Region:Global

Author(s):Dev

Product Code:KRAB0501

Pages:99

Published On:August 2025

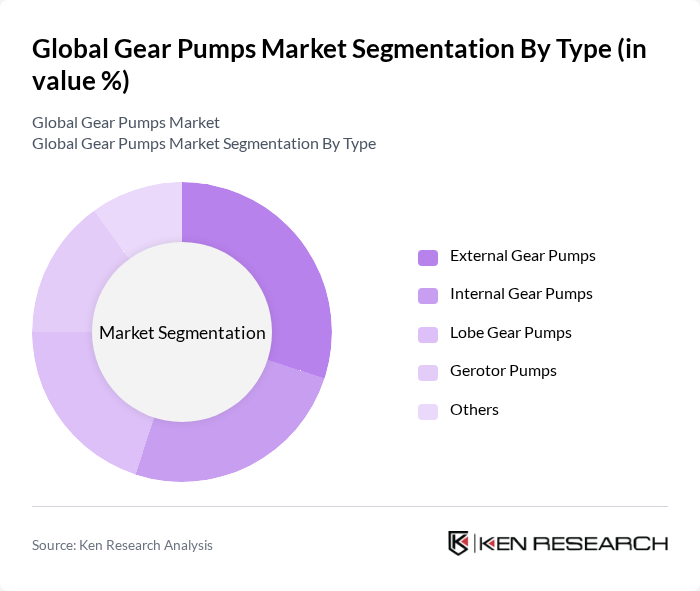

By Type:The gear pumps market is segmented into various types, including External Gear Pumps, Internal Gear Pumps, Lobe Gear Pumps, Gerotor Pumps, and Others. Each type serves specific applications and industries, catering to diverse customer needs.

The External Gear Pumps segment is currently leading the market due to their widespread use in hydraulic power, lubrication, and transfer of oils and fuels; their simple design, high reliability, and ability to handle a broad viscosity range make them preferred in industrial machinery and mobile equipment. Increasing emphasis on energy-efficient hydraulic systems and low-maintenance components further supports adoption.

By End-User:The market is segmented based on end-users, including Oil & Gas, Chemical & Petrochemical, Food & Beverage, Industrial Machinery & Material Handling, Automotive, Water & Wastewater Treatment, and Others. Each end-user segment has unique requirements and applications for gear pumps.

The Oil & Gas sector is a major end-user of gear pumps for transfer of lubricants, fuels, and process fluids across upstream, midstream, and downstream operations. Safety and environmental compliance, along with continued investments in brownfield upgrades and maintenance of refining and petrochemical assets, sustain demand for reliable positive displacement pumps.

The Global Gear Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Parker Hannifin Corporation, Bosch Rexroth AG, Eaton Corporation plc, Danfoss A/S, Bucher Hydraulics GmbH, Kawasaki Heavy Industries, Ltd. (Hydraulic Components), Casappa S.p.A., Marzocchi Pompe S.p.A., Sumitomo Drive Technologies (Sumitomo Heavy Industries, Ltd.), Viking Pump, Inc. (a Unit of IDEX Corporation), IDEX Corporation, Tuthill Pump (Formerly Tuthill Corporation; now Terranova Industrial Group), Yuken Kogyo Co., Ltd., HYDAC International GmbH, Jihostroj a.s. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gear pumps market appears promising, driven by ongoing technological advancements and increasing industrial demand. As industries prioritize energy efficiency and sustainability, the integration of IoT technologies into gear pumps is expected to enhance operational performance. Furthermore, the shift towards renewable energy sources will create new applications for gear pumps, particularly in solar and wind energy sectors, fostering growth and innovation in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | External Gear Pumps Internal Gear Pumps Lobe Gear Pumps Gerotor Pumps Others |

| By End-User | Oil & Gas Chemical & Petrochemical Food & Beverage Industrial Machinery & Material Handling Automotive Water & Wastewater Treatment Others |

| By Application | Hydraulic Systems Lubrication & Circulation Systems Fuel Transfer & Engine Feed Chemical Dosing & Metering Viscous Fluids Transfer (e.g., oils, resins, bitumen) Others |

| By Distribution Channel | Direct (OEM & Key Accounts) Authorized Distributors/Integrators Online/Marketplace Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pressure Range | Up to 100 bar –300 bar Above 300 bar |

| By Pump Materials | Cast Iron Stainless Steel Aluminum Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydraulic Gear Pumps in Construction | 100 | Project Managers, Equipment Operators |

| Industrial Gear Pumps in Manufacturing | 80 | Production Supervisors, Maintenance Engineers |

| Food Processing Gear Pumps | 70 | Quality Control Managers, Process Engineers |

| Oil & Gas Sector Gear Pumps | 90 | Field Engineers, Operations Managers |

| Automotive Gear Pumps | 75 | R&D Managers, Supply Chain Analysts |

The Global Gear Pumps Market is valued at approximately USD 4.6 billion, driven by increasing demand for efficient fluid transfer across various industries, including oil and gas, chemicals, and food and beverage sectors.