Region:Global

Author(s):Dev

Product Code:KRAD0511

Pages:88

Published On:August 2025

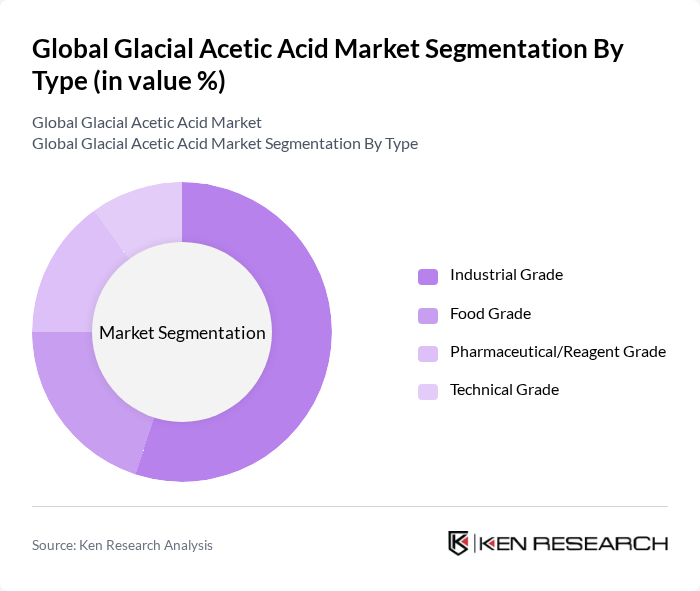

By Type:The market is segmented into four types: Industrial Grade, Food Grade, Pharmaceutical/Reagent Grade, and Technical Grade. Among these, Industrial Grade acetic acid is the most dominant segment due to its extensive use in chemical synthesis (notably VAM, acetic anhydride, and acetate esters) and broad application in coatings, adhesives, engineered materials, and packaging value chains .

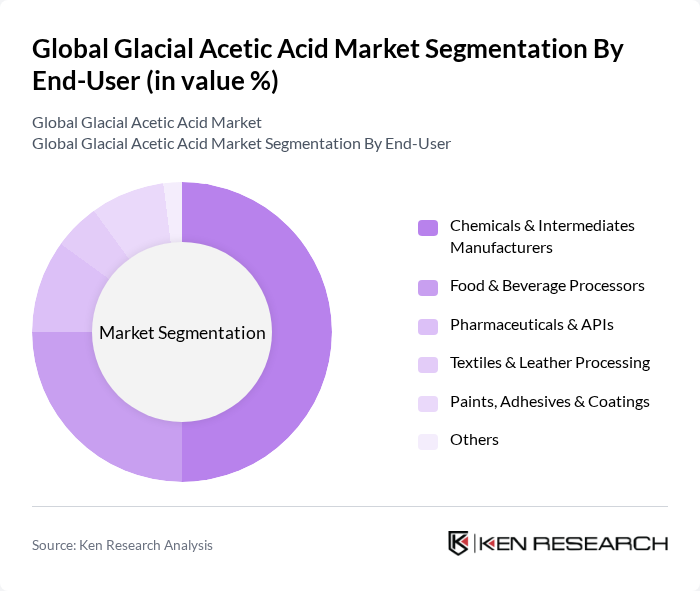

By End-User:The end-user segmentation includes Chemicals & Intermediates Manufacturers, Food & Beverage Processors, Pharmaceuticals & APIs, Textiles & Leather Processing, Paints, Adhesives & Coatings, and Others. The Chemicals & Intermediates Manufacturers segment leads the market, driven by high demand for acetic acid in producing VAM, acetic anhydride, and acetate esters that feed into downstream adhesives, paints, coatings, films, and engineered materials .

The Global Glacial Acetic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Celanese Corporation, Eastman Chemical Company, INEOS Group Limited, LyondellBasell Industries N.V., Jiangsu Sopo (Group) Co., Ltd., Sichuan Vinylon Works (SVW, Sinopec Group), BP p.l.c. (Acetyls heritage; assets now under INEOS), SABIC, Shanxi Sanwei Group Co., Ltd., Daicel Corporation, Kingboard Holdings Limited, Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC), Chang Chun Group, Wacker Chemie AG, Lotte Chemical Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the glacial acetic acid market appears promising, driven by increasing applications across various industries, including textiles and food preservation. Innovations in production technologies are expected to enhance efficiency and reduce costs, while the shift towards sustainable practices will likely attract investment. Additionally, emerging markets in Asia and Africa are anticipated to contribute significantly to demand, as industrialization and urbanization continue to rise, creating new opportunities for growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Food Grade Pharmaceutical/Reagent Grade Technical Grade |

| By End-User | Chemicals & Intermediates Manufacturers Food & Beverage Processors Pharmaceuticals & APIs Textiles & Leather Processing Paints, Adhesives & Coatings Others |

| By Application | Vinyl Acetate Monomer (VAM) Production Acetic Anhydride Production Ester Production (e.g., Ethyl/Methyl Acetate) Solvents & Diluent Uses PTA/PET and Fibers Food Additive/Preservative Others |

| By Distribution Channel | Direct (Producer to Industrial Buyer) Chemical Distributors Online/Spot Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk (ISO tanks, Railcars) Drums/IBC Totes Small Packs (Bottles) Others |

| By Price Range | Contracted Prices Spot Prices Regional Benchmarks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Industry | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceuticals Sector | 80 | Regulatory Affairs Managers, R&D Directors |

| Textile Manufacturing | 70 | Production Supervisors, Supply Chain Managers |

| Chemical Intermediates | 90 | Procurement Managers, Operations Directors |

| Industrial Applications | 75 | Process Engineers, Technical Sales Representatives |

The Global Glacial Acetic Acid Market is valued at approximately USD 9.5 billion, based on a five-year historical analysis. This valuation reflects the market's growth driven by demand in various applications, including adhesives, paints, coatings, and food preservation.