Region:Global

Author(s):Shubham

Product Code:KRAD0701

Pages:80

Published On:August 2025

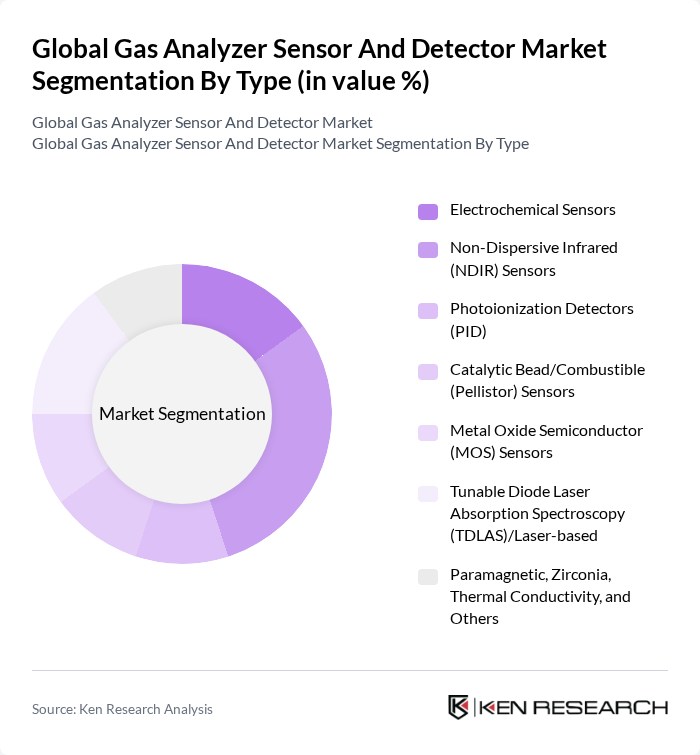

By Type:The market is segmented into various types of gas analyzers and detectors, including Electrochemical Sensors, Non-Dispersive Infrared (NDIR) Sensors, Photoionization Detectors (PID), Catalytic Bead/Combustible (Pellistor) Sensors, Metal Oxide Semiconductor (MOS) Sensors, Tunable Diode Laser Absorption Spectroscopy (TDLAS)/Laser-based, and Paramagnetic, Zirconia, Thermal Conductivity, and Others. Among these, Non-Dispersive Infrared (NDIR) Sensors are leading due to their accuracy and reliability in detecting gases like CO2 and CH4, which are critical in various applications such as environmental monitoring and industrial safety.

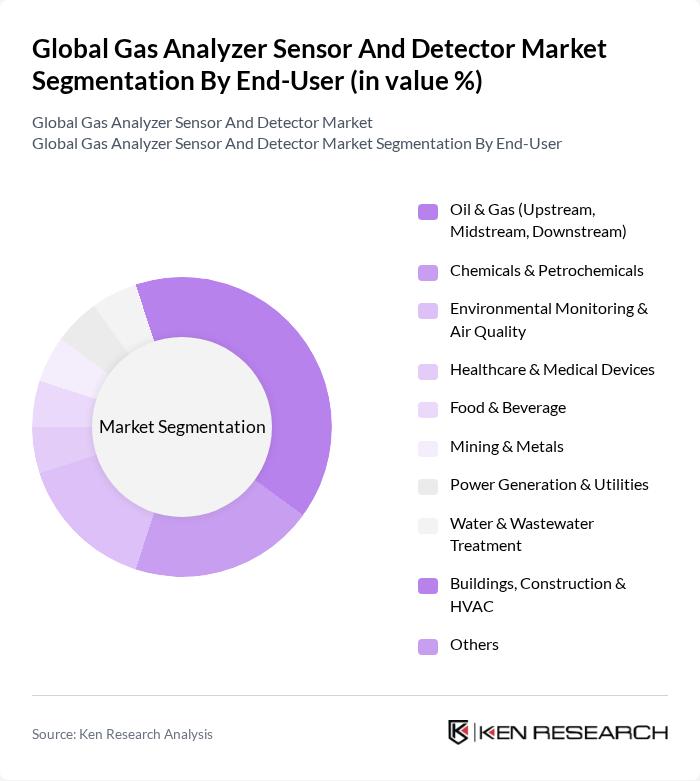

By End-User:The end-user segmentation includes Oil & Gas (Upstream, Midstream, Downstream), Chemicals & Petrochemicals, Environmental Monitoring & Air Quality, Healthcare & Medical Devices, Food & Beverage, Mining & Metals, Power Generation & Utilities, Water & Wastewater Treatment, Buildings, Construction & HVAC, and Others. The Oil & Gas sector is the dominant end-user, driven by the need for safety and compliance with environmental regulations, which necessitate the use of advanced gas detection systems to monitor emissions and ensure worker safety.

The Global Gas Analyzer Sensor And Detector Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc. (Honeywell Analytics), Siemens AG, Drägerwerk AG & Co. KGaA, Emerson Electric Co., MSA Safety Incorporated, Teledyne Technologies Incorporated, AMETEK, Inc., RKI Instruments, Inc., Industrial Scientific Corporation, Crowcon Detection Instruments Ltd., SENSIT Technologies, Aeroqual Limited, Gasmet Technologies Oy, Thermo Fisher Scientific Inc., Yokogawa Electric Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gas analyzer sensor and detector market appears promising, driven by technological advancements and increasing regulatory pressures. The integration of artificial intelligence in gas detection systems is expected to enhance accuracy and efficiency, while the shift towards real-time monitoring solutions will facilitate proactive environmental management. As industries prioritize sustainability, the demand for innovative gas analyzers will likely rise, fostering a competitive landscape that encourages continuous improvement and investment in cleaner technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrochemical Sensors Non-Dispersive Infrared (NDIR) Sensors Photoionization Detectors (PID) Catalytic Bead/Combustible (Pellistor) Sensors Metal Oxide Semiconductor (MOS) Sensors Tunable Diode Laser Absorption Spectroscopy (TDLAS)/Laser-based Paramagnetic, Zirconia, Thermal Conductivity, and Others |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Chemicals & Petrochemicals Environmental Monitoring & Air Quality Healthcare & Medical Devices Food & Beverage Mining & Metals Power Generation & Utilities Water & Wastewater Treatment Buildings, Construction & HVAC Others |

| By Application | Leak Detection and Repair (LDAR) Continuous Emissions Monitoring Systems (CEMS) Process Control & Optimization Occupational Safety, Hazardous Area Monitoring, and Compliance Indoor Air Quality (IAQ) and Ambient Monitoring Research, Calibration, and Laboratories Others |

| By Distribution Channel | Direct/OEM Sales Authorized Distributors & System Integrators Online (Vendor Portals & Marketplaces) Retail/Trade Counters Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Form Factor | Fixed/Stationary Gas Detectors Portable/Handheld Gas Detectors Wearable/Personal Gas Monitors Wireless/IoT-Enabled Gas Monitoring Systems Multi-Gas vs. Single-Gas Instruments Others |

| By Price Range | Low Range Mid Range High Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Gas Detection Systems | 110 | Safety Managers, Operations Directors |

| Environmental Monitoring Applications | 85 | Environmental Engineers, Compliance Officers |

| Oil & Gas Sector Sensors | 75 | Field Engineers, Project Managers |

| Healthcare Gas Analyzers | 65 | Biomedical Engineers, Hospital Safety Officers |

| Research & Development in Gas Sensing | 95 | Research Scientists, Product Development Managers |

The Global Gas Analyzer Sensor and Detector Market is valued at approximately USD 4.6 billion, reflecting a significant growth trend driven by industrial safety regulations, environmental concerns, and the demand for air quality monitoring solutions across various sectors.