Region:Global

Author(s):Rebecca

Product Code:KRAC0317

Pages:99

Published On:August 2025

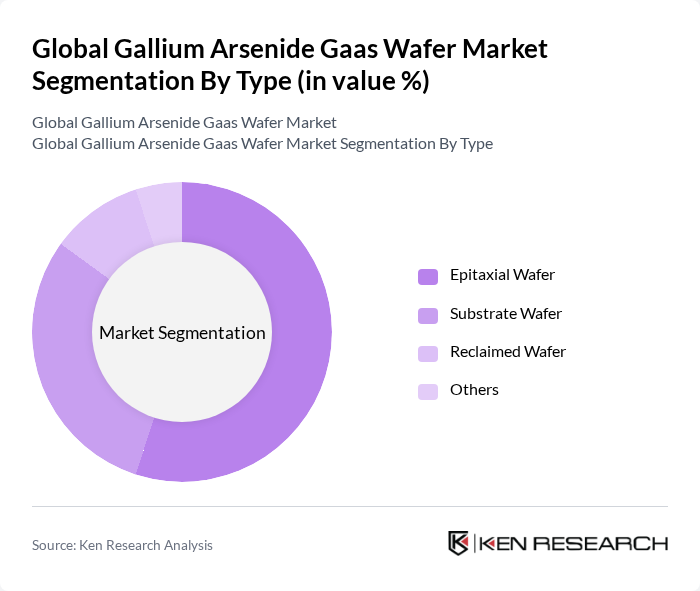

By Type:The GaAs wafer market is segmented into Epitaxial Wafer, Substrate Wafer, Reclaimed Wafer, and Others. Among these, the Epitaxial Wafer segment leads due to its critical role in high-frequency and high-power applications, particularly in telecommunications, automotive radar, and aerospace sectors. The demand for Epitaxial Wafers is driven by their superior electron mobility and efficiency, making them essential for advanced RF devices, power amplifiers, and optoelectronic components. The Substrate Wafer segment follows, serving various applications in consumer electronics, LEDs, and industrial sectors .

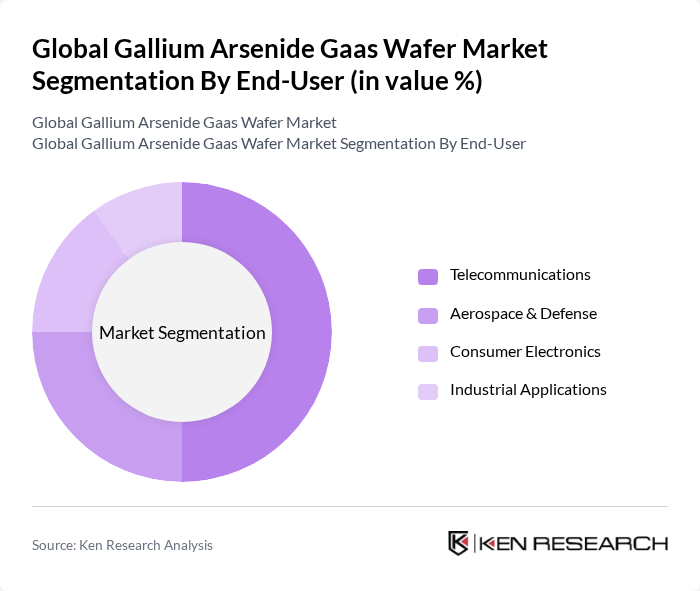

By End-User:The market is categorized into Telecommunications, Aerospace & Defense, Consumer Electronics, and Industrial Applications. The Telecommunications segment is dominant, driven by the increasing demand for mobile communication technologies, rapid deployment of 5G networks, and the proliferation of wireless infrastructure. Growth in this segment is fueled by the need for high-performance RF components and power amplifiers. The Aerospace & Defense segment also shows significant growth due to the rising demand for reliable, efficient electronic systems and radar technologies in defense applications. Consumer electronics and industrial applications continue to expand, supported by the integration of GaAs wafers in LEDs, sensors, and industrial automation .

The Global Gallium Arsenide GaAs Wafer Market is characterized by a dynamic mix of regional and international players. Leading participants such as AXT Inc., IQE PLC, Sumitomo Electric Industries, Ltd., Freiberger Compound Materials GmbH, II-VI Incorporated, Skyworks Solutions, Inc., NTT Advanced Technology Corporation, WIN Semiconductors Corp., Global Communication Semiconductors, LLC, Semiconductor Wafer Inc. (SWI), Xiamen Powerway Advanced Material Co., Ltd., Broadcom Inc., Qorvo, Inc., Panasonic Corporation, Mitsubishi Electric Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GaAs wafer market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of AI in semiconductor manufacturing is expected to enhance production efficiency and reduce costs. Furthermore, the trend towards miniaturization of electronic devices will continue to fuel demand for GaAs wafers, as they offer superior performance in compact designs. As sustainability becomes a priority, manufacturers are likely to adopt eco-friendly practices, aligning with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Epitaxial Wafer Substrate Wafer Reclaimed Wafer Others |

| By End-User | Telecommunications Aerospace & Defense Consumer Electronics Industrial Applications |

| By Application | RF Devices Solar Cells LED Technology Laser Diodes |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Technology | MOCVD (Metal-Organic Chemical Vapor Deposition) LPE (Liquid Phase Epitaxy) VGF (Vertical Gradient Freeze) LEC (Liquid Encapsulated Czochralski) CVD (Chemical Vapor Deposition) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Applications | 60 | Product Managers, Technology Directors |

| Solar Energy Solutions | 50 | Project Engineers, Procurement Specialists |

| Consumer Electronics Manufacturing | 55 | Operations Managers, Supply Chain Analysts |

| Research & Development in Semiconductors | 40 | R&D Managers, Technical Leads |

| Wafer Fabrication Facilities | 45 | Manufacturing Engineers, Quality Control Managers |

The Global Gallium Arsenide Wafer Market is valued at approximately USD 670 million, reflecting a significant growth trend driven by the demand for high-performance electronic devices, particularly in telecommunications and consumer electronics.