Region:Global

Author(s):Dev

Product Code:KRAA1667

Pages:95

Published On:August 2025

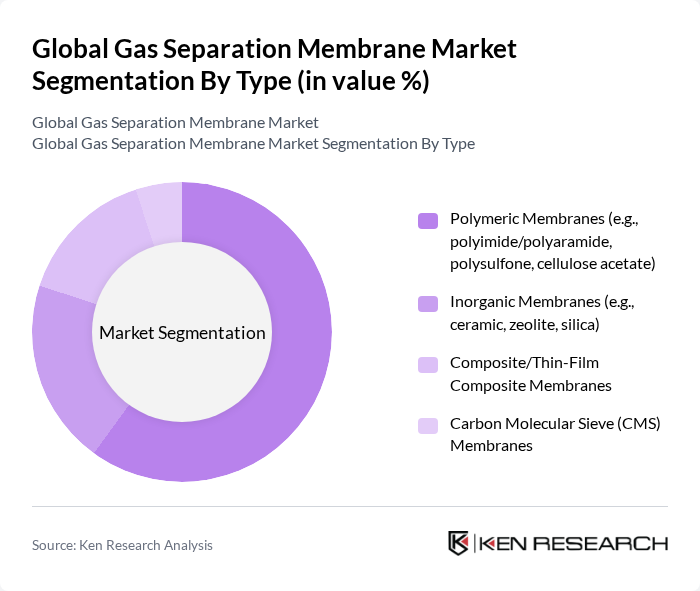

By Type:The gas separation membrane market is segmented into four main types: Polymeric Membranes, Inorganic Membranes, Composite/Thin-Film Composite Membranes, and Carbon Molecular Sieve (CMS) Membranes. Among these,Polymeric Membranesdominate due to cost-effectiveness, versatility, and scalable manufacturing (e.g., cellulose acetate, polysulfone/PES, PVDF, polyimide) and are widely used in natural gas sweetening, nitrogen generation, hydrogen recovery, and biogas upgrading .Inorganicandcomposite/TFCmembranes can offer higher selectivity/temperature resistance for niche separations but are generally higher cost and less prevalent commercially, whileCMS membranesare used where high selectivity for oxygen/nitrogen or hydrocarbon separations is needed .

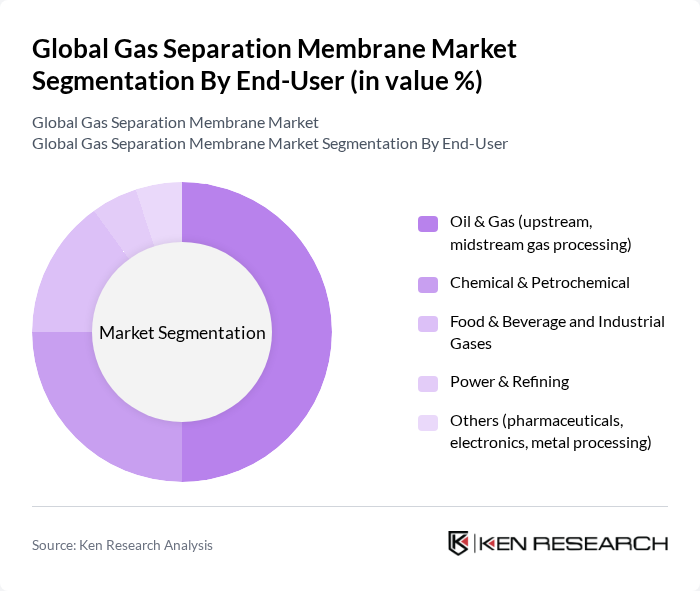

By End-User:The market is segmented by end-user industries, including Oil & Gas, Chemical & Petrochemical, Food & Beverage and Industrial Gases, Power & Refining, and Others.Oil & Gasis the largest consumer, driven by natural gas CO?/H?S removal, nitrogen rejection, and dehydration; theChemical & Petrochemicalsector follows for hydrogen recovery, CO? removal, and hydrocarbon separations;industrial gases and food & beverageuse membranes for nitrogen generation, CO? control, and carbonation;power & refiningdemand is tied to refinery hydrogen management and emerging CCS; other uses span electronics, metals, and pharmaceuticals .

The Global Gas Separation Membrane Market features a mix of regional and international players. Leading participants such as Membrane Technology and Research, Inc. (MTR), Air Products and Chemicals, Inc., DIC Corporation, UBE Corporation, Parker Hannifin Corporation, Honeywell International Inc. (UOP), 3M Company, Mitsubishi Chemical Group Corporation, Membrane Solutions LLC, Air Liquide S.A. (Air Liquide Advanced Separations), SUEZ WTS (formerly GE Water) — for industrial gas-related membranes, Evonik Industries AG, The Linde Group (Linde plc), Air Products PRISM Membranes, BASF SE (BASF SE – OASE/SELEXOL related offerings) contribute through product development, installed base expansion, and application diversification across CO? removal, N? generation, and H? recovery .

The future of the gas separation membrane market appears promising, driven by ongoing technological innovations and increasing environmental awareness. As industries prioritize sustainability, the demand for efficient gas separation solutions is expected to rise. Furthermore, the integration of smart technologies, such as IoT, will enhance operational efficiencies and monitoring capabilities, making gas separation processes more effective and reliable. This trend will likely attract new investments and partnerships, fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Polymeric Membranes (e.g., polyimide/polyaramide, polysulfone, cellulose acetate) Inorganic Membranes (e.g., ceramic, zeolite, silica) Composite/Thin-Film Composite Membranes Carbon Molecular Sieve (CMS) Membranes |

| By End-User | Oil & Gas (upstream, midstream gas processing) Chemical & Petrochemical Food & Beverage and Industrial Gases Power & Refining Others (pharmaceuticals, electronics, metal processing) |

| By Application | Carbon Dioxide Removal (natural gas sweetening, biogas upgrading) Nitrogen Generation/Air Separation Hydrogen Recovery/Purification Oxygen Enrichment and Air Dehydration Vapor/Gas and Hydrocarbon Separation |

| By Material | Polyimide/Polyaramide Polysulfone/Polyethersulfone (PSU/PES) Cellulose Acetate Polyvinylidene Fluoride (PVDF) and Other Fluoropolymers Others (Pebax, PIMs, PDMS) |

| By Module/Configuration | Hollow Fiber Spiral Wound Plate & Frame Others (tubular, capillary) |

| By Region | North America Europe Asia-Pacific Middle East & Africa South America |

| By Price/Performance Tier | Entry Mid Premium Custom/Engineered Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Natural Gas Processing | 100 | Process Engineers, Operations Managers |

| Petrochemical Applications | 80 | Product Development Managers, Technical Directors |

| Hydrogen Production | 70 | R&D Scientists, Project Engineers |

| CO2 Capture Technologies | 60 | Environmental Engineers, Compliance Officers |

| Industrial Gas Separation | 90 | Supply Chain Managers, Procurement Specialists |

The Global Gas Separation Membrane Market is valued at approximately USD 1.6 billion, driven by the increasing demand for efficient gas separation technologies across various industries, including oil and gas, chemical processing, and environmental applications.