Region:Global

Author(s):Rebecca

Product Code:KRAA2943

Pages:83

Published On:August 2025

By Type:The market is segmented into various types of gas sensors, each catering to specific applications and industries. The subsegments include Electrochemical Sensors, Infrared Sensors, Semiconductor (MOS) Sensors, Photoionization Detectors (PID), Catalytic Bead Sensors, Laser-based Sensors, Ultrasonic Gas Leak Detectors, and Others. Among these, Electrochemical Sensors are leading due to their high sensitivity and accuracy in detecting toxic gases, making them essential in industrial safety applications.

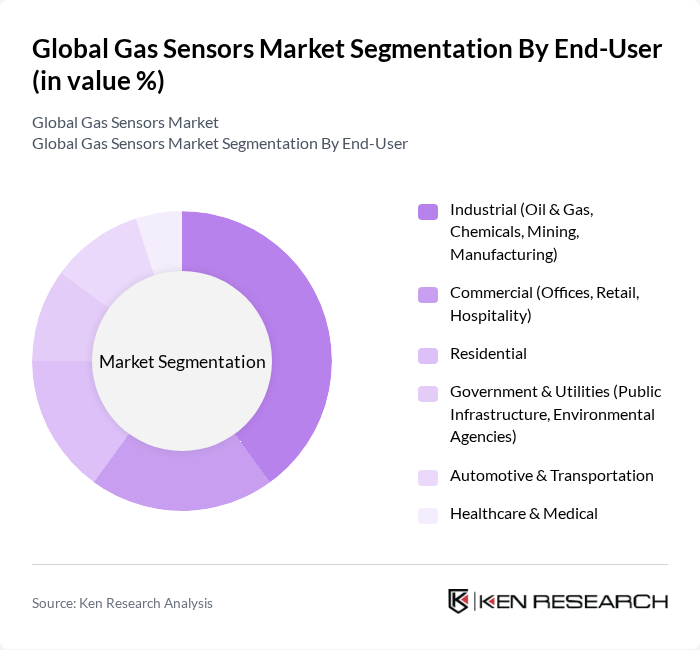

By End-User:The market is segmented by end-user applications, including Industrial (Oil & Gas, Chemicals, Mining, Manufacturing), Commercial (Offices, Retail, Hospitality), Residential, Government & Utilities (Public Infrastructure, Environmental Agencies), Automotive & Transportation, and Healthcare & Medical. The Industrial segment is the largest due to the stringent safety regulations and the need for continuous monitoring of hazardous gases in various industrial processes.

The Global Gas Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Siemens AG, Figaro Engineering Inc., Amphenol Corporation, Aeroqual Ltd., Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Emerson Electric Co., ABB Ltd., Sensirion AG, Gas Sensing Solutions Ltd., Teledyne Technologies Incorporated, Panasonic Corporation, RKI Instruments, Inc., AlphaSense Inc., City Technology Ltd., Dynament Ltd., Membrapor AG, Nemoto & Co., Ltd., Robert Bosch GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gas sensors market in None appears promising, driven by technological advancements and increasing regulatory pressures. The integration of artificial intelligence in gas detection systems is expected to enhance accuracy and predictive capabilities, while the shift towards wireless sensor networks will facilitate easier deployment and data collection. As industries prioritize safety and environmental compliance, the demand for innovative gas sensors will likely continue to rise, fostering a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrochemical Sensors Infrared Sensors Semiconductor (MOS) Sensors Photoionization Detectors (PID) Catalytic Bead Sensors Laser-based Sensors Ultrasonic Gas Leak Detectors Others |

| By End-User | Industrial (Oil & Gas, Chemicals, Mining, Manufacturing) Commercial (Offices, Retail, Hospitality) Residential Government & Utilities (Public Infrastructure, Environmental Agencies) Automotive & Transportation Healthcare & Medical |

| By Application | Environmental Monitoring (Air Quality, Emissions) Industrial Safety & Process Control Automotive Emissions & Cabin Air Quality HVAC Systems & Building Automation Medical & Life Sciences Smart Cities & IoT Devices Others |

| By Distribution Channel | Direct Sales (OEMs, System Integrators) Online Retail Distributors/Value-Added Resellers Retail Stores |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of APAC) Latin America (Brazil, Rest of LATAM) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Sensor Size | Miniature Sensors Standard Sensors Large Sensors |

| By Pricing Strategy | Premium Mid-range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Gas Sensors | 100 | Plant Managers, Safety Officers |

| Automotive Emission Sensors | 60 | Automotive Engineers, Compliance Managers |

| Healthcare Gas Monitoring Systems | 40 | Biomedical Engineers, Hospital Administrators |

| Environmental Monitoring Solutions | 50 | Environmental Scientists, Policy Makers |

| Consumer Gas Detection Devices | 45 | Retail Managers, Product Development Teams |

The Global Gas Sensors Market is valued at approximately USD 4.2 billion, driven by increasing industrial safety regulations, environmental concerns, and the demand for air quality monitoring systems across various sectors, including industrial, automotive, and healthcare.