Region:Global

Author(s):Dev

Product Code:KRAD0337

Pages:83

Published On:August 2025

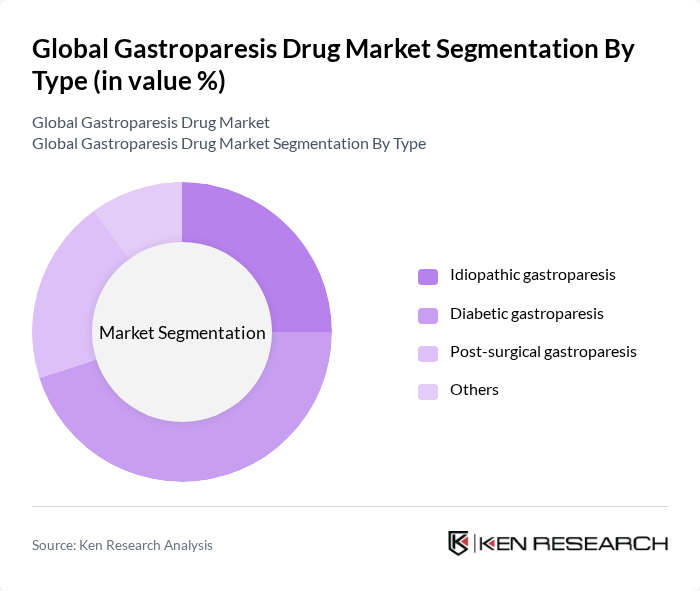

By Type:The market is segmented into four main types: Idiopathic gastroparesis, Diabetic gastroparesis, Post-surgical gastroparesis, and Others. Among these, Diabetic gastroparesis is the leading sub-segment due to the rising incidence of diabetes globally, which significantly contributes to the prevalence of gastroparesis. The increasing awareness and diagnosis of this condition among diabetic patients further drive the demand for effective treatment options.

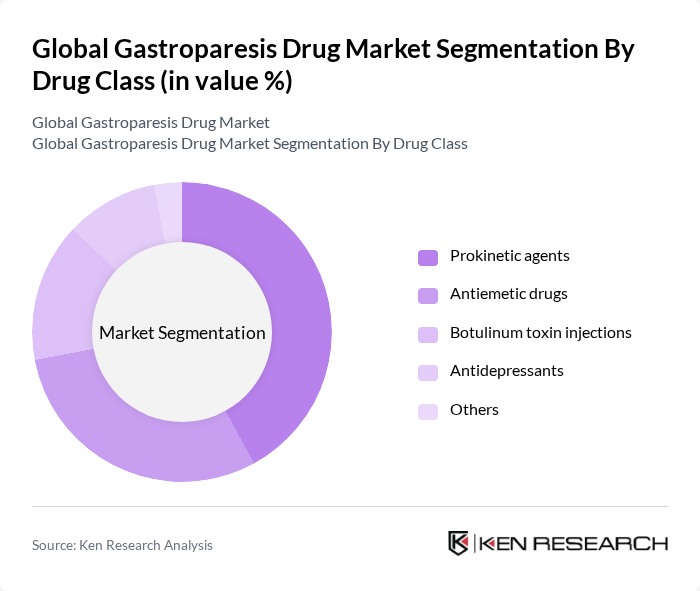

By Drug Class:The market is categorized into Prokinetic agents, Antiemetic drugs, Botulinum toxin injections, Antidepressants, and Others. Prokinetic agents dominate this segment due to their effectiveness in enhancing gastric motility, which is crucial for managing gastroparesis symptoms. The increasing prescription of these agents by healthcare professionals is a significant factor contributing to their market leadership.

The Global Gastroparesis Drug Market is characterized by a dynamic mix of regional and international players. Leading participants such as AbbVie Inc. (Allergan Plc), Takeda Pharmaceutical Company Limited, Johnson & Johnson, Amgen Inc., GlaxoSmithKline plc (GSK), Merck & Co., Inc., Pfizer Inc., AstraZeneca plc, Eli Lilly and Company, Novartis AG, Sanofi S.A., Bayer AG, Boehringer Ingelheim GmbH, Teva Pharmaceutical Industries Ltd., Mallinckrodt Pharmaceuticals, Evoke Pharma, Inc., Cadila Pharmaceuticals Ltd., Neurogastrx, Inc., CinDome Pharma, Dr. Falk Pharma GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gastroparesis drug market appears promising, driven by ongoing research and development efforts aimed at creating more effective therapies. Innovations in drug delivery systems, such as implantable devices and smart pills, are expected to enhance treatment adherence and patient outcomes. Additionally, the growing trend towards personalized medicine will likely lead to tailored treatment options, improving efficacy and minimizing side effects, thus fostering a more robust market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Idiopathic gastroparesis Diabetic gastroparesis Post-surgical gastroparesis Others |

| By Drug Class | Prokinetic agents Antiemetic drugs Botulinum toxin injections Antidepressants Others |

| By Treatment Modality | Jejunostomy Gastric electrical stimulation Parenteral nutrition Others |

| By End-User | Hospitals Specialty clinics Home healthcare Pharmacies |

| By Route of Administration | Oral Injectable Transdermal |

| By Distribution Channel | Retail pharmacies Hospital pharmacies Online pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Age group (children, adults, elderly) Gender Comorbid conditions |

| By Treatment Duration | Short-term Long-term Maintenance therapy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Clinics | 100 | Gastroenterologists, Nurse Practitioners |

| Patient Support Groups | 80 | Patients with Gastroparesis, Caregivers |

| Pharmaceutical Sales Representatives | 40 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 50 | Health Economists, Policy Analysts |

| Clinical Research Organizations | 60 | Clinical Researchers, Trial Coordinators |

The Global Gastroparesis Drug Market is valued at approximately USD 6.7 billion, driven by the increasing prevalence of gastroparesis, particularly among diabetic patients, and advancements in drug development that enhance patient outcomes.