality, and Institutional. The Residential segment holds the largest share, underpinned by household formation, renovations, and replacement cycles; rising online penetration and specialty retail also support residential demand, while commercial categories (office, hospitality) are influenced by workplace redesign, flexible office investments, and lodging refurbishment cycles .

The Global Furniture And Home Furnishing Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Ashley Furniture Industries, LLC, Steelcase Inc., MillerKnoll, Inc. (Herman Miller + Knoll), La-Z-Boy Incorporated, Wayfair Inc., Williams-Sonoma, Inc., TJX Companies, Inc. (HomeGoods, HomeSense), Flexsteel Industries, Inc., HNI Corporation, Inter IKEA Systems B.V. (Franchise System), Sauder Woodworking Co., Dorel Industries Inc., Tempur Sealy International, Inc., RH (Restoration Hardware), Walmart Inc. (Home & Furniture), Amazon.com, Inc. (Home & Furniture), Home Depot, Inc. (Decor & Furniture), Lowe’s Companies, Inc. (Home Decor & Furniture), Haverty Furniture Companies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the furniture and home furnishing market appears promising, driven by ongoing urbanization and technological advancements. As consumers increasingly seek personalized and sustainable options, manufacturers are likely to innovate in product design and materials. Additionally, the integration of smart technology into furniture is expected to enhance functionality and appeal. With the rise of e-commerce, companies will continue to expand their online presence, catering to a tech-savvy consumer base that values convenience and variety in their purchasing decisions.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Office Furniture Outdoor Furniture Storage Solutions Home Decor Items Home Textiles (e.g., bedding, towels, curtains) |

| By End-User | Residential Commercial Hospitality Institutional |

| By Distribution Channel | Online Retail (e-commerce, marketplaces, DTC) Offline Retail (specialty stores, brand outlets) Direct Sales (project/bulk, contract) Wholesale (distributors, dealer networks) |

| By Material | Wood Metal Plastic Fabric/Upholstery Glass Engineered Wood & Laminates |

| By Price Range | Budget Mid-range Premium/Luxury |

| By Style | Contemporary/Modern Traditional/Classical Rustic/Farmhouse Industrial Scandinavian/Minimalist |

| By Functionality | Multi-functional Space-saving Customizable/Modular Smart/Connected |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 100 | Office Managers, Facility Coordinators |

| Online Furniture Retail Trends | 120 | E-commerce Managers, Digital Marketing Specialists |

| Luxury Home Furnishings | 80 | High-End Retailers, Luxury Interior Designers |

| Sustainable Furniture Practices | 70 | Sustainability Officers, Product Development Managers |

The Global Furniture and Home Furnishing Market is valued at approximately USD 1 trillion, reflecting strong demand across various categories, including furniture and home decor, driven by rising disposable incomes and increased e-commerce penetration.