Region:Global

Author(s):Dev

Product Code:KRAC0424

Pages:81

Published On:August 2025

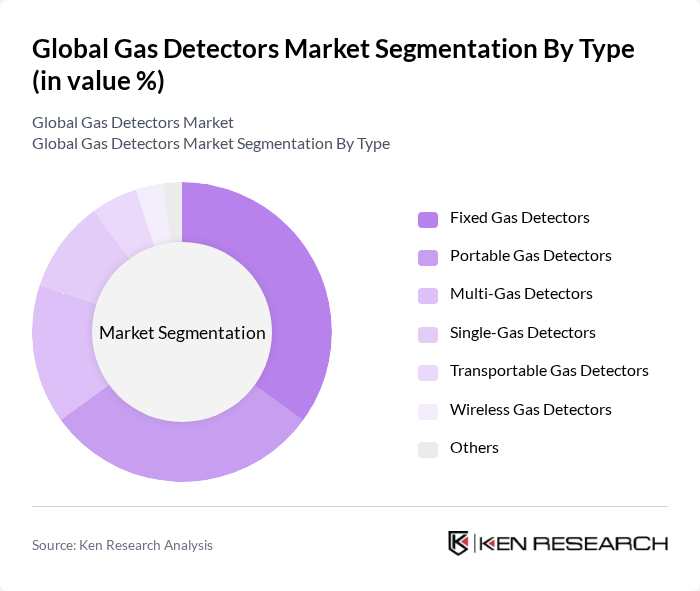

By Type:The market is segmented into various types of gas detectors, including Fixed Gas Detectors, Portable Gas Detectors, Multi-Gas Detectors, Single-Gas Detectors, Transportable Gas Detectors, Wireless Gas Detectors, and Others. Among these,Fixed Gas Detectorsare gaining traction due to continuous area monitoring, integration with plant DCS/SCADA, and higher sensitivity/coverage for process safety in hazardous locations.Portable Gas Detectorsare also popular for confined space entry, maintenance, and emergency response, with increasing adoption of connected wearables and docking systems that automate calibration and bump testing .

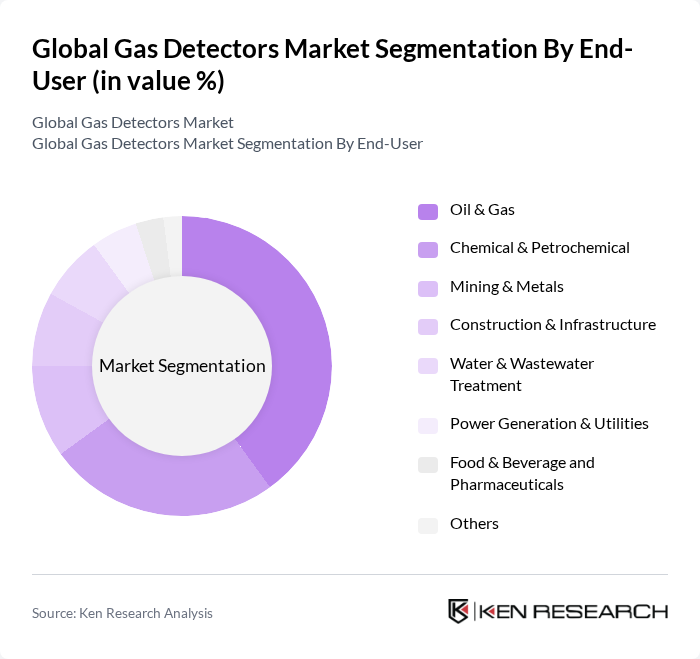

By End-User:The end-user segmentation includes Oil & Gas, Chemical & Petrochemical, Mining & Metals, Construction & Infrastructure, Water & Wastewater Treatment, Power Generation & Utilities, Food & Beverage and Pharmaceuticals, and Others. TheOil & Gassector is the leading end-user given elevated explosion/toxicity risks and stringent LDAR and process safety management requirements; Chemical & Petrochemical follows due to hazardous material handling and continuous emissions monitoring integration. Utilities, wastewater, and metals/mining also maintain robust demand tied to confined space hazards and toxic/combustible gas risks .

The Global Gas Detectors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc. (Honeywell Analytics & BW Technologies), Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Emerson Electric Co. (Rosemount, Net Safety), RKI Instruments, Inc., Industrial Scientific Corporation, Teledyne Technologies Incorporated (Teledyne Gas & Flame Detection), Crowcon Detection Instruments Ltd. (Halma plc), GfG Gesellschaft für Gerätebau mbH, SENSIT Technologies, LLC, Trolex Ltd., Bacharach, Inc. (a division of MSA Safety), Oldham (Teledyne Gas & Flame Detection), Det-Tronics (Detector Electronics Corporation, a Carrier company), Sensidyne, LP (Schauenburg International) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gas detectors market in the None region appears promising, driven by ongoing technological advancements and increasing regulatory pressures. As industries continue to prioritize safety and environmental compliance, the integration of IoT technologies into gas detection systems is expected to enhance monitoring capabilities. Furthermore, the growing trend towards wireless solutions will likely facilitate easier deployment and maintenance, making gas detection more accessible to a broader range of industries and applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Gas Detectors Portable Gas Detectors Multi-Gas Detectors Single-Gas Detectors Transportable Gas Detectors Wireless Gas Detectors Others |

| By End-User | Oil & Gas Chemical & Petrochemical Mining & Metals Construction & Infrastructure Water & Wastewater Treatment Power Generation & Utilities Food & Beverage and Pharmaceuticals Others |

| By Application | Industrial Safety & Confined Space Monitoring Environmental Monitoring & Emissions Leak Detection & Repair (LDAR) Process Safety & Plant Monitoring Residential & Commercial Safety Others |

| By Distribution Channel | Direct Sales Authorized Distributors/Value-Added Resellers Online (OEM webstores & e-marketplaces) Systems Integrators & EPCs Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Technology | Catalytic Bead (Pellistor) Infrared (NDIR & Point/Open-Path) Electrochemical (EC) Photoionization Detector (PID) Ultrasonic & Acoustic Gas Leak Detection Semiconductor/Metal-Oxide Sensors (MOS) Laser-Based (TDLAS/Tunable Diode Laser) Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Gas Detection | 140 | Safety Managers, Operations Directors |

| Commercial Building Safety | 100 | Facility Managers, Compliance Officers |

| Oil & Gas Sector Applications | 90 | Project Engineers, HSE Managers |

| Mining Industry Gas Monitoring | 70 | Site Managers, Safety Supervisors |

| Residential Gas Safety Solutions | 60 | Homeowners, Property Managers |

The Global Gas Detectors Market is valued at approximately USD 3.0 billion, reflecting steady adoption in industrial safety and compliance-driven upgrades. This valuation is supported by historical analysis and aligns with industry trackers indicating a range of USD 23 billion recently.