Region:Global

Author(s):Shubham

Product Code:KRAB0816

Pages:88

Published On:August 2025

By Type:The market is segmented into gold, diamond, platinum, silver, precious gemstones, semi-precious gemstones, fine jewelry, costume/fashion jewelry, antique jewelry, custom/bespoke jewelry, and others. Gold jewelry remains the most popular, driven by its cultural significance and investment value, especially in Asia-Pacific. Diamond jewelry follows closely, associated with luxury and special occasions. Platinum and silver jewelry are preferred for their durability and contemporary appeal. Precious and semi-precious gemstones are increasingly sought after for customization and personal expression, while fine jewelry dominates the premium segment. Costume/fashion jewelry appeals to younger consumers seeking affordable trends, and antique/custom jewelry caters to niche collectors and bespoke buyers.

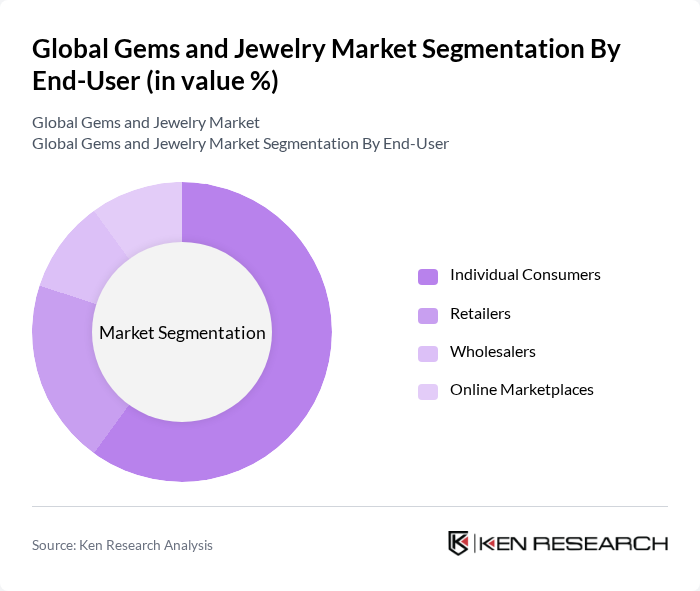

By End-User:The end-user segmentation includes individual consumers, retailers, wholesalers, and online marketplaces. Individual consumers dominate the market, driven by personal purchases for weddings, anniversaries, and gifting. Retailers and online marketplaces are significant, providing broad access to products and driving digital transformation in the sector. Wholesalers play a crucial role in supply chain efficiency and bulk distribution.

The Global Gems and Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as De Beers Group, Tiffany & Co., Signet Jewelers, Chow Tai Fook Jewellery Group, Richemont, Swatch Group, LVMH Moët Hennessy Louis Vuitton, Pandora A/S, Harry Winston, Graff Diamonds, Bulgari, Cartier, Chopard, Van Cleef & Arpels, Mikimoto contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gems and jewelry market in None appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to adopt ethical sourcing practices, appealing to environmentally conscious consumers. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance customer engagement, making the purchasing process more interactive and personalized, thus fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Gold Jewelry Diamond Jewelry Platinum Jewelry Silver Jewelry Precious Gemstones Semi-Precious Gemstones Fine Jewelry Costume/Fashion Jewelry Antique Jewelry Custom/Bespoke Jewelry Others |

| By End-User | Individual Consumers Retailers Wholesalers Online Marketplaces |

| By Sales Channel | Online Sales Brick-and-Mortar Stores Trade Shows and Exhibitions Direct Sales |

| By Material | Gold Silver Platinum Diamonds Other Precious Metals |

| By Price Range | Luxury Segment Mid-Range Segment Budget Segment |

| By Occasion | Weddings Anniversaries Birthdays Festivals |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Retailers | 120 | Store Managers, Sales Executives |

| Gemstone Suppliers | 90 | Procurement Managers, Supply Chain Analysts |

| Jewelry Designers | 60 | Creative Directors, Product Designers |

| Consumer Insights | 150 | End Consumers, Jewelry Enthusiasts |

| Industry Experts | 40 | Market Analysts, Trend Forecasters |

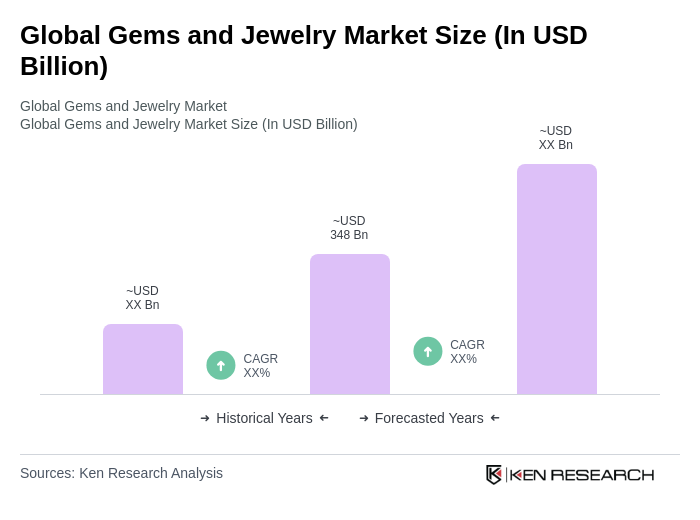

The Global Gems and Jewelry Market is valued at approximately USD 348 billion, reflecting a significant growth trend driven by increasing consumer demand for luxury goods and rising disposable incomes, particularly in regions like Asia-Pacific and North America.