Region:Global

Author(s):Shubham

Product Code:KRAC0726

Pages:80

Published On:August 2025

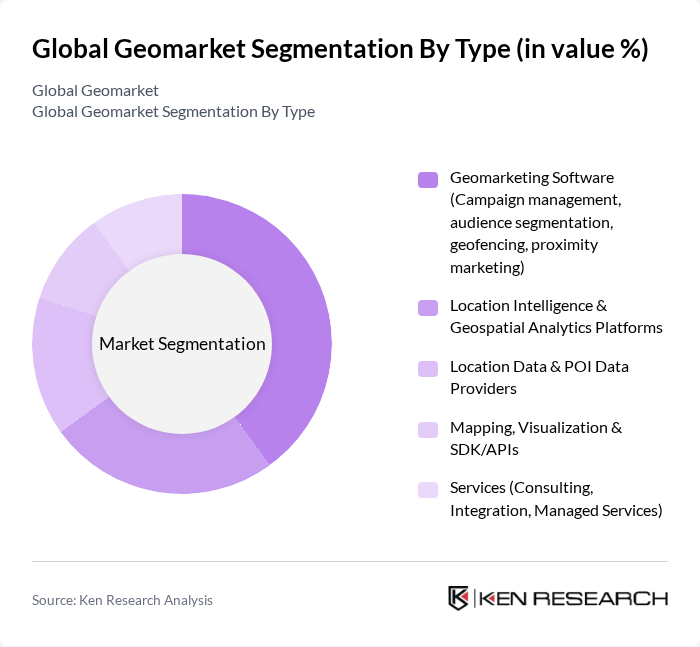

By Type:The geomarketing market can be segmented into various types, including geomarketing software, location intelligence and geospatial analytics platforms, location data and POI data providers, mapping, visualization and SDK/APIs, and services such as consulting, integration, and managed services. Among these, geomarketing software is currently the leading subsegment, driven by the increasing need for businesses to manage campaigns effectively, activate geofencing/proximity marketing, and segment audiences using first-party and consented location data, with AI/ML improving targeting accuracy and ROI.

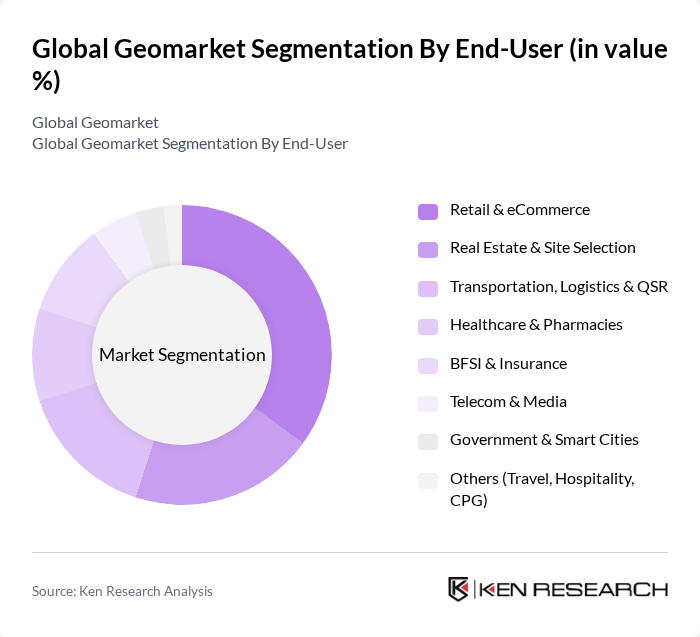

By End-User:The end-user segmentation of the geomarketing market includes retail and eCommerce, real estate and site selection, transportation, logistics and QSR, healthcare and pharmacies, BFSI and insurance, telecom and media, government and smart cities, and others such as travel, hospitality, and consumer packaged goods. The retail and eCommerce sector is the dominant end-user, leveraging location-based advertising, store visitation analytics, and omnichannel personalization, while North America leads adoption and Asia Pacific shows rapid uptake with rising digitalization and smartphone use.

The Global Geomarketing market is characterized by a dynamic mix of regional and international players. Leading participants such as Esri, Google LLC, IBM Corporation, Oracle Corporation, SAP SE, HERE Technologies, Precisely (formerly Pitney Bowes Software & Data), Mapbox, TIBCO Software Inc., QGIS Project, CARTO, Foursquare Labs, Inc., Salesforce Maps (formerly MapAnything/Geopointe), Spatial.ai, Placer.ai, TomTom, Near Intelligence, Quantarium, Unacast, Airship (formerly Urban Airship) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the geomarket in future is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt AI and machine learning, the integration of these technologies into geomarketing strategies will enhance targeting precision and customer engagement. Additionally, the rise of smart cities will create new opportunities for location-based services, fostering innovation and collaboration across sectors, ultimately shaping a more data-driven economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Geomarketing Software (Campaign management, audience segmentation, geofencing, proximity marketing) Location Intelligence & Geospatial Analytics Platforms Location Data & POI Data Providers Mapping, Visualization & SDK/APIs Services (Consulting, Integration, Managed Services) |

| By End-User | Retail & eCommerce Real Estate & Site Selection Transportation, Logistics & QSR Healthcare & Pharmacies BFSI & Insurance Telecom & Media Government & Smart Cities Others (Travel, Hospitality, CPG) |

| By Application | Customer Segmentation & Audience Targeting Campaign Management & Attribution Market & Trade Area Analysis Store/Site Selection & Network Planning Footfall Analytics & Competitive Benchmarking Personalized Offers, Geofencing & Proximity Marketing Others |

| By Distribution Channel | Direct Enterprise Sales Cloud Marketplaces (e.g., AWS, Azure, GCP) Value-Added Resellers & System Integrators Technology Partnerships & OEM/ISV Others |

| By Industry Vertical | Automotive & Mobility Telecommunications Financial Services Government & Public Sector Travel, Hospitality & Entertainment Consumer Goods & Manufacturing Others |

| By Technology | Cloud-Based On-Premises Mobile SDKs & Apps Edge/IoT & Beacons Others |

| By Pricing Model | Subscription (SaaS) Usage-Based (API/Requests, MAUs) Data Licensing (POI, Mobility, Demographics) Enterprise/Custom Freemium/Developer Tier |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Geomarketing Strategies | 120 | Marketing Directors, Brand Managers |

| Real Estate Market Analysis | 90 | Real Estate Analysts, Property Managers |

| Tourism and Location-Based Marketing | 70 | Tourism Board Officials, Marketing Executives |

| Consumer Behavior Insights | 110 | Market Researchers, Data Scientists |

| GIS Technology Adoption | 80 | GIS Specialists, IT Managers |

The Global Geomarketing Market is valued at approximately USD 17.8 billion, reflecting the increasing adoption of location-based services and AI/ML-powered analytics across various sectors, including retail, eCommerce, and travel.