Region:Global

Author(s):Dev

Product Code:KRAB0466

Pages:89

Published On:August 2025

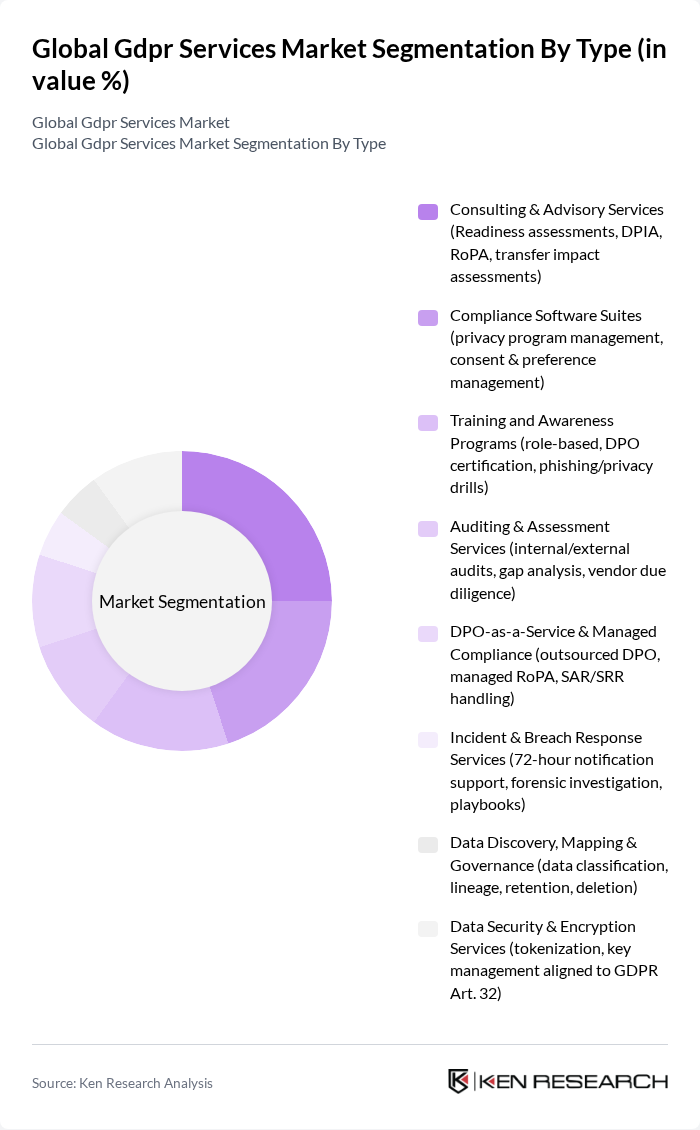

By Type:

The Consulting & Advisory Services segment is currently leading the market due to the increasing complexity of GDPR compliance requirements. Organizations are seeking expert guidance to navigate the regulatory landscape, conduct readiness assessments, and perform Data Protection Impact Assessments (DPIAs). This trend is driven by the need for businesses to mitigate risks associated with data breaches and ensure compliance with evolving regulations. The demand for tailored consulting services is expected to continue growing as companies prioritize data privacy and security.

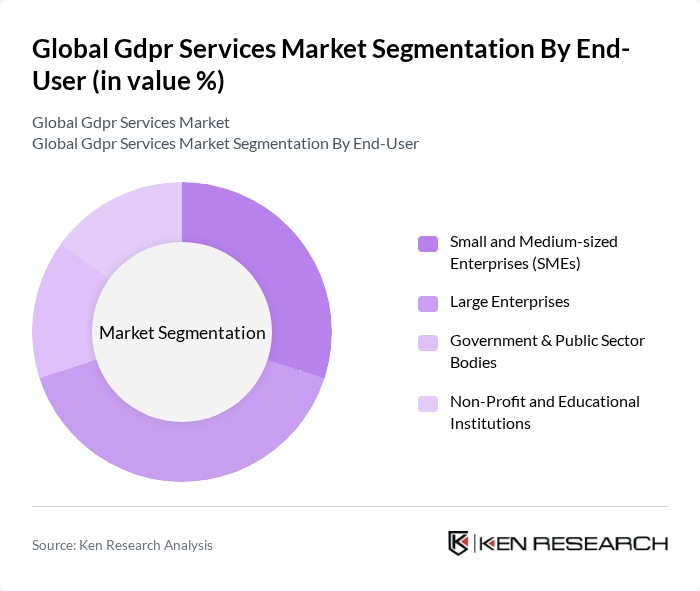

By End-User:

Large Enterprises dominate the market due to their extensive data handling operations and the significant regulatory scrutiny they face. These organizations are more likely to invest in comprehensive GDPR compliance solutions to protect sensitive customer data and avoid substantial fines. Additionally, the complexity of their operations necessitates a robust compliance framework, leading to increased demand for specialized services and software solutions tailored to their needs.

The Global GDPR Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as OneTrust, TrustArc, IBM (International Business Machines Corporation), Microsoft Corporation, Cisco Systems, Inc., SAP SE, Oracle Corporation, Capgemini SE, Accenture plc, Deloitte, KPMG, PwC (PricewaterhouseCoopers), EY (Ernst & Young), Veritas Technologies LLC, Proofpoint, Inc., DataGrail, Inc., BigID, Inc., Securiti, Inc., Collibra NV, Informatica Inc., Micro Focus International plc (OpenText Cybersecurity), Iron Mountain Incorporated, Trustwave Holdings, Inc., AWS (Amazon Web Services, Inc.), Google Cloud (Alphabet Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of GDPR services is poised for significant evolution, driven by technological advancements and regulatory changes. As organizations increasingly adopt artificial intelligence for data protection, the demand for automated compliance solutions is expected to rise. Furthermore, the integration of GDPR with other global regulations will create a more cohesive compliance landscape, enabling businesses to streamline their data protection efforts. This convergence will likely foster innovation and collaboration among service providers, enhancing the overall effectiveness of GDPR compliance strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Consulting & Advisory Services (Readiness assessments, DPIA, RoPA, transfer impact assessments) Compliance Software Suites (privacy program management, consent & preference management) Training and Awareness Programs (role-based, DPO certification, phishing/privacy drills) Auditing & Assessment Services (internal/external audits, gap analysis, vendor due diligence) DPO-as-a-Service & Managed Compliance (outsourced DPO, managed RoPA, SAR/SRR handling) Incident & Breach Response Services (72-hour notification support, forensic investigation, playbooks) Data Discovery, Mapping & Governance (data classification, lineage, retention, deletion) Data Security & Encryption Services (tokenization, key management aligned to GDPR Art. 32) |

| By End-User | Small and Medium-sized Enterprises (SMEs) Large Enterprises Government & Public Sector Bodies Non-Profit and Educational Institutions |

| By Industry Vertical | Healthcare & Life Sciences Banking, Financial Services & Insurance (BFSI) Retail & E-commerce Information Technology & Software Telecommunications & Media Government, Education & Public Services Manufacturing & Industrial |

| By Service Model | On-Premises Cloud-Based (SaaS, managed services) |

| By Geographic Presence | Europe North America Asia-Pacific Latin America Middle East and Africa |

| By Compliance Level | Full Compliance Partial Compliance Non-Compliance |

| By Pricing Model | Subscription-Based (per-seat, per-record/SAR, tiered modules) One-Time Implementation/Project Fees Pay-As-You-Go (usage-based for DSAR, scanning, or storage) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector GDPR Compliance | 120 | Data Protection Officers, Compliance Managers |

| Financial Services GDPR Implementation | 100 | Legal Advisors, Risk Management Executives |

| Retail Industry Data Protection Strategies | 80 | IT Managers, Marketing Directors |

| Technology Firms GDPR Solutions | 90 | Product Managers, Software Developers |

| Consulting Firms GDPR Advisory Services | 60 | Consultants, Business Development Managers |

The Global GDPR Services Market is valued at approximately USD 3 billion, reflecting a significant increase driven by the growing need for organizations to comply with stringent data protection regulations and heightened consumer awareness regarding data privacy.